On Tuesday, the International Energy Agency (IEA) released an update to its 2021 Net Zero Roadmap. As with all things related to climate change, there is good news and bad news.

In short, according to the IEA, the global pathway to net zero emissions by 2050 remains achievable, but we had better hurry, especially if we want to hold the level of warming to 1.5°C. Many of the report’s conclusions are arguable.

For example, IEA projects that if all the currently announced carbon capture, use and storage (CCUS) are completed and operating at capacity by 2030, just over 1 billion metric tons of CO2 will be captured, or 8% of cumulative CO2 emissions. Direct air capture (DAC) could reach the same tonnage by 2050. (See which city emits the most carbon dioxide on earth.)

Even if those calculations are realized, is a CO2 reduction of 8% worth the time and money it will cost to achieve it? A study published earlier this week by DeSmog, a global warming watchdog organization, looks at 12 large-scale CCUS projects from around the world and concludes that the promises of the technology are rarely delivered. The most successful CCUS projects are those where the captured carbon is used to produce more oil.

Here are a few charts from the IEA report that chart out a roadmap for reaching net zero emissions.

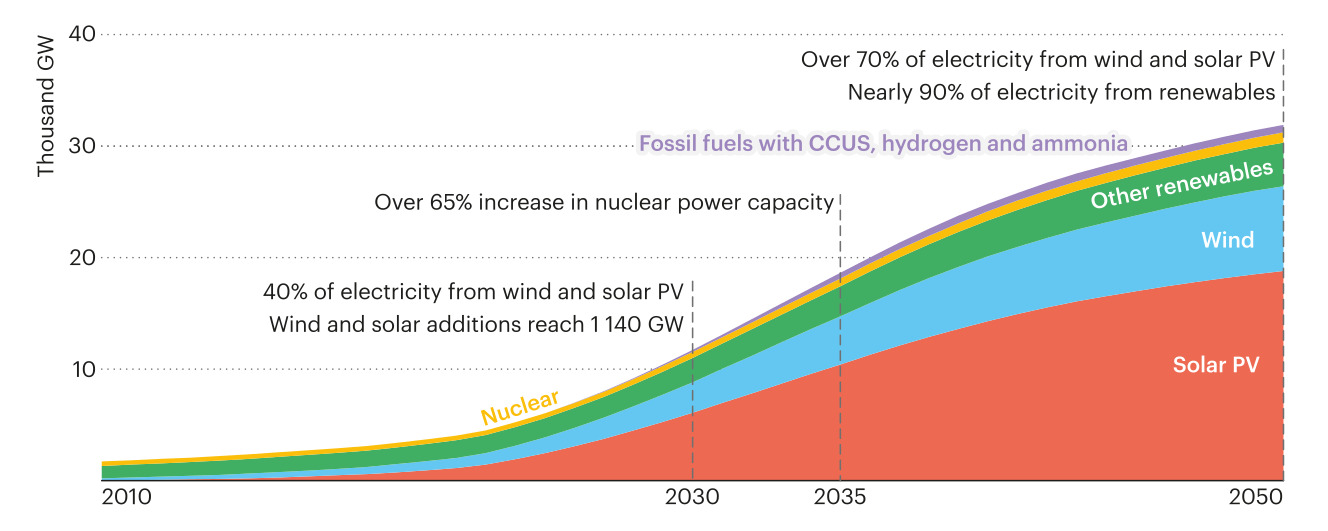

Using low-emissions methods to generate electricity generates a 34% reduction in emissions:

Renewables capacity triples by 2030 led by solar PV and wind, complemented by growth in nuclear and other sources, raising the share of low-emissions sources in electricity generation from 39% in 2022 to 71% in 2030 and 100% in 2050.

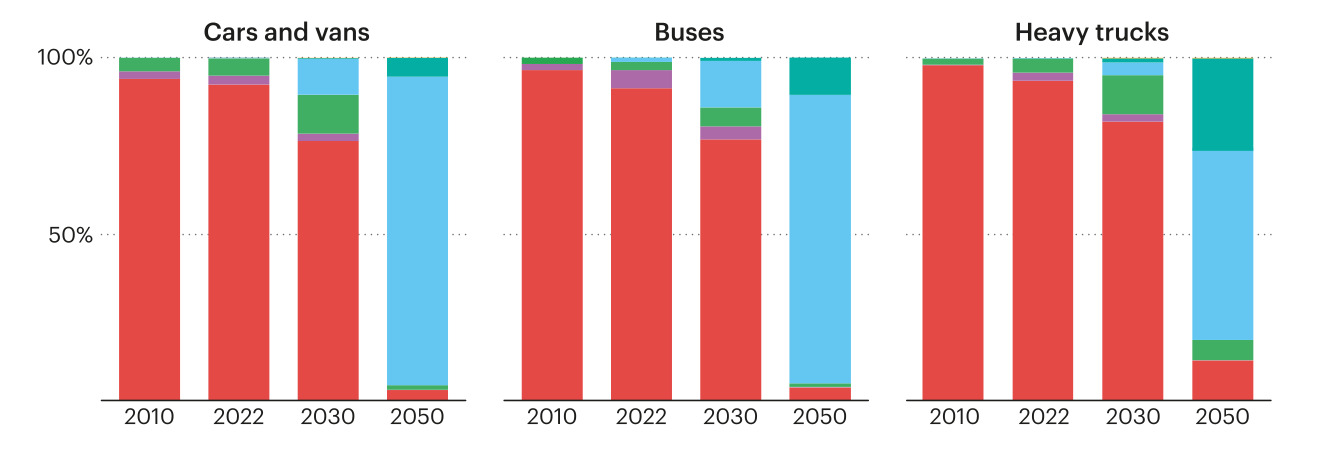

Emissions from transportation fuels generate a 16% reduction in emissions:

Ramping up electrification and biofuels plays a major role to decarbonise road transport to 2030. Thereafter, electrification is the prominent lever, with electricity representing three-quarters of energy consumption in road transport in 2050.

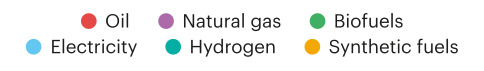

Declining demand for fossil fuels for all uses results in a 97% reduction in fossil fuel emissions:

Declines in fossil fuel demand are sufficiently steep that there is no need for new long lead time upstream oil and gas conventional projects, nor for new coal mines or mine extensions.

The existence of fossil fuel companies is being threatened, and the industry is fighting back with plans and projects like CCUS and blue hydrogen that are both hugely expensive and of limited value in reducing carbon emissions.

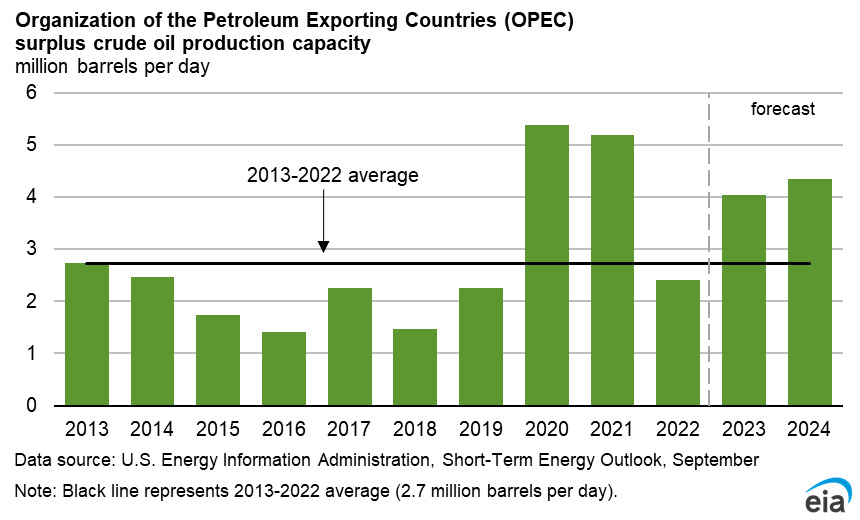

One last chart, this one from the U.S. Energy Information Administration’s Short-Term Energy Outlook published earlier this month. While demand for oil may be declining slightly due to more consumers purchasing EVs, OPEC production cuts (from Saudi Arabia, mostly) are driving up the cartel’s spare capacity. That reduction in supply is what is currently driving prices higher. Can OPEC continue restricting production forever–or at least until 2050? Probably not.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.