The predictions come from analysts at Goldman Sachs, who are forecasting that the 55% drop in crude prices since last summer will continue through the first half of this year. Bloomberg cited an emailed copy of the report for the new forecast. Previously Goldman had forecast WTI prices for the next six months at $75 a barrel and $80 for the next 12 months. Brent prices were forecast at $83 and $90 a barrel for the same periods.

The basis for the projection is the Goldman’s assessment of when it will become uneconomic for producers to continue investing in new drilling:

To keep all capital sidelined and curtail investment in shale until the market has re-balanced, we believe prices need to stay lower for longer. The search for a new equilibrium in oil markets continues.

ALSO READ: North Dakota Producers Looking at Crude Falling to $30

Goldman does not expect OPEC members to renege on their decision to maintain current production levels of around 30 million barrels a day. This is a change from the firm’s previous belief that the cartel would blink and cut production to rebalance the market in the first half of 2015:

This [reversal of our previous opinion] is anchored on our expectation that the slowdown in U.S. shale oil production in second-half 2015 will be sufficient to clear the market overhang and the threat of capital being quickly redeployed to restart U.S. production growth.

Goldman’s view may be optimistic, at least for some small producers. What the new forecast implies is that if a small company can just hang on for six months, prices will start to rise and everyone will get well. That is possible, certainly, but it is equally possible that prices will continue to fall because rates of return on invested capital — which is really the only metric that should matter to producers today — differ widely from field to field and even from well to well in a given field.

Wells producing marginal returns will be the first to go, but a highly productive well may more than make up the difference in total production. Of course the two wells may be operated by different companies, but on a macro level, output may be relatively unchanged as the marginal wells in marginal locations are either shut-in or not drilled.

The land rig count fell by 61 in the week ended January 9, its biggest one-week decline in more than two decades. Most of the losses were in the Permian Basin of Texas and the Williston Basin of North Dakota.

ALSO READ: 10 Dying and 10 Thriving U.S. Industries

Production, however, is not expected to fall; rather, it is expected to rise as producers concentrate on locations in these plays that offer better rates of return. That cannot go on forever either, of course, but some of these wells can probably produce a barrel of oil for $30 or less.

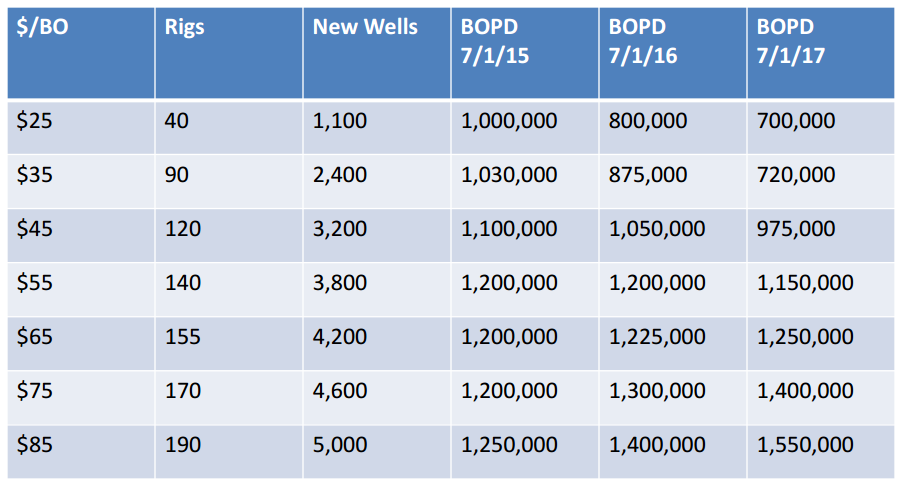

In a presentation to the North Dakota state legislature’s House Natural Resources Committee last Friday, Lynn Helms, director of the state’s Department of Mineral Resources, said the state’s daily production now totals 1.2 million barrels from 166 active rigs. Helms included a table in his presentation (see below) showing that at $45 a barrel (WTI marker price) North Dakota’s rig count would drop to 120 and that production would fall to 1.1 million barrels a day by July 1.

The Flint Hills refinery was paying $32.25 a barrel for Bakken crude on Friday, already well below Goldman’s $40 target. Plains Marketing offered to pay $31.94 for a barrel of Williston Basin Sweet on Friday. Plains’ posted price for WTI was $44.75 on Friday, and WTI was trading for around $47 a barrel Monday morning on the NYMEX, down nearly 3% from Friday’s close.

Note: BO=barrels of oil; BOPD=barrels of oil per day

ALSO READ: Gas Prices Fall for 107 Days Straight

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.