The tip-off should have been TransCanada Corp.’s (NYSE: TRP) request for the U.S. State Department to delay a decision on the main leg of the Keystone XL pipeline. If the company had expected a favorable decision it would not have asked for a delay. And on Thursday when the Obama administration rejected the requested delay, the deal had been sealed: the United States will officially reject construction of the Keystone XL pipeline.

President Obama delivered the news himself shortly before noon on Friday. Calling the Keystone XL pipeline neither a “silver bullet for the economy nor an express lane to environmental disaster,” the president said the pipeline does not offer long-term economic growth nor would it lower gasoline prices, and that bringing what he called “dirtier” oil into the United States would not increase the country’s energy security.

TransCanada first applied to build the Keystone XL in 2009, and the route the company has had to navigate since then is tortuous. The State Department completed an environmental review in 2011 but was forced to do a second one, and the pipeline ran into opposition from environmentalists in Nebraska. The big knock from environmentalists, though, has been the dirtiness of oil sands crude oil and the amount of carbon emissions that are generated, not just by burning the crude but by mining it as well.

ALSO READ: The 10 Most Profitable Companies in the World

It is naive, however, to think that mining the oil sands will end. In the first place, the investments are huge and were made by the biggest oil companies in the world. Right now demand from the oil sands region for rail transportation has fallen as the producers have cut back on producing some of the most expensive barrels in the world. Once prices rise again, there out to be a fair amount of unused rail transportation capacity that can come back into service quickly to move the crude to the east or the west of Canada.

In the second place, TransCanada already is reversing the flow on an existing pipeline that will move 1.1 million barrels a day of western Canadian crude oil to Canada’s east coast port. Another company, Enbridge Inc. (NYSE: ENB), will soon begin operating a west-to-east pipeline from Sarnia, Ontario, to Montreal. The so-called Line 9 pipeline also will be expanded to transport 300,000 barrels of crude per day.

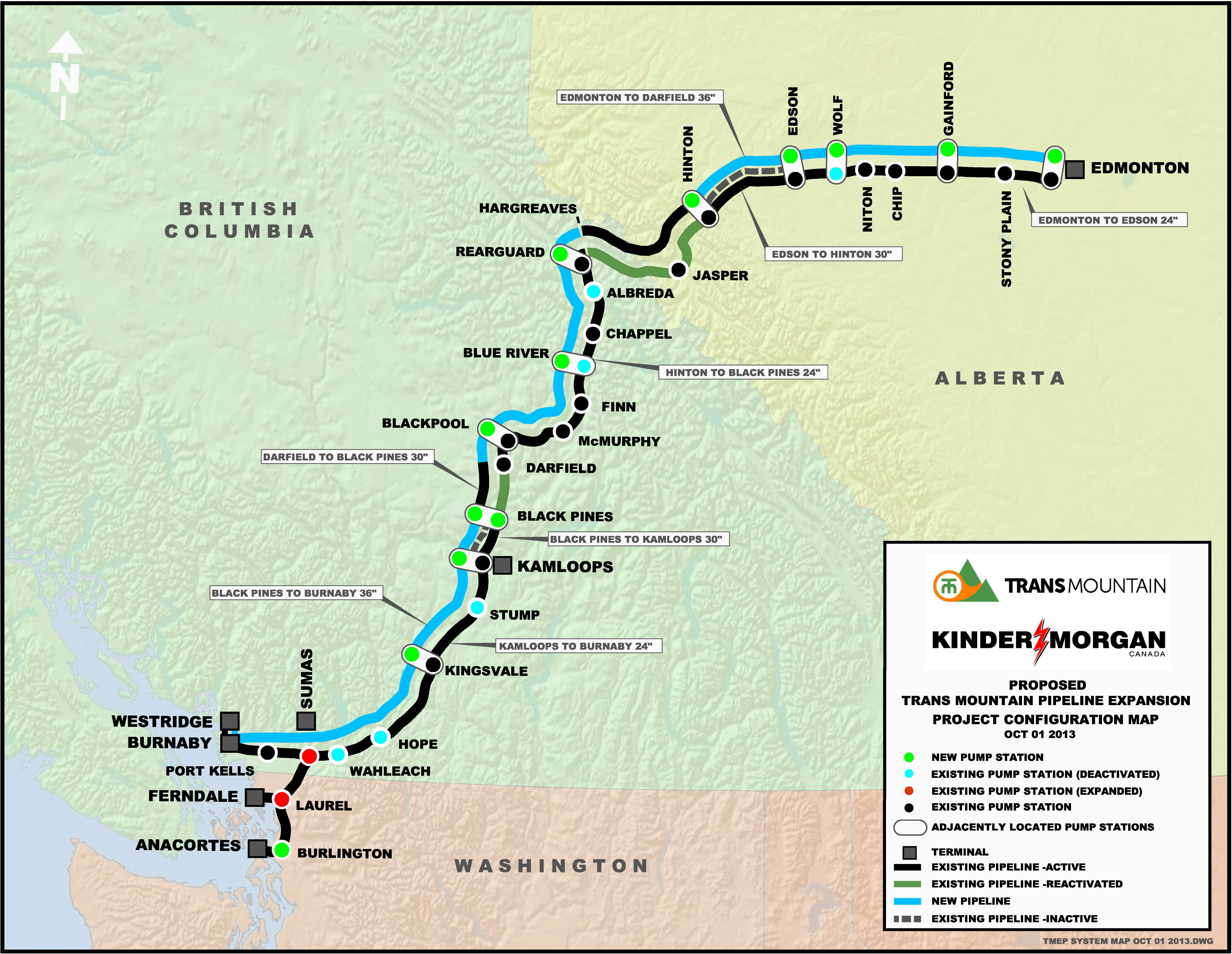

Other pipeline companies, including Kinder Morgan Inc. (NYSE: KMI), have proposed new or expanded pipeline systems to carry Alberta’s oil to Canada’s west coast. Those proposals have run into stiff opposition from Canada’s First Nations’ populations and from the country’s environmentalists.

ALSO READ: America’s 50 Best Cities to Live In

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.