Energy

Crude Oil Pipeline Capacity Out of the Permian Basin Is Vanishing

Published:

Last Updated:

West Texas Intermediate (WTI) crude oil traded at a discount of $7 a barrel to Brent crude late Monday morning, but that reflects just one headwind faced by U.S. crude producers. In the Permian Basin, the discount may surpass $20 or more a barrel due to a lack of pipeline takeaway capacity to transport the oil to Houston or Corpus Christi, where it can be loaded on a tanker for export.

This is truly a good news-bad news kind of story. Permian Basin production has been rising by about 70,000 barrels a day in the past few months, which translates to an increase of some 800,000 barrels a day by the end of this year. With crude prices hovering around $71 a barrel, there is little incentive for Permian producers to stop because even if they have to ship crude by rail or truck — and pay transportation costs of anywhere between $8 and $20 or more a barrel as opposed to $3 or $4 a barrel for pipeline transportation — they can still make money. Just not as much.

Earlier this month we reported on a survey by the Federal Reserve Bank of Dallas that indicated that transportation out of the Permian Basin to the Gulf Coast could be constrained until the middle of next year.

In the meantime, producers are paying up to $8 a barrel to transport Permian crude by rail to the coast and $20 a barrel or more to transport crude by truck. Now the problem becomes one of sufficient rail and truck capacity to do the job.

Further complicating the transportation issue is what producers will do with the associated natural gas that is released by drilling for oil. Some is being transported to out of the Permian Basin to other pipelines or processing plants, but some is also being flared (burned off) because there is not enough natural gas pipeline capacity to transport the gas. Barring a permit from the Texas Railroad Commission, the body that regulates energy production in the state, drilling may have to be curtailed once the flaring limit is reached.

Producers and pipeline operators are getting creative, according to a report this morning from RBN Energy:

Is there an idle refined-products pipe that could be put back into service? Could drag-reducing agents be added to an existing crude pipeline to boost its throughput? How quickly could that mothballed crude-by-rail terminal be restarted?

Drag-reducing agents are being injected into pipelines to increase the volume of oil that flows through the pipeline by reducing the turbulence within the pipe. This works but is hardly capable of dealing with the expected surge in production.

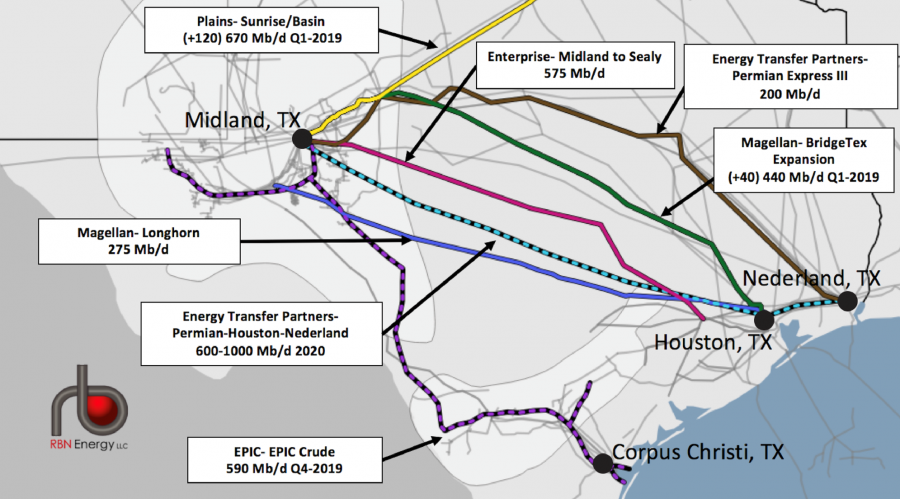

While these are short-term solutions and may get Permian producers through the current takeaway shortage, the medium-term to long-term solution is new pipelines. RBN Energy produced the following map showing both existing and planned expansion and new pipelines (dashed lines on the map) that will increase takeaway capacity by more than 1.6 million barrels a day by 2020. In the short term (12 months or so), an additional 160 barrels a day are coming online, well short of projected production growth, and most of that is taking oil to Cushing, Oklahoma, not the Gulf Coast.

For producers, this is a tough spot. For U.S. consumers it may be that the lack of capacity to Houston and Corpus Christi will force producers to ship their crude to a domestic destination. WTI may fetch a lower price domestically, but there’s still a profit to be made, and it’s a better choice than not drilling new wells or shutting in producing ones.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.