Health and Healthcare

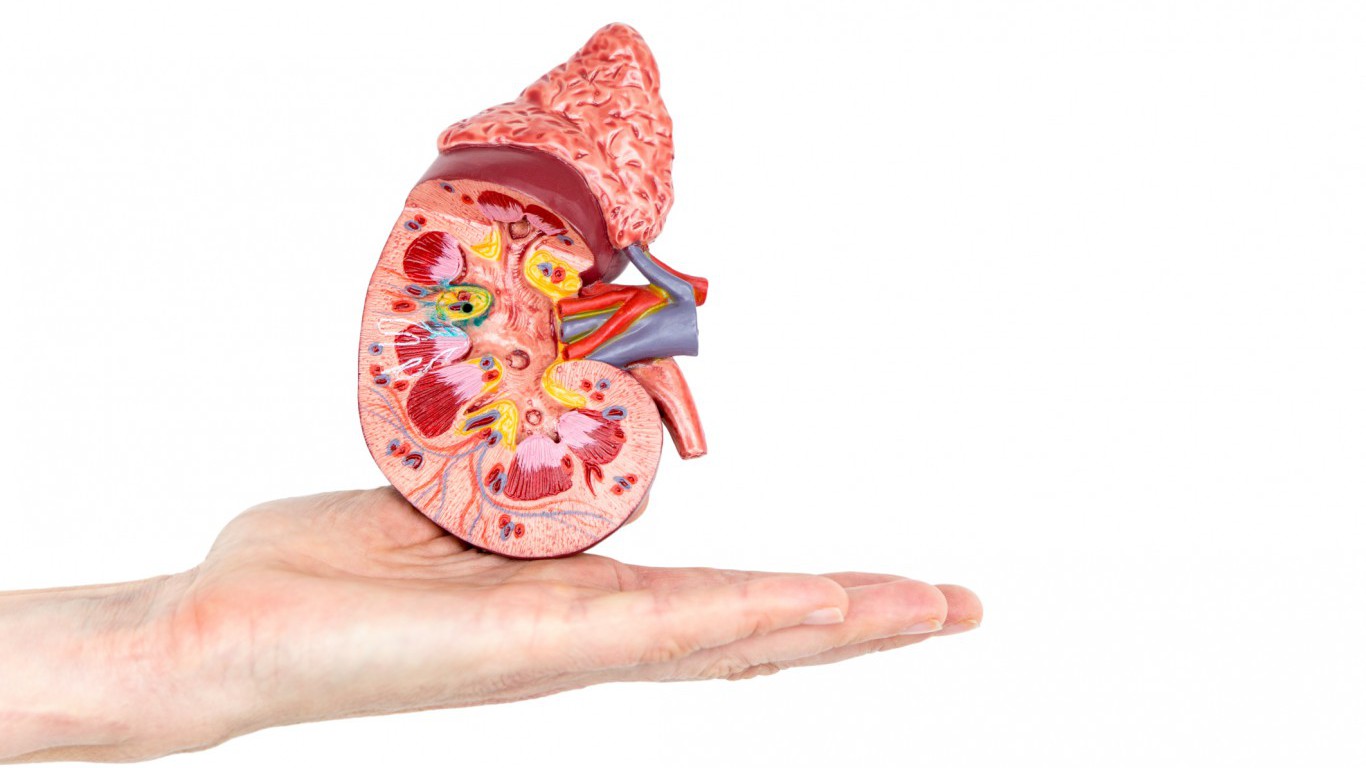

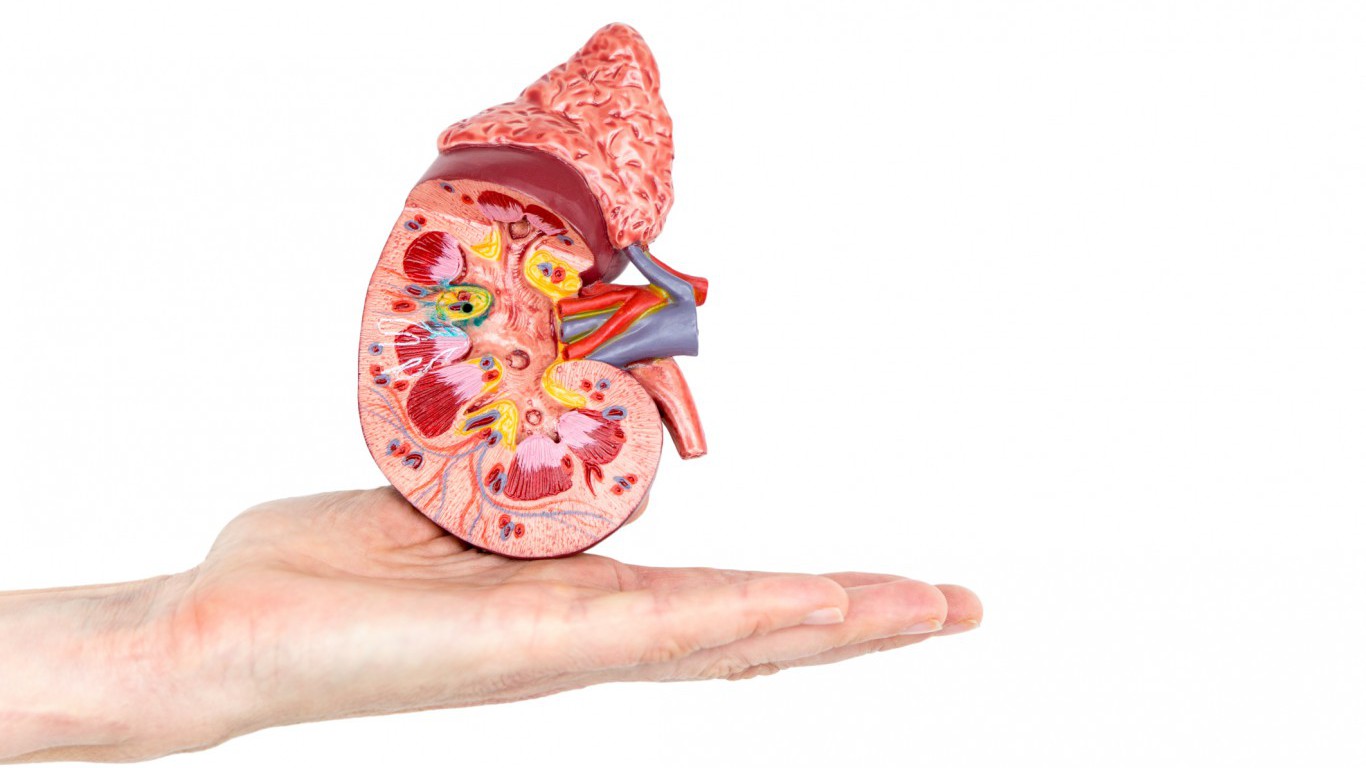

Akebia and Keryx Combine to Fight Chronic Kidney Disease

Published:

Last Updated:

Akebia Therapeutics Inc. (NASDAQ: AKBA) and Keryx Biopharmaceuticals Inc. (NASDAQ: KERX) each saw their shares take a dive on Thursday following news that these two companies had agreed upon a merger. This deal will create a fully integrated biopharmaceutical company focused on chronic kidney disease (CKD), with an implied pro forma equity value of approximately $1.3 billion. The combined company will be named Akebia Therapeutics.

Under the terms of the agreement, Keryx shareholders will receive 0.37433 common shares of Akebia for each share of Keryx they own. The exchange results in implied equity ownership in the combined company of 49.4% for Akebia shareholders and 50.6% for Keryx shareholders on a fully diluted basis. John P. Butler, president and CEO of Akebia, is expected to lead the combined company, and Keryx will appoint the chairperson of the board of directors of the combined company.

According to the release:

The merger of Akebia and Keryx creates a renal-focused company committed to developing and delivering innovative therapeutic products. Keryx’s Auryxia (ferric citrate) is a U.S. Food and Drug Administration (FDA)-approved medicine to treat dialysis dependent CKD patients for hyperphosphatemia and non-dialysis dependent CKD patients for iron deficiency anemia (IDA). Akebia’s vadadustat is an investigational Phase 3 oral hypoxia-inducible factor prolyl hydroxylase inhibitor (HIF-PHI) with the potential to advance the treatment of patients with anemia due to CKD, many of whom are currently receiving injectable erythropoietin-stimulating agents (ESAs). The companies believe that Auryxia and vadadustat, if FDA-approved, have the potential to deliver an all-oral treatment approach for patients with anemia due to CKD. More broadly, the combined company has the potential to offer therapeutic options to patients across all stages of CKD, including non-dialysis dependent and dialysis dependent patients, and to become a partner of choice for the renal community and for companies developing renal products.

Shares of Akebia were last seen down over 14% at $8.87, with a consensus analyst price target of $22.43 and a 52-week trading range of $8.86 to $20.25.

Keryx traded down about 9% at $4.09 a share, with a consensus price target of $6.92 and a 52-week range of $3.80 to $8.38.

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4% today, and inflation is much higher. Checking accounts are even worse.

Every day you don’t move to a high-yield savings account that beats inflation, you lose more and more value.

But there is good news. To win qualified customers, some accounts are paying 9-10x this national average. That’s an incredible way to keep your money safe, and get paid at the same time. Our top pick for high yield savings accounts includes other one time cash bonuses, and is FDIC insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes and your money could be working for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.