So, you keep hearing time after time that lower and lower oil is good for the economy as a whole. It seems that way on the surface, but when you consider an extreme bust in oil the spillover of blood seems to be worse than the benefits seen elsewhere. News has broken on Thursday that Halliburton Co. (NYSE: HAL) is laying off another 5,000 workers. At the time of this writing, a press release or an SEC filing have not been seen, but 24/7 Wall St. has received information from Halliburton’s media relations.

As a reminder, Halliburton is in the process of trying to acquire Baker Hughes Inc. (NYSE: BHI). Halliburton has roughly 65,000 employees located in over 80 countries. Baker Hughes said in its most recent rig count data that it has 43,000 employees in more than 80 countries.

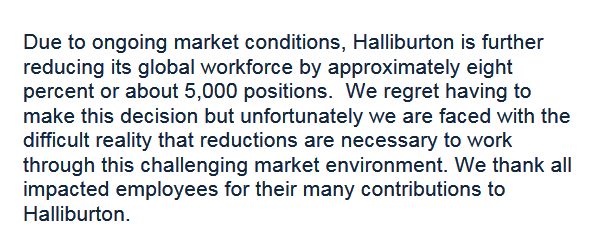

24/7 Wall St. has reached out to the media relations at Halliburton, and we have received the following statement from the company:

Due to ongoing market conditions, Halliburton is further reducing its global workforce by approximately eight percent or about 5,000 positions. We regret having to make this decision but unfortunately we are faced with the difficult reality that reductions are necessary to work through this challenging market environment. We thank all impacted employees for their many contributions to Halliburton.

Layoffs in the oil patch are not new by any stretch. Sadly, they are not yet done. Also, they could get far worse before they get better if the oil market remains stuck in an area where losses are the norm. Now consider that energy jobs have been placed economically as having two to three times the economic impact (depending on your source) of non-energy jobs. This marks more than 20,000 Halliburton layoffs since the start of the oil drop.

It was just on February 10 that Halliburton announced its 2016 first-quarter dividend of $0.18 per share for the common stock.

On February 22, a Baker Hughes SEC filing responded to the European Commission’s suspension of the formal review period. The SEC filing said:

The European Commission has requested additional information as part of its ongoing review process, and Halliburton and Baker Hughes intend to provide the additional information as expeditiously as possible. Requests for additional information are part of the usual post-filing process. The suspension of the formal review period is standard procedure where additional time is needed beyond the Commission’s deadline in order to respond fully to the Commission’s request. Halliburton has presented its divestment plan to the European Commission and will make a formal offer of remedies in the near future to address the Commission’s concerns. The companies continue to work constructively with the Commission and other competition enforcement authorities that have expressed an interest in the proposed transaction. Halliburton remains focused on closing the transaction as early as possible in 2016.

To date, the transaction has received regulatory clearances in Canada, Colombia, Ecuador, Kazakhstan, Russia, South Africa and Turkey. Halliburton and Baker Hughes remain focused on completing the regulatory approval process and closing the transaction in order to begin realizing the benefits of the combination for customers, stockholders and employees.

Halliburton shares were last seen down 0.7% at $32.22, against a 52-week trading range of $27.64 to $50.20. Baker Hughes shares were up 3.9% at $43.54, in a 52-week range of $37.58 to $70.45.

An image of the email confirmation from Halliburton media relations has been included.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.