Canaccord Genuity is one of the few firms that are willing to cover small-cap biotech and emerging pharma stocks. Sometimes the price target upside is off the charts as well. In case of Lpath Inc. (NASDAQ: LPTN), analyst John Newman is calling for a massive upside of nearly 300%.

Lpath was started as a Buy rating, and it was given a $17 price target. The upside target is so high compared to a $4.25 prior closing price that we even asked to double-check that the research report did not contain a typo. It was $17.

Newman’s thesis is based on Lpath’s iSONEP chance of being paradigm-changing in wet AMD (age related macular degeneration) with some $2.4 billion in peak sales potential. He said:

The name is still under the radar, with Lpath developing a novel wet AMD treatment that targets the underlying cause, unlike current standard of care which focuses on symptom treatment.

ALSO READ: Jefferies Biotech Stock Picks for Breakthrough Drug Innovations

iSONEP is listed as being potentially a $650 million drug in the sub-responder wet-AMD market in the United States, and Phase 2 study data is expected by the fourth quarter of this year. Newman said:

We believe iSONEP could be a paradigm-changing wet age-related macular degeneration (AMD) treatment by targeting the underlying choroidal neovascularization (CNV) lesion vs. current drugs that address fluid buildup, with Phase 2 data expected by 4Q14. We model U.S. peak sales of ~$650M in wet AMD sub- responders, assuming FDA approval, and we expect positive Phase 2 data by the fourth quarter. Importantly, we expect Phase 2 data to provide an efficacy trend for increasing vision, and is powered at p=0.2, assuming a two-sided comparison.

Pfizer Inc. (NYSE: PFE) has a role here also as Newman calls its exit manageable. Newman expects Pfizer to announce the divestiture of its rights to iSONEP soon, and he views Pfizer’s termination of the partnership as related to structural changes. He said:

The economics of Lpath would not change if the agreement is acquired by another partner, which we expect to be a large market leader. Larger players have sought out assets in wet AMD recently, including Allergan, Novo Nordisk, Roche, and Novartis, suggesting ample interest in the space. Importantly, Lpath was outbid in its attempts to reacquire iSONEP from Pfizer.

Lpath shares are responding favorably with a gain of 4.4% to $4.44, but trading volume is thin here. Keep in mind that this market cap is only $66.5 million, and the stock has traded in a range of $3.87 to $6.70 over the past 52 weeks.

ALSO READ: The Next Wave of Biotech Buyout Candidates

Only two other upside targets exist, according to Thomson Reuters, and they are also full of large upside — one is $13 and one is $14. Note that while this has a very high implied upside, this is a very risky stock that would not be suitable for most investors. If a small cap has 300% upside potential, how much downside is there if things do not pan out? Likely close to 100%.

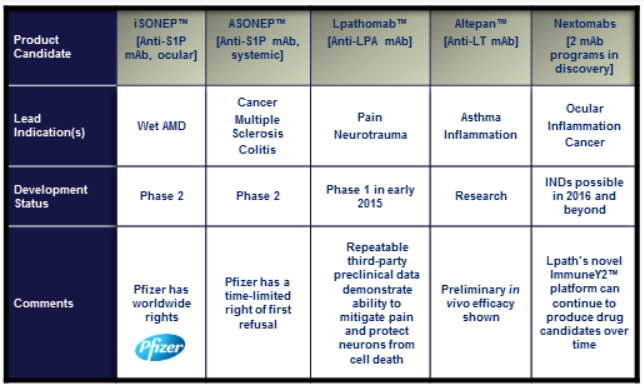

We would also point out that the Canaccord Genuity report is about 40 pages long. A copy of the company’s pipeline is below, and the company has a very long list of patents as well.

Credit Card Companies Are Doing Something Nuts

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.