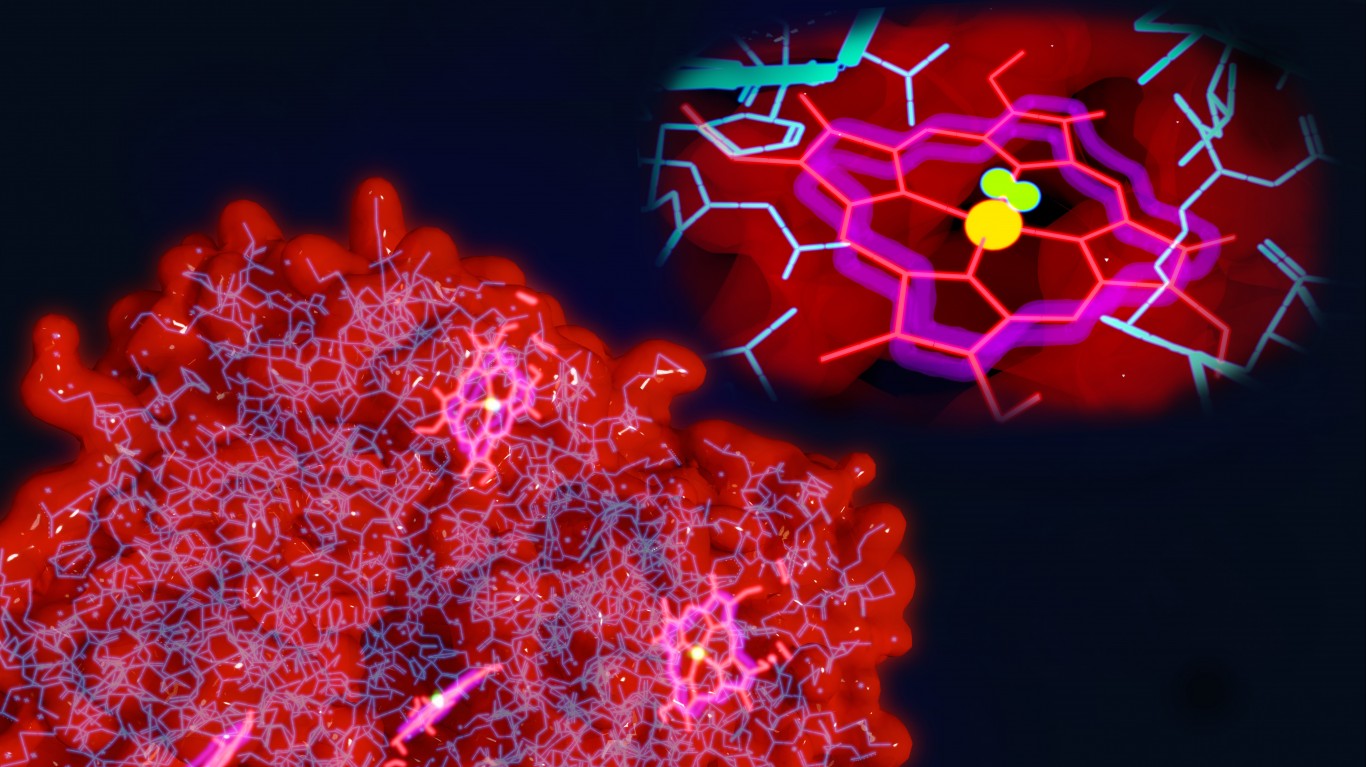

GlaxoSmithKline PLC (NYSE: GSK) is joining the race for a COVID-19 vaccine with its newest acquisition, but it may be tough to catch Pfizer and BioNTech after their most recent results. GlaxoSmithKline announced that it is acquiring a 10% stake in the German biopharma firm CureVac.

The 10% stake is part of CureVac and GlaxoSmithKline’s collaboration for the research, development, manufacturing and commercialization of up to five mRNA-based vaccines and monoclonal antibodies targeting infectious disease pathogens.

Under the terms of the deal, GlaxoSmithKline will make an equity investment in CureVac of €150 million, representing close to a 10% stake, an upfront cash payment of €120 million.

The company also will make a one-time reimbursable payment of €30 million for manufacturing capacity reservation, upon certification of CureVac’s commercial-scale manufacturing facility currently under construction in Germany.

The companies will combine their mRNA expertise on development opportunities across a range of infectious disease pathogens, selected with the potential to best leverage the advantages of this platform technology, while addressing significant unmet medical need and economic burden.

CureVac’s existing COVID-19 mRNA and rabies vaccines research programs are not included in the collaboration announced today.

CureVac will be eligible to receive development and regulatory milestone payments of up to €320 million, commercial milestone payments of up to €380 million and tiered royalties on product sales.

GlaxoSmithKline stock traded at $41.65 on Monday, in a 52-week range of $31.43 to $48.25. The consensus price target is $47.70.

Credit Card Companies Are Doing Something Nuts

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.