Energy

Global Greenhouse Gas Emissions Won't Peak Until After 2040

Published:

Last Updated:

Worldwide demand for energy will continue to increase by 1% a year for the next 20 years. More than half of that demand growth will be met by expanding renewable sources like solar and wind generation, while about a third of demand growth will be met by natural gas.

None of this will help meet global sustainability goals, according to the International Energy Agency (IEA), which released on Tuesday its World Energy Outlook 2019. The transformation to sustainable energy has begun, but the effort has not been large enough to reduce the greenhouse gas (GHG) emissions that are driving global warming. Under current governmental policies, energy demand rises by 1.3% annually through 2040, “resulting in strains across all aspects of energy markets and a continued strong upward march in energy-related emissions.”

If governments actually follow through on their stated policies, demand growth dips to 1% a year, but the effects are only slightly less bad than under current policies. What the IEA calls its stated policies scenario “describes a world in 2040 where hundreds of millions of people still go without access to electricity, where pollution-related premature deaths remain around today’s elevated levels, and where CO2 emissions would lock in severe impacts from climate change.”

The IEA notes that oil demand will flatten out in the 2030s and coal use will fall, but that the overall impact will not be large enough to reduce GHG emissions: “[T]he momentum behind clean energy technologies is not enough to offset the effects of an expanding global economy and growing population. The rise in emissions slows but, with no peak before 2040, the world falls far short of shared sustainability goals.”

Under either the current policies or stated policies scenario, GHG emissions continue rising through 2040 and don’t even peak until well after the Paris Agreement’s 2050 target for net-zero emissions in order to hold the increase in global temperatures to “well below 2° C … and pursuing efforts to limit [the rise] to 1.5° C” by 2100.

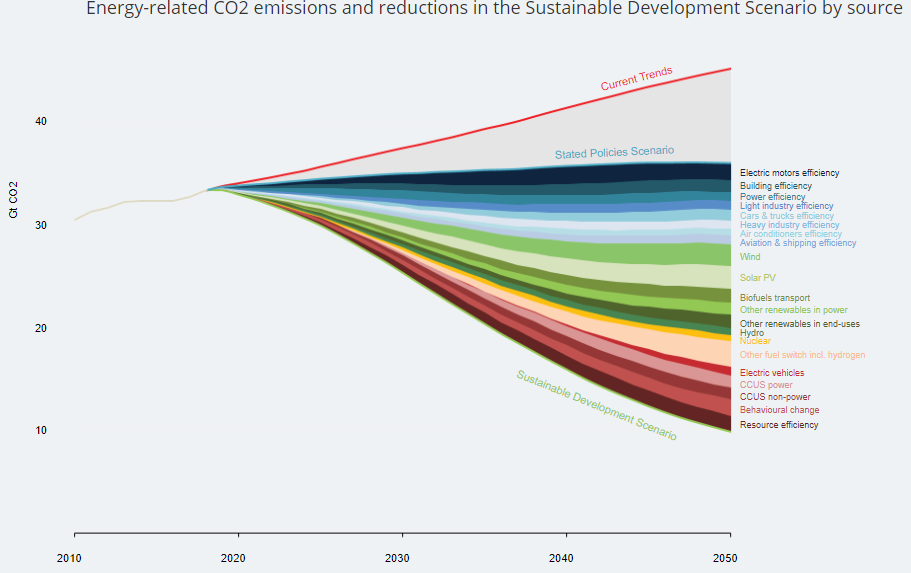

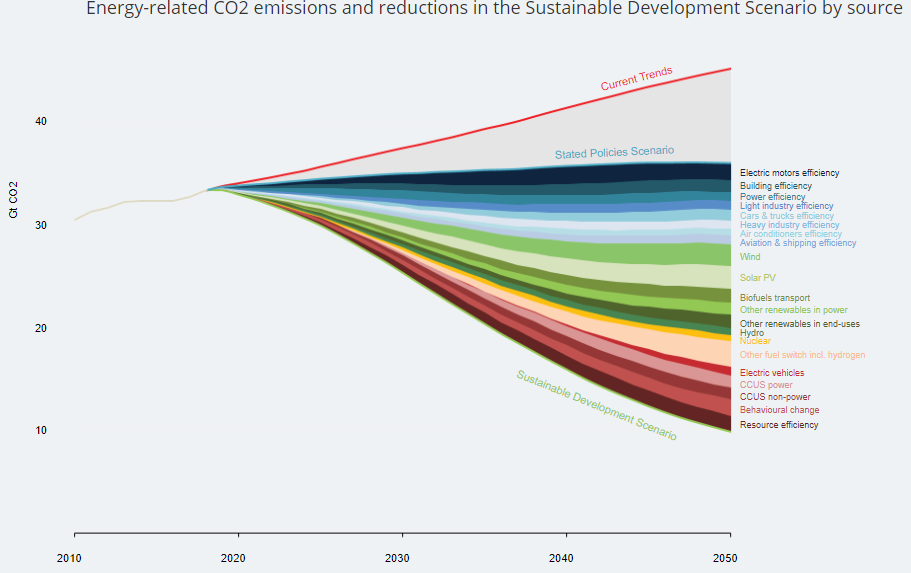

Under the third IEA scenario, which the agency calls its sustainable development scenario, the use of multiple fuels and technologies achieves dramatic cuts in GHG emissions while at the same time providing “efficient and cost-effective energy services for all.” The following chart from the 2019 Outlook shows the impact of sustainable development on reducing emissions. The areas shown in shades of blue represent energy efficiency gains, the green shading indicates gains from adding more renewable electricity generation, the yellow shading indicates nuclear power and other fuel-source switching, and the red-shaded areas denote the impact of electric vehicles, carbon capture, behavior change and resource efficiency.

In 2018, global GHG emissions totaled nearly 34 billion metric tons of carbon dioxide equivalent. As the chart shows, only the sustainable development scenario actually reduces carbon emissions. If fully implemented, emissions would fall to around 12 billion metric tons in 2050. Even then it may take another 20 years to reach net-zero carbon emissions, according to Bloomberg.

Dr. Fatih Birol, executive director of the IEA, said, “What comes through with crystal clarity in this year’s World Energy Outlook is there is no single or simple solution to transforming global energy systems. Many technologies and fuels have a part to play across all sectors of the economy. For this to happen, we need strong leadership from policy makers, as governments hold the clearest responsibility to act and have the greatest scope to shape the future.”

24/7 Wall St. recently reviewed 27 specific impacts resulting from climate change.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.