Health and Healthcare

Can Keryx Biopharma Bounce Back From This Supply Interruption?

Published:

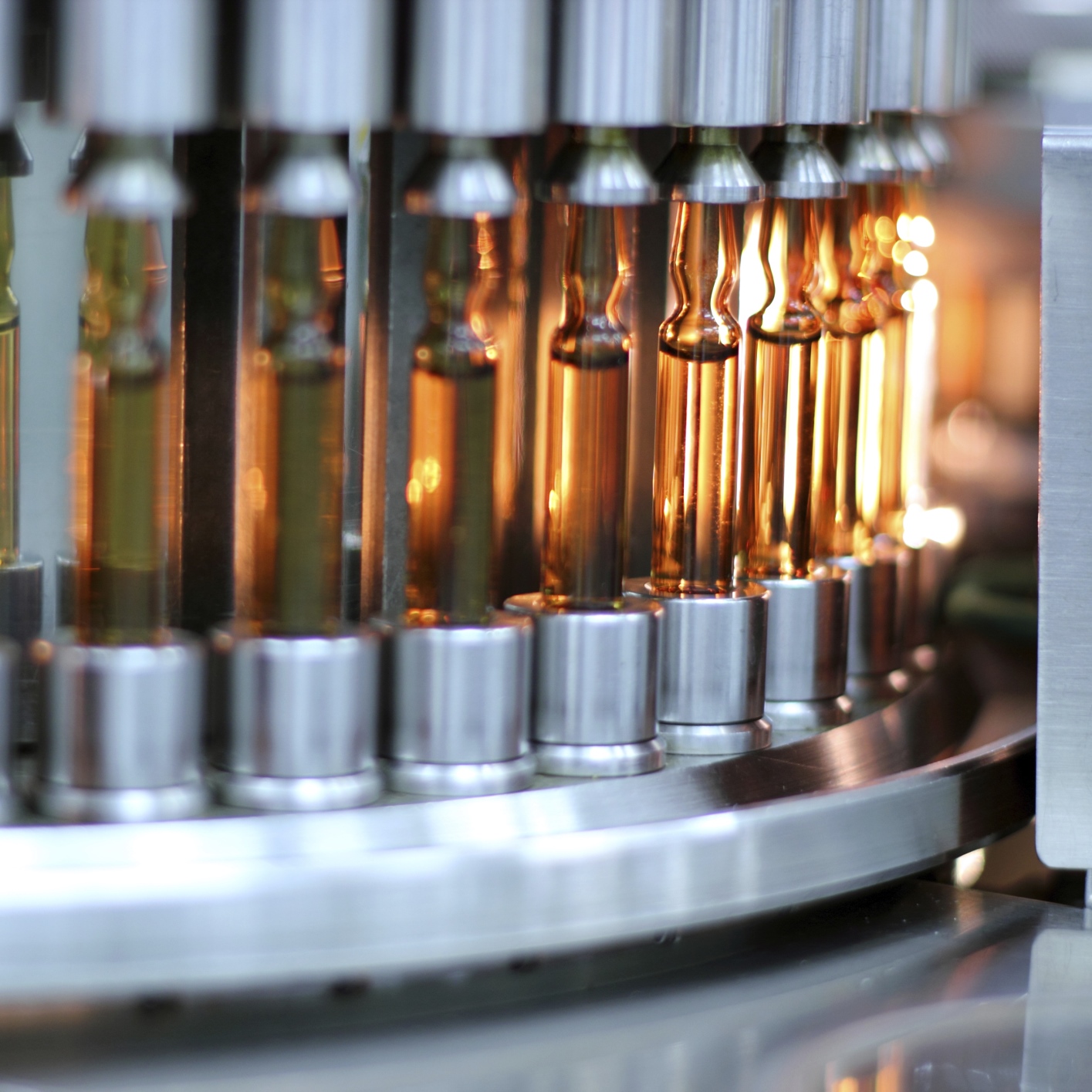

Shares of Keryx Biopharmaceuticals Inc. (NASDAQ: KERX) sank on Monday after the company announced that there will be an interruption in the supply of Auryxia (ferric citrate) tablets due to a production-related issue converting active pharmaceutical ingredient (API) to finished drug product. Many investors are wondering whether this is a temporary dip or if the stock can bounce back.

The company expects to make Auryxia available to patients when supply of Auryxia is back to adequate levels, which Keryx anticipates will be during the fourth quarter of 2016.

Keryx determined that a supply interruption is going to occur due to a production-related issue in converting API to finished drug product at its contract manufacturer. As a result, the company has exhausted its reserve of finished drug product. At this time, current inventories of Auryxia are not sufficient to ensure uninterrupted patient access to this medicine.

Looking forward, Keryx recently filed for approval of a secondary manufacturer with the U.S. Food and Drug Administration (FDA) and the FDA has assigned a Prescription Drug User Fee Act (PDUFA) action date of November 13, 2016. The company expects to restore adequate supply of Auryxia and to make Auryxia available to patients during the fourth quarter of 2016.

Keep in mind that the supply interruption does not affect the safety profile of currently available Auryxia.

The company also provided an update on its second quarter. Total revenues for the second quarter were $9.3 million, versus 2.5 million in the same period last year. Revenues consisted of Auryxia net U.S. product sales of $8.3 million and license revenue of $1.0 million. Cost of goods sold for the quarter was $5.1 million. Cash and cash equivalents totaled $155.8 million at the end of the second quarter.

Greg Madison, CEO of Keryx, commented:

We take our responsibility to patients and the treating community very seriously and recognize the impact this interruption of supply will cause for patients and their healthcare providers. Our field-based teams have been doing an outstanding job educating the community on the benefits of Auryxia and will be a critical resource during this supply interruption as we continue to support healthcare providers and their patients with hyperphosphatemia.

Shares of Keryx were trading down 30% at $5.14 on Monday, with a consensus analyst price target of $9.44 and a 52-week trading range of $2.80 to $8.11.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.