Energy

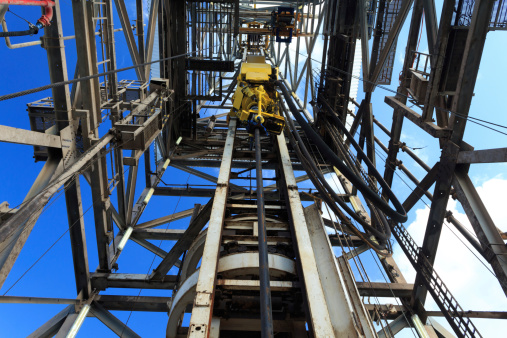

Why Sentiment Is Very Positive for Land Drillers at Energy Conference

Published:

Last Updated:

Despite the tug-of-war over oil inventories and the future price direction for oil, one thing is for sure. When it comes to what investors and energy industry experts like the most, it is the land drillers. In a new report from Angie Sedita, the well-respected UBS oil drilling and services analyst, she wraps up the company’s recent conference and hits on the key takeaways from the event.

One of the key takeaways was the commentary on the land drilling group. It was more positive than many would have expected, especially with almost all the companies expecting a rig recovery in the second half of this year, and one company saying the count could increase by as much as 200 rigs. The UBS team keeps a conservative hat on and does not price in a recovery until next year.

The UBS analyst focused on three top companies to buy in the land drilling arena. These are companies they have stayed positive on for some time.

Helmerich & Payne

This company primarily operates as a contract drilling company in South America, the Middle East and Africa. Helmerich & Payne Inc. (NYSE: HP) provides drilling rigs, equipment, personnel and camps on a contract basis to explore for and develop oil and gas from onshore areas and fixed platforms, tension-leg platforms and spars in offshore areas.

As of November 13, 2014, the company’s fleet included 333 land rigs in the United States, 37 international land rigs, and nine offshore platform rigs. Its contract drilling business operates through three reportable segments: U.S. Land, Offshore and International Land. The U.S. Land segment operates primarily in Oklahoma, California, Texas, Wyoming, Colorado, Louisiana, Mississippi, Pennsylvania, Ohio, Utah, New Mexico, Montana, North Dakota, West Virginia and Nevada.

ALSO READ: Sentiment Improves for MLPs: 4 Top Companies to Buy Now

The drilling giant beat on fiscal second-quarter 2015 earnings. Earnings per share from continuing operations (excluding special items) came in at $0.96, surpassing the consensus estimate of $0.79. Revenues of $883.1 million were down 1.2% from the prior-year quarter. However, the top-line came above the Wall Street estimates of $759 million.

Helmerich & Payne investors are paid a very solid 3.76% dividend. The UBS price target for the stock is $85, and the Thomson/First Call consensus figure is at $74.92. Shares closed Thursday at $73.09.

Nabors Industries

This company provides drilling and rig services. Nabors Industries Ltd. (NYSE: NBR) offers rig instrumentation, optimization software and directional drilling services. It also provides completion, life-of-well maintenance and plugging and abandonment of a well.

In addition, the company markets approximately 466 land drilling rigs for oil and gas land-based drilling operations in the United States, Canada and approximately 20 other countries worldwide; approximately 445 rigs for land well-servicing and workover services in the United States; 98 rigs for land well-servicing and workover services in Canada; 42 rigs for offshore drilling operations in the United States and internationally; and seven jackup units and components of trucks and fluid hauling vehicles.

ALSO READ: 4 Chip Stocks That Could Be Huge Internet of Things Winners

Nabors also posted strong earnings for the quarter. The company reported first-quarter 2015 earnings from continuing operations — excluding one-time items — of $0.20 per share, crushing the consensus estimate of $0.05. The bottom line also jumped 25% from $0.16 per share in the year-ago quarter. Significant higher profit from drilling and rig services aided the results.

Nabors investors are paid a 1.65% dividend. The UBS price target is posted at $19, and the consensus price objective is $17.43. Shares closed most recently at $14.53.

Patterson-UTI Energy

Patterson-UTI Energy Inc. (NASDAQ: PTEN) subsidiaries provide onshore contract drilling and pressure pumping services to exploration and production companies in North America. Patterson-UTI Drilling and its subsidiaries operate land-based drilling rigs in oil and natural gas-producing regions of the continental United States and western Canada. Universal Pressure Pumping and Universal Well Services provide pressure pumping services primarily in Texas and the Appalachian region.

To make it a clean sweep for these big three earnings wise, the company also reported better-than-expected first-quarter 2015 results on improved rig revenues. However, the bottom line did witness a substantial year-over-year decline due to a decrease in rig activity. Patterson-UTI reported earnings per share — excluding non-cash charges — of $0.06 surpassing the consensus of $0.03. The reported earnings were substantially below the year-ago quarter earnings of $0.24. While not the blow-out of the other two, still very good considering the sector.

Investors are paid a 2% dividend. The UBS price target is $27, and consensus target stands at $24.13. The stock closed most recently at $19.96.

ALSO READ: 10 Stocks to Own for the Next Decade

Given the hurt that has been put on the energy sector over the past year, all three have performed well. Plus, they are taking market share from the weaker companies as the lower oil prices wash out some of the smaller, and more leveraged players.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.