Energy

Study Outlines What Happens If Oil Hits $100 -- and It's a Mess

Published:

Last Updated:

At the end of September last year, Brent crude oil briefly traded at a three-year high of around $85 a barrel. By the end of December, the price had dropped by about $30 a barrel.

Crude prices have risen steadily since the December bottom, and Brent crude closed at nearly $74 a barrel on Wednesday. The Trump administration’s decision announced last week to eliminate waivers on buying oil from Iran figured into the most recent uptick, but there are other factors that threaten a rise to $100 for a barrel of Brent.

According to a new briefing from U.K.-based Oxford Economics, the elimination of U.S. waivers to buyers of Iranian crude raises the risk that Middle East tensions could drive crude prices to the $100-a-barrel mark. The Oxford analysts then ran a simulation to determine the effect of $100 oil on the global economy. The result is not pretty.

As the analysts noted, in the short term, dwindling supply from Iran can be replaced by rising production from Saudi Arabia, Russia and the United States. During the fourth quarter of last year, Saudi Arabia and Russia agreed to raise production by about 500,000 barrels a day. U.S. production rose from around 11.1 million barrels a day at the end of September to around 11.7 million barrels by the end of December. Last week, the U.S. Energy Information Administration reported U.S. production had reached 12.2 million barrels a day, 1.6 million barrels above production at the same time in 2018. Over the next five years, the United States is expected to lead the world in crude production growth.

The Oxford simulation assumed that the current state of the global oil market is similar to historical periods when Middle East tensions were elevated. That tension alone adds $2.50 a month to the price of oil. An unexpected shock to supply — for example, a sudden steep drop in supply from Nigeria — could push the price of crude to $100.

By the end of 2019, assuming no reduction in Middle East tensions, that alone could add $22.50 a barrel to the price of crude, lifting the price to around $96.50 a barrel. Even a moderately sized shock could easily push the price to or above $100.

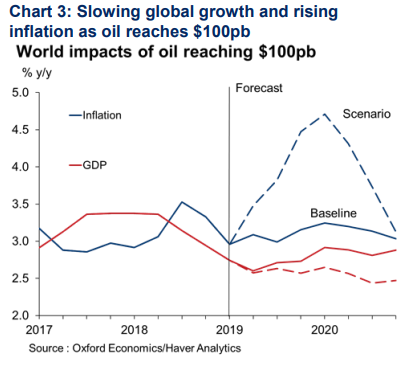

The impact on the global economy, according to Oxford, is a decline of 0.6% in global gross domestic product from 2.6% growth in the first quarter of this year to 2.5% at the end of 2020. Inflation would rise by 1.5 points above a baseline estimate to average 4% year-over-year growth in 2020.

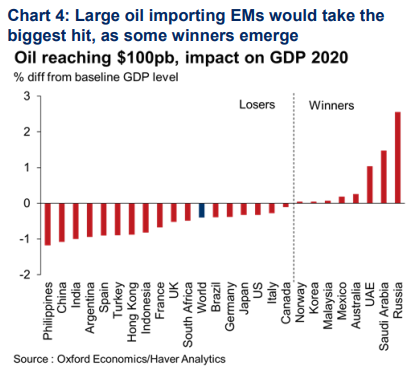

The countries hardest hit by a rise to $100 would be emerging economies that import oil. Oxford notes especially the Philippines (a 1.2% drop below 2020 GDP), Argentina and Turkey (a drop of 0.9%) and Indonesia (a drop of 0.8%).

The main beneficiaries of $100 oil are Saudi Arabia, Russia and the United Arab Emirates. The United States, though it is one of the world’s largest producers, actually sees a decline in GDP growth largely due to its still high demand for imported crude.

Keep in mind that as the Saudis and Russians curtail production, the world’s spare capacity rises. The oil doesn’t just disappear; it’s merely taken out of production. As the global economy slows down, demand for crude typically slows as well. At that point, the Saudis have to decide whether to keep those spare barrels in the ground and, perhaps, lose more market share or pump more oil and put downward pressure on the price.

On top of that, electric cars are coming and any barrels left in the ground may be worth a lot less in 10 years than they are today. Bloomberg New Energy Finance (BNEF) forecasts that by 2022, car buyers will have some 289 different electric models to choose from. By 2040, one-third of the global car fleet (559 million vehicles) will be electric according to BNEF, and 55% of new cars sold that year will be electric.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.