SunPower Corp. (NASDAQ: SPWR) has some painful news regarding its 2015 guidance ahead of its 2014 analyst day. The guidance also hurt SunPower considerably, and it has spilled over into other key solar stocks as well. This news comes just three days after it announced the acquisition of SolarBridge Technologies for its high-performance microinverter technology.

For SunPower’s fiscal year 2015, the company is forecasting non-GAAP revenue of $2.4 billion to $2.6 billion and net income of $1.10 to $1.50 per diluted share. Thomson Reuters has estimates of $2.8 billion in revenue and $1.69 in earnings per share. Other key guidance metrics for 2015 were as follows:

- Gross margin of 21% to 23%

- Capital expenditures of $300 million to $350 million

- Gigawatts (GW) recognized in the range of 1.3 GW to 1.4 GW

On a GAAP basis, SunPower expects revenue of $2.4 billion to $2.6 billion, net income per diluted share of $0.55 to $0.95, and gross margin of 21% to 23%. SunPower noted that its 2015 guidance excludes any financial impact that may occur if SunPower decides to pursue the formation of a separately traded yieldco vehicle, which is currently under review. If this strategy is used, then the company will update its 2015 guidance.

ALSO READ: Stock Market Rally Has Money Pouring Into These 5 Top Stocks

SunPower is maintaining that it is committed to expanding investments in self-developed projects, its technology road map and the scope of manufacturing cost reduction initiatives. One longer-term forecast from SunPower was that it expects to triple upstream capacity over the next five years. The company said:

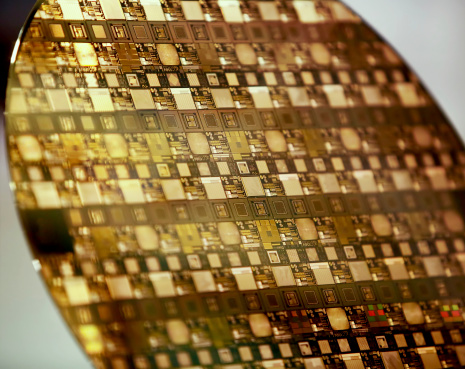

This capacity expansion includes completion of the company’s fourth solar cell fabrication facility, Fab 4, 800 megawatts (MW) of planned solar cell and panel manufacturing capacity in Fab 5, and more than 1 GW additional capacity of Low Concentration PV (LCPV), which leverages the company’s high efficiency solar cell capacity by up to a factor of ten. SunPower will provide additional details about these capacity expansions at key milestone stages.

SunPower also updated its fourth quarter 2014 GAAP financial guidance to reflect the benefit of approximately $450 million in revenue and $0.80 – $0.90 in earnings per share related to the real estate accounting treatment of its 579-MW Solar Star projects. The company now expects fourth quarter 2014 GAAP revenue of $1.12 billion to $1.17 billion, gross margin of 26 percent to 28 percent and net income per diluted share of $1.00 to $1.25. Fourth quarter 2014 non-GAAP guidance remains unchanged.

The only good news seen on Thursday was that the drop was “only” about 8% to $26.80 in the premarket. The first indications had shares down over 11% and we had seen over 300,000 shares trade hands with almost 30 minutes left to the opening bell. Note that shares opened at $28.66.

First Solar Inc. (NASDAQ: FSLR) saw its shares fall on Wednesday after lower guidance from Canadian Solar Inc. (NASDAQ: CSIQ), and unfortunately it was lower yet again on Thursday. Thursday’s drop was 1.4% to $48.90 in the premarket, after falling to $49.59 from $50.99 the prior day. But it opened at $49.25. First Solar was defended by the independent research firm Argus on Wednesday, with a call of well over 50% upside. Its 52-week range is $47.07 to $74.84, and its consensus analyst price target is up at $63.06.

SolarCity Corp. (NASDAQ: SCTY) shares rose to $52.05 from $50.96 on Wednesday, despite weak solar fallout, but its shares were indicated to be down 1.25% at $51.40 in fairly thin trading volume on Thursday morning’s premarket session, before opening at $51.72. SolarCity’s 52-week trading range is $42.38 to $88.35, and it has a consensus price target from analysts of $87.80.

ALSO READ: The 5 Most Revered DJIA Stocks Since the V-Bottom

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.