In 2016, U.S. utilities invested about $7.6 billion in energy efficiency programs and saved approximately 25.4 million megawatt-hours (MWh) of electricity. The U.S. Energy Information Administration (EIA) reported that in July of this year, the average cost of a kilowatt-hour in the United States was 13.12 cents, or $131.20 per MWh. That’s a savings of $3.33 billion.

Energy efficiency efforts vary among states, but in 2016 about half the states reported saving more as a result of energy efficiency programs than they did in 2015.

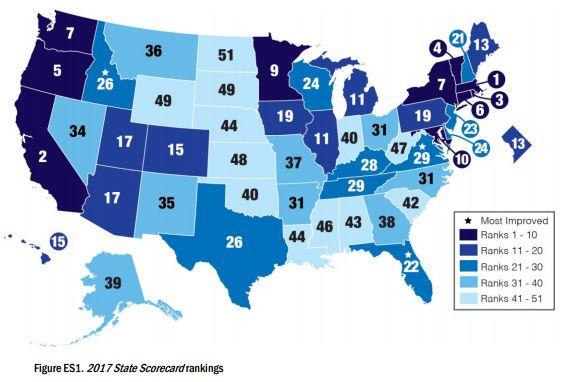

The American Council for an Energy-Efficient Economy (ACEEE) just published its annual “State Energy Efficiency Scorecard” that ranks the 50 states and the District of Columbia in six categories: utility programs, transportation, building energy codes, combined heat and power, state initiatives and appliance standards. Scores are assigned in a range of 1 to 50.

The 10 states with the highest (best) energy efficient scores last year were:

- Massachusetts: 44.5

- California: 42.0

- Rhode Island: 41.5

- Vermont: 39.0

- Oregon: 36.5

- Connecticut: 35.5

- New York: 34.5

- Washington: 34.5

- Minnesota: 33.0

- Maryland: 31.0

In only one state, Maryland, did the cost of a kilowatt hour fall in the period between July 2016 and July 2017.

The 10 states with the lowest energy efficiency scores were:

- North Dakota: 3.5

- Wyoming: 5.0

- South Dakota: 5.0

- Kansas: 6.0

- West Virginia: 6.5

- Mississippi: 7.5

- Nebraska: 8.5

- Louisiana: 8.5

- Alabama: 9.0

- South Carolina: 9.5

Only Nebraska showed a year-over-year decline in the price of a kilowatt-hour.

Here’s a map with scores for all 50 states and D.C.

The full ACEEE 2017 Scorecard is available at the organization’s website.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.