Oil supermajor Royal Dutch Shell PLC (NYSE: RDS-A) announced Friday morning that it had made a sixth oil discovery in its Norphlet play in the Gulf of Mexico. The Dover well is 100% owned by Shell and is located about 170 miles southeast of New Orleans.

Last month the company launched its multibillion Appomattox platform into the Gulf, and the newly discovered well is about 13 miles south of the platform’s location. That’s good luck for the company because it foreshadows a tieback connection from Dover to Appomattox, saving the billions in costs for building another platform. Appomattox is partially owned (21%) by Nexen, the North American subsidiary of China National Offshore Oil Co. Ltd. (NYSE: CEO) or Cnooc, and is expected to be producing oil by the end of next year.

Shell said the well was drilled in 7,500 feet of water to a depth of 29,000 feet below the seafloor. The net pay area of the well is 800 vertical feet, and the company gave no estimate of the number of barrels in the discovery. The Dover well is expected to begin production before the end of next year.

Andy Brown, Shell’s upstream director, said:

Dover showcases our expertise in discovering new, commercial resources in a heartland helping deliver our deep water growth priority. By focusing on near-field exploration opportunities in the Norphlet, we are adding to our resource base in a prolific basin that will be anchored by the Appomattox development.

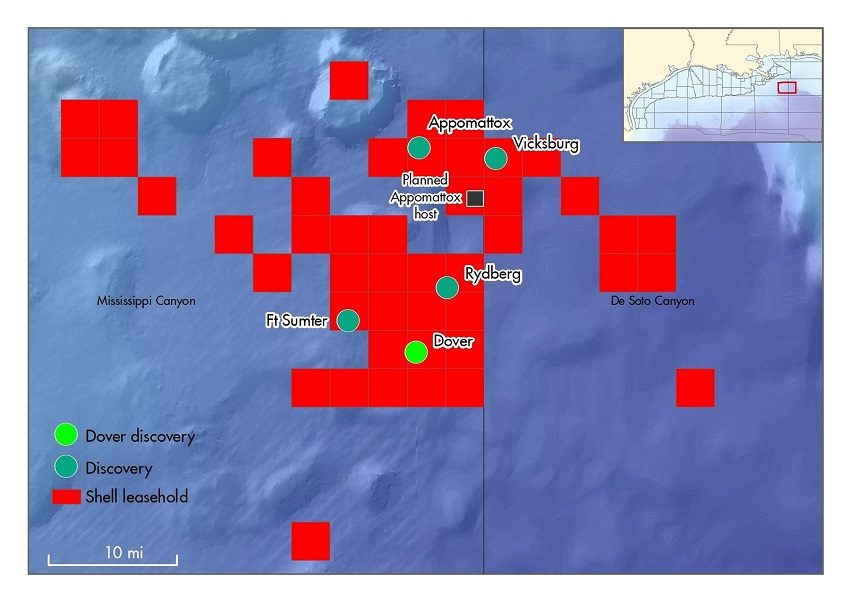

Shell provided the following map of its leases and wells in the Norphlet. The inset shows the location of the play relative to the Gulf Coast.

The Appomattox project was authorized by Shell in 2015 and was the first major deepwater project announced after the 2014 crash in oil prices. West Texas Intermediate (WTI) crude oil prices above $70 a barrel are expected to encourage more of these super-expensive deepwater projects in the Gulf of Mexico and elsewhere.

WTI crude for July delivery has dropped more than 4% by the noon hour Friday to $67.70, after closing last night at $70.71. That’s more than $5 a barrel off the highest price in nearly four years set earlier this week. Brent crude for August delivery has dropped about 2.6% to trade at $76.16.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.