FibroGen Inc. filed its S-1 form with the U.S. Securities and Exchange Commission (SEC) for its initial public offering (IPO). No terms were given for the offering, but they filed to sell up to $125 million shares. The company plans to list under the Nasdaq Global Market but has yet to decide under what symbol to list.

The underwriters for this offering are Goldman Sachs, RBC, Citigroup, Stifel, Leerink Partners and William Blair.

FibroGen is a research-based biopharmaceutical company focused on the discovery, development and commercialization of therapeutics. The company specializes in fibrosis and hypoxia-inducible factor, or HIF.

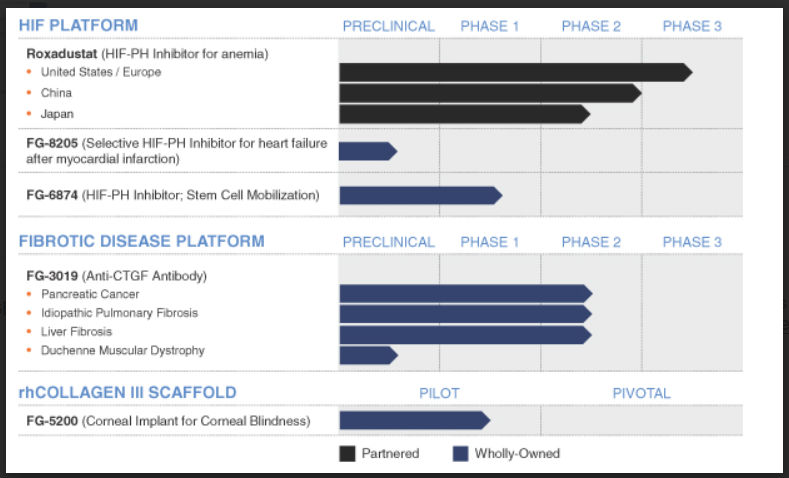

The most advanced product candidate, roxadustat, or FG-4592, is an oral small molecule inhibitor of HIF prolyl hydroxylases, or HIF-PHs, in Phase 3 clinical development for the treatment of anemia in chronic kidney disease. The second product candidate, FG-3019, is a monoclonal antibody in Phase 2 clinical development for the treatment of idiopathic pulmonary fibrosis, pancreatic cancer and liver fibrosis. There have been 1,271 subjects enrolled in 22 completed Phase 1 and 2 clinical studies for roxadustat in North America, Europe and Asia.

ALSO READ: Major Fallout Stocks After Confirmed U.S. Ebola Case

The proceeds from this offering will go toward developing roxadustat and other candidates within the pipeline, as well as for general corporate purposes. The company’s pipeline is shown in the diagram below.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.