Energy

Did OPEC Production Cut Make More Speculative Oil Stocks Rally Too Much?

Published:

Last Updated:

On a day that the Organization of Petroleum Exporting Countries (OPEC) announces a production cut, which is actually just announcing a formalized cut after previously stating that a cut was coming, many of the top oil stocks have risen handily. Where the moves look really crazy is in the more speculative second-tier oil stocks, which are either not as strong in the balance sheet or are still down massively from their highs of 2014 before the big sell-off started. Do equity moves of 15%, 20%, 25% and more seem normal?

OPEC announced that it will reduce oil production by 1.2 million barrels per day to 32.5 million. The agreed-to deal to cut the supply of oil was made after weeks of strained negotiations. What matters, even if this deal was telegraphed multiple times, is that this is really OPEC’s first real cut in eight years.

24/7 Wall St. would encourage readers to consider what is normal. Benchmark Brent crude went over $50 per barrel again for the first time in a month, and West Texas Intermediate crude was last seen up over 8% at $48.88 on Wednesday. A rise in any given day of 8% is far from normal. Still, moves of 20% in many multi-billion-dollar companies just feels like a head-scratcher.

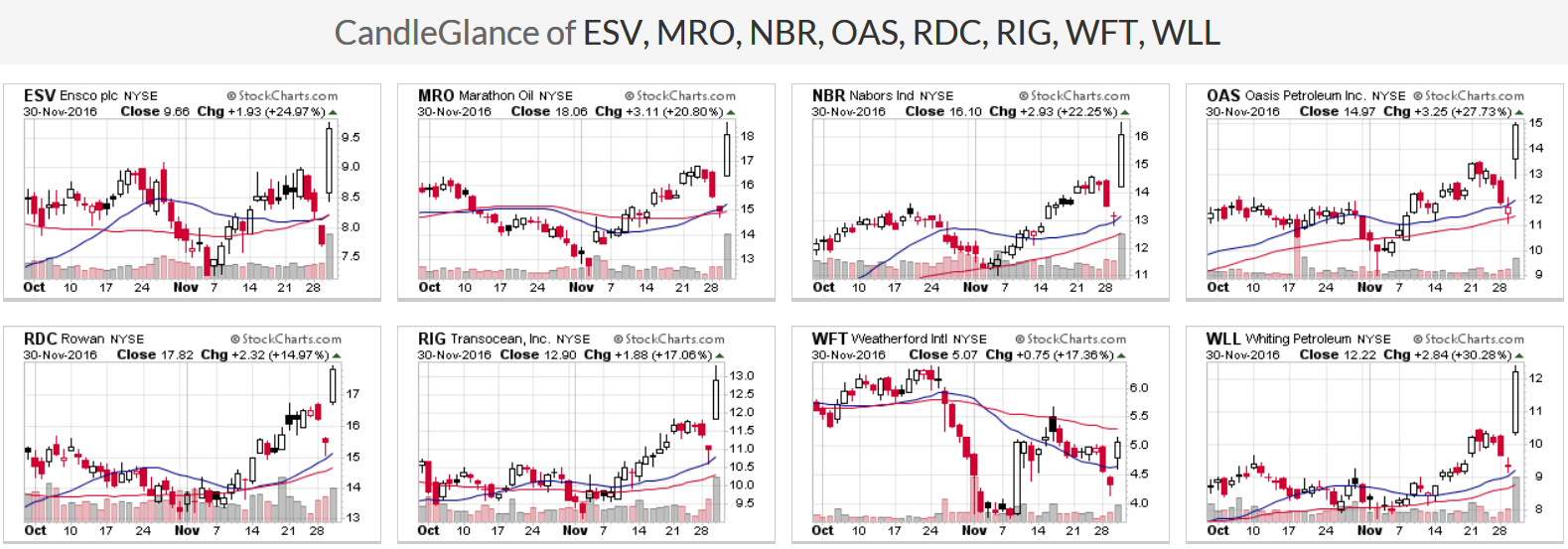

With solid gains across the board, here are just some of the moves seen on Wednesday, November 30. In an effort to keep these gains from looking too crazy, only stocks with a market capitalization north of $1 billion have been considered.

Basic information has been included on what gains were seen, how much of a trading volume spike was seen, where the stock is in its 52-week trading range, what its consensus analyst price target was, and what the market value of each company is as of the closing bell on Wednesday.

Ensco PLC (NYSE: ESV) saw its shares rally a sharp 25.1% to $9.67, and its 25 million shares is nearly three times normal trading volume. Ensco has a 52-week trading range of $6.50 to $17.40 and a total market cap of $2.9 billion.

Marathon Oil Corp. (NYSE: MRO) shares were up a whopping 209.9% at $18.08 on Wednesday, and the 70.5 million shares at the close was almost five times normal trading volume. It has a consensus analyst price target of $18.12 and a 52-week trading range of $6.52 to $18.55. The company has a total market cap of $15 billion.

Nabors Industries Ltd. (NYSE: NBR) rose by 22.3% to $16.11 on Wednesday. Its volume of 17.4 million shares was about 2.5 times normal trading volume. The consensus price target is $15.04, and the 52-week range is $4.93 to $16.50. The company has a total market cap of $4.6 billion.

Oasis Petroleum Inc. (NYSE: OAS) rose a whopping 27.8% to $14.98, and the 33.2 million shares was about 2.5 times normal volume. The 52-week range is $3.40 to $15.02, and the consensus price target is $14.54. The total market cap is $3.5 billion.

Rowan Companies PLC (NYSE: RDC) closed up 15.1% at $17.84, and the 5.2 million shares traded was just 1.3 times normal trading volume. The consensus analyst target is $15.04. The 52-week range is $10.67 to $20.88, and the market cap is $2.2 billion.

Transocean Ltd. (NYSE: RIG) was last seen up 17.1% at $12.91. Its volume of more than 42 million shares equated to right at three times normal volume. It has a consensus price target of $9.72 and a 52-week range of $7.67 to $14.50. The company has a total market cap of $4.7 billion.

Weatherford International PLC (NYSE: WFT) saw a per-share 18.9% gain to $5.14 on Wednesday, and the 55.9 million shares was right at twice normal trading volume. The consensus price target is $7.43, and a 52-week range is $3.73 to $11.14. The company has a total market cap of $5 billion.

Whiting Petroleum Corp. (NYSE: WLL) saw its shares rocket up by 30.2% to $12.21 on 79.5 million shares on Wednesday. That represents almost four times normal trading volume. With a total market cap of $3.5 billion, its shares have a consensus price target of $11.39 and a 52-week range of $3.35 to $16.62.

Deutsche Bank recently named four hot stocks to win off the Permian Basin as well, and these rose with the sector on Wednesday too.

Before you throw your hands up in the air or before you buy into the OPEC cuts too much, ask yourself what OPEC’s history of actual cuts and production quotas has been on and off over the past 50 years or more. Stocks can run endlessly higher when good news changes the situation of supply and demand. That being said, runs of this magnitude are just not normal, even if much of the move can be tied to short sellers covering their bases in the more speculative stocks.

A chart montage from StockCharts.com has been provided below.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.