Energy

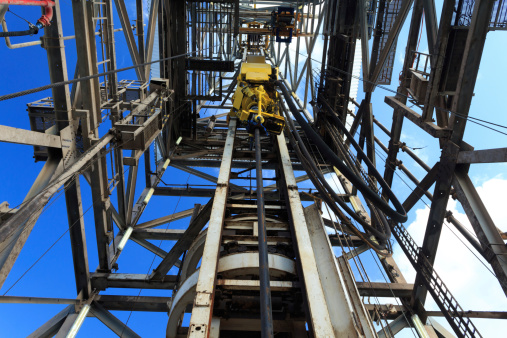

Devon Energy to Cut Capex 20% in 2015, Expects 25% Production Growth

Published:

Last Updated:

For the full year, Devon reported adjusted EPS of $4.91 on revenues of $19.57 billion, compared with a net loss of $0.06 and revenues of $10.4 billion in 2013. Analysts were looking for EPS of $5.16 on revenues of $18.09 billion.

Devon is planning to reduce its capital spending budget by about 20% in 2015, down to a range of $4.1 billion to $4.4 billion. As with other producers, however, Devon anticipates no reduction in its production growth:

With significant improvements in completion design and a capital program focused on development drilling, Devon expects to deliver oil production growth of 20 to 25 percent year over year on a retained property basis. This production outlook is driven by balanced oil growth in both the U.S. and Canada.

In 2014 the company’s revenues jumped 16% year-over-year, which Devon attributes to increased production in light crude oil. Oil sales increased to 60% of Devon’s total upstream revenues during the year.

In the fourth quarter, upstream revenue fell 3% year-over-year. Thanks to the company’s hedging plan, cash settlements per barrel of oil equivalent raised Devon’s revenue by $4.23 a barrel, helping to offset lower realized prices for oil and natural gas liquids.

Shares traded down about 0.8% in Tuesday’s after-hours session, at $66.10 in a 52-week range of $51.76 to $80.63. Thomson Reuters had a consensus analyst price target of around $69.50 before today’s report.

ALSO READ: 10 States With the Worst Taxes for Average Americans

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.