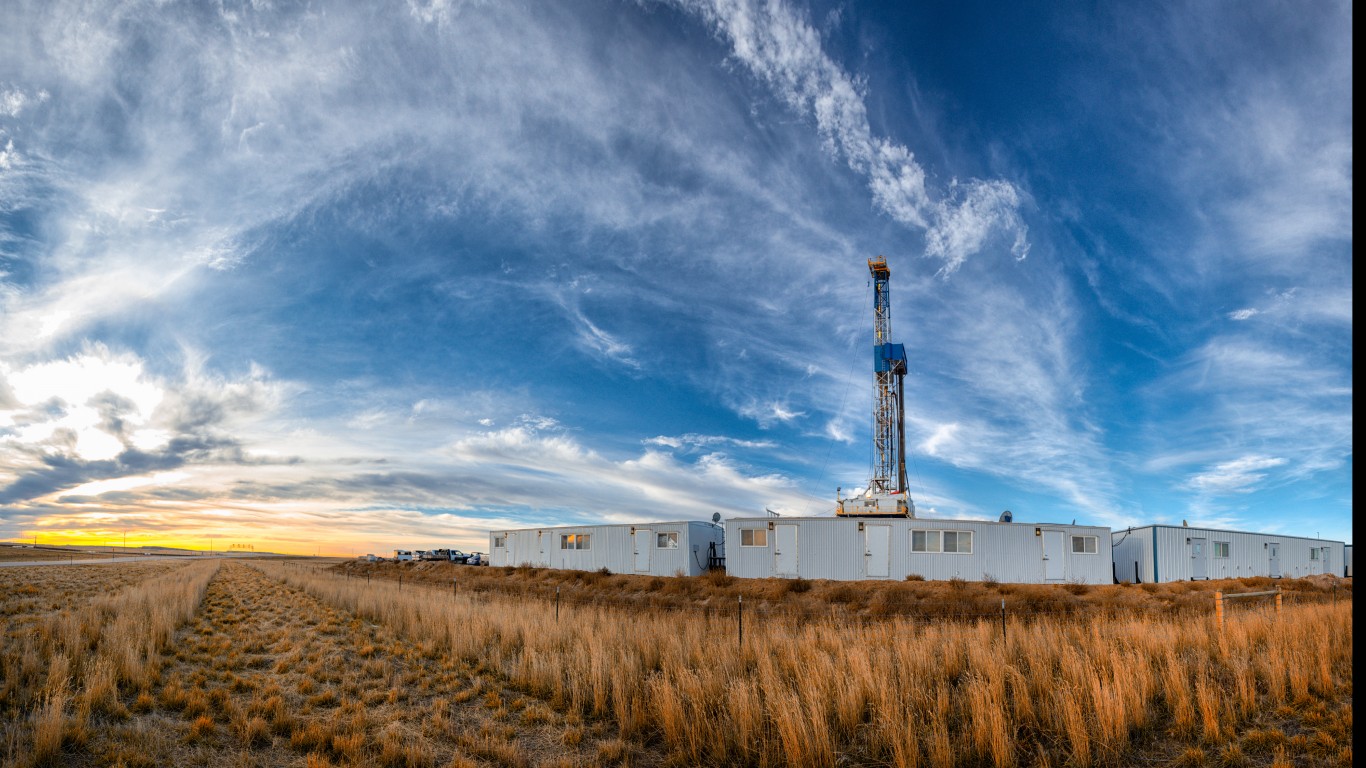

Energy

5 Blue Chip Dividend Oil Stocks Could Be Acquired Next If Huge Oil Mergers Happen

Published:

Last Updated:

Last fall, Exxon Mobil Corporation (NYSE: XOM) made a monumental move, announcing its acquisition of oil shale titan Pioneer Natural Resources (NYSE: PXD) for a staggering $59.5 billion in an all-stock deal. This landmark agreement will establish Exxon Mobil as the largest U.S. oil field producer, ensuring a decade of cost-effective production.

Exxon Mobil’s latest acquisition marks a significant milestone in its history, surpassing even its purchase of Mobil in 1999 for $81 billion. This strategic move merges a powerhouse in the energy sector with one of the key players in the shale revolution, which has been instrumental in revitalizing U.S. production over the past fifteen years.

In a testament to the industry’s ever-evolving landscape, Chevron Corporation (NYSE: CVX) swiftly followed Exxon’s footsteps, announcing its definitive agreement to acquire all outstanding shares of Hess Corporation (NYSE: HES) in a substantial all-stock transaction valued at $53 billion.

This equates to $171 per share based on Chevron’s closing price on October 20, 2023. Under the terms of this agreement, Hess shareholders will receive 1.0250 shares of Chevron for each Hess share, with the total enterprise value, including debt, of the transaction standing at $60 billion.

We screened our 24/7 Wall St. energy research database and found five top companies that could be next as oil majors look to consolidate the industry and grow their oil, gas, and LNG footprint. All pay dependable dividends and all are rated Buy at top Wall Street firms.

This company was long considered an industry leader when they were known as Apache and is offering one of the best entry points in the sector while paying a 2.97% dividend. APA Corporation (NYSE: APA) explores for and produces oil and gas properties through its subsidiaries.

It has operations in the United States, Egypt, and the United Kingdom, as well as exploration activities offshore Suriname. It also operates gathering, processing, and transmission assets in West Texas and owns four Permian-to-Gulf Coast pipelines.

The company is one of the largest US E&P companies, with 2.3 BBOE of proven reserves (63% liquids). It is an acquirer/exploiter/explorer, a fiscally conservative company that has consistently grown its reserves and production via acquisitions and organic projects.

APA Corporation also operates gathering, compression, processing, and transmission assets in West Texas and owns four long-haul pipelines in the Permian Basin.

This company was formed by closing the $17 billion merger of Cabot Oil & Gas Corp. and Cimarex Energy Company in 2021 and pays a solid 2.98% dividend. Corterra Energy Inc. (NASDAQ: CTRA) is an independent oil and gas company engaged in the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States.

It primarily focuses on the Marcellus Shale, which has approximately 177,000 net acres in the dry gas window of the play and is located in Susquehanna County, Pennsylvania.

The company also holds approximately 306,000 net acres of Permian Basin properties and approximately 182,000 net acres of Anadarko Basin properties in Oklahoma.

In addition, it operates natural gas and saltwater disposal gathering systems in Texas.

The company sells its natural gas to:

This energy company may offer one of the best value propositions in the sector as it utilizes the variable dividend strategy and currently pays a 4.44% dividend. Devon Energy Corporation (NYSE: DVN) is an independent energy company that primarily explores, develops, and produces oil, natural gas, and natural gas liquids (NGLs) in the United States and Canada. It operates approximately 19,000 wells.

The company also offers midstream energy services through:

Production is primarily crude oil-focused, while growth opportunities are focused on liquids. The Delaware Basin, SCOOP/STACK, Eagle Ford Shale, Canadian Oil Sands, and the Barnett anchor the company.

Devon also owns equity in the publicly traded midstream MLP EnLink Midstream, LLC (NYSE: ENLC)

This red-hot energy play looks poised to press higher again and offers a rich 4.13% dividend. Diamondback Energy, Inc. (NASDAQ: FANG) is an independent oil and natural gas company focused on the acquisition, development, exploration, and exploitation of unconventional and onshore oil and natural gas reserves in the Permian Basin in West Texas.

Diamondback Energy is focused on developing:

The company also owns, operates, develops, and acquires midstream infrastructure assets, including 770 miles of crude oil gathering pipelines, natural gas gathering pipelines, and an integrated water system in the Midland and Delaware Basins of the Permian Basin.

This company is a solid way for more conservative accounts to play the energy sector and pays shareholders a 1.48% dividend. Marathon Oil Corporation (NYSE: MRO) is an independent exploration and production company, engages in exploration, production, and marketing of crude oil and condensate, natural gas liquids, and natural gas in the United States and internationally.

The company also produces and markets products manufactured from natural gas, such as liquefied natural gas and methanol. In addition, it owns and operates Sugarloaf gathering system, a natural gas pipeline. The company was formerly known as USX Corporation and changed its name to Marathon Oil Corporation in December 2001.

While it remains to be seen if Exxon Mobil and Chevron do indeed close the huge plays to acquire Pioneer Natural Resources and Hess Corporation, it’s a good bet that if they do, the competition will start thinking about doing the same; over the last 75 years there have been numerous big oil deals, and with prices on the move higher, and demand from China, India and other emerging markets expected to grow sequentially over the coming years, more deals could be on tap in the energy world.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: am I ahead, or behind on my goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With Zoe Financial’s free matching tool, you can connect with trusted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.