Health and Healthcare

Can Keryx Biopharma Bounce Back From This Supply Interruption?

Published:

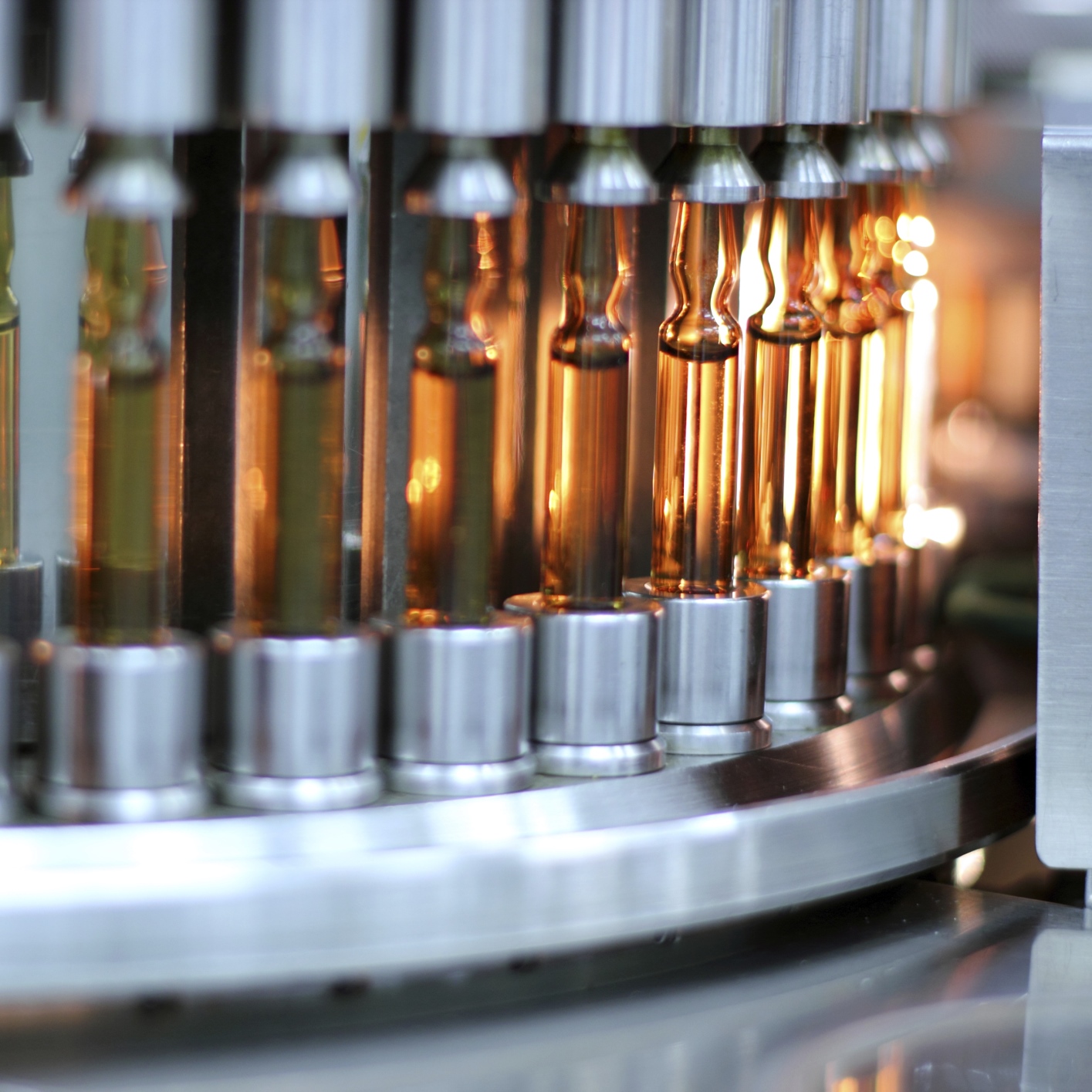

Shares of Keryx Biopharmaceuticals Inc. (NASDAQ: KERX) sank on Monday after the company announced that there will be an interruption in the supply of Auryxia (ferric citrate) tablets due to a production-related issue converting active pharmaceutical ingredient (API) to finished drug product. Many investors are wondering whether this is a temporary dip or if the stock can bounce back.

The company expects to make Auryxia available to patients when supply of Auryxia is back to adequate levels, which Keryx anticipates will be during the fourth quarter of 2016.

Keryx determined that a supply interruption is going to occur due to a production-related issue in converting API to finished drug product at its contract manufacturer. As a result, the company has exhausted its reserve of finished drug product. At this time, current inventories of Auryxia are not sufficient to ensure uninterrupted patient access to this medicine.

Looking forward, Keryx recently filed for approval of a secondary manufacturer with the U.S. Food and Drug Administration (FDA) and the FDA has assigned a Prescription Drug User Fee Act (PDUFA) action date of November 13, 2016. The company expects to restore adequate supply of Auryxia and to make Auryxia available to patients during the fourth quarter of 2016.

Keep in mind that the supply interruption does not affect the safety profile of currently available Auryxia.

The company also provided an update on its second quarter. Total revenues for the second quarter were $9.3 million, versus 2.5 million in the same period last year. Revenues consisted of Auryxia net U.S. product sales of $8.3 million and license revenue of $1.0 million. Cost of goods sold for the quarter was $5.1 million. Cash and cash equivalents totaled $155.8 million at the end of the second quarter.

Greg Madison, CEO of Keryx, commented:

We take our responsibility to patients and the treating community very seriously and recognize the impact this interruption of supply will cause for patients and their healthcare providers. Our field-based teams have been doing an outstanding job educating the community on the benefits of Auryxia and will be a critical resource during this supply interruption as we continue to support healthcare providers and their patients with hyperphosphatemia.

Shares of Keryx were trading down 30% at $5.14 on Monday, with a consensus analyst price target of $9.44 and a 52-week trading range of $2.80 to $8.11.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.