Energy

Why Does the IEA Always Underestimate Solar Energy's Rapid Growth?

Published:

Last Updated:

Baseball philosopher Yogi Berra once said, “It’s tough to make predictions, especially about the future.” That doesn’t stop people from making them, mostly because predictions going out years or decades are long forgotten when the predicted time arrives.

A research engineer at Eindhoven University of Technology in The Hague, Auke Hoekstra, decided to check up on the International Energy Agency (IEA) and its predictions for the rise in solar photovoltaic (PV) installation.

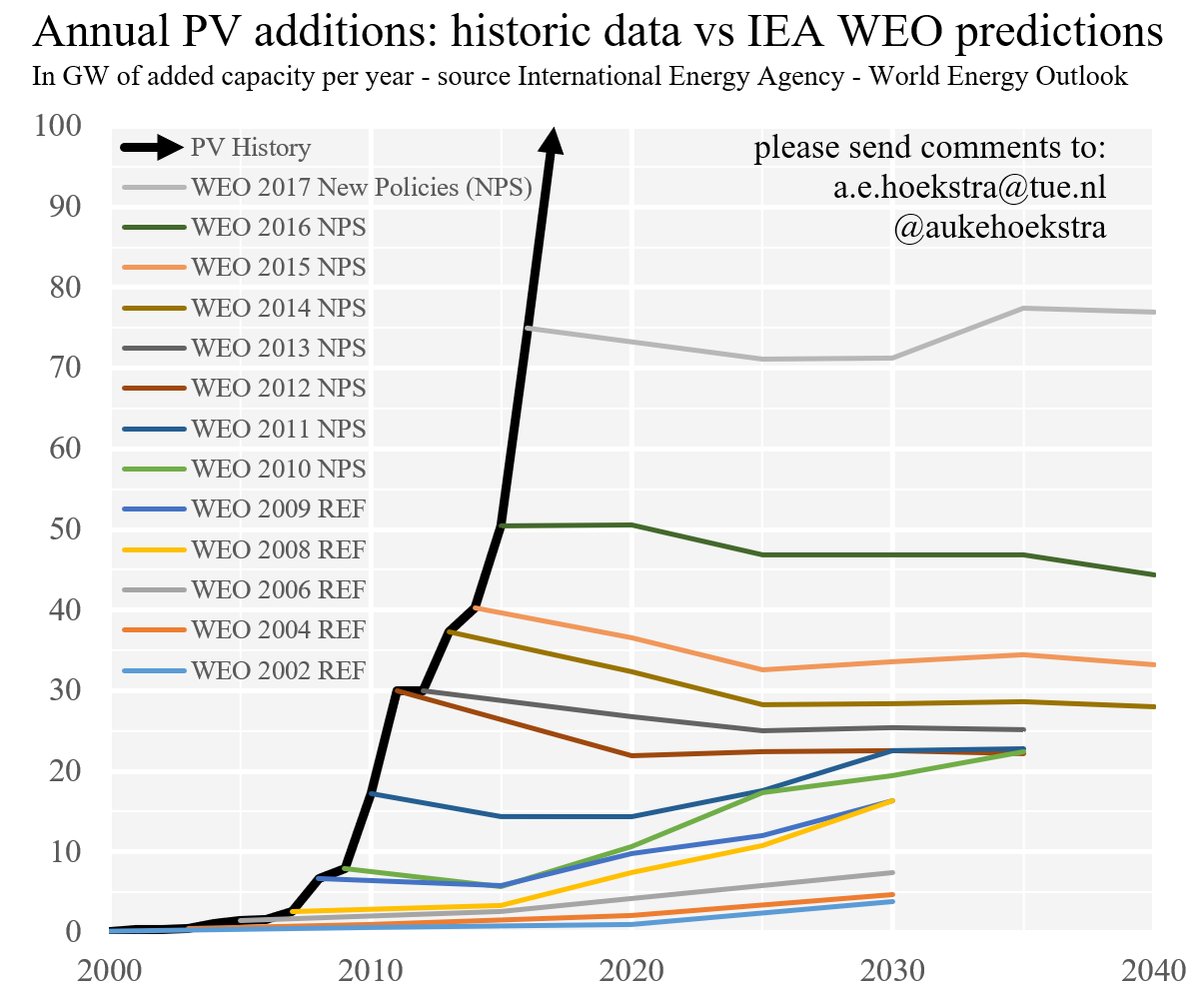

Using data from the agency’s World Economic Outlook (WEO) for 13 of the past 16 years, Hoekstra graphed the actual growth of solar PV installation (the thick black line on the following chart) against the IEA predictions from the WEO.

The starting point for each year’s new prediction moves higher and in some years sharply higher. Hoekstra notes that “every single time since the future of photovoltaics was first predicted in the IEA WEO in 2002, the WEO has assumed the sector would hardly grow or even contract, even though this runs contrary to the observed reality.”

Because the IEA’s WEO is a widely used source for policy makers around the world, consistently underestimating the growth of solar PV when the data say otherwise discourages investment in solar and can hold back even faster growth.

Hoekstra, in a blog post last June, offers some possible explanations for the IEA’s low and inaccurate predictions:

- Incumbent industries almost never foresee radical innovations that develop along exponential trends. This was true for steam engines, planes, computers, Internet, mobile phones, digital cameras, et cetera. Now we might see the same thing happening in energy (including storage) and transportation (electric vehicles using batteries that are plummeting in price). So it could be a lack of imagination.

- Models that are honed using years and years of effort tend to become inflexible. That is especially true for relatively static equilibrium models that are often used in economics. They cannot deal with radical exponential change. I think this is one of the reasons why agent-based models are such a good idea, but I digress. So it could be inflexible models.

- The IEA could have been captured by the old fossil energy order in terms of thinking or interests. This could be conscious or unconscious. I would guess largely unconscious because I’m a firm believer in Hanlon’s razor.

- The IEA might assume costs that are much too high. This indeed seems to be the case. We saw that in WEO2004 the assumption for the capital costs in 2030 was around ten times higher than the actual capital cost in 2016. However this just reformulates the problem from “the WEO underestimates photovoltaic growth” to “the WEO underestimates photovoltaic price reductions”.

- The IEA might assume high storage costs because solar is an intermittent resource.Sources close to the modelers have told me that the use of solar “explodes” when storage is left out. So it could be an important variable. However, storage becomes more of an issue when the percentage of photovoltaics increases. Put simply: storage is no issue if less than 20% of electricity comes from photovoltaics (and after that smart grids, smart charging of electric vehicles and storage come into play) while the IEA model plateaus no matter how insignificant the adoption rate. So if storage is the cause, it is still modeled wrong.

A more detailed look at Hoekstra’s analysis and conclusions is available in this October post.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.