Health and Healthcare

Are Earnings Enough to Counter COVID-19 Study Setback at Johnson & Johnson?

Published:

When Johnson & Johnson (NYSE: JNJ) released its most recent quarterly results before the markets opened on Tuesday, the pharmaceutical giant said that it had $2.20 in earnings per share (EPS) and $21.1 billion in revenue. That compares with consensus estimates of $1.98 in EPS and revenue of $20.2 billion for the third quarter, as well as the $2.12 per share and $20.73 billion posted in the same period of last year.

Consumer Health sales increased 3.1% on an adjusted operational basis to $3.51 billion. This was driven primarily by the COVID-19 pandemic. Sales growth was driven by U.S. growth in over-the-counter products, including Tylenol analgesics and digestive health products.

Pharmaceutical sales increased 4.7% to $11.42 billion, driven by Stelara, Darzalex, Imbruvica, Erleada and Uptravi.

Medical Devices worldwide operational sales, excluding the net impact of acquisitions and divestitures, declined by 3.3% to $6.15 billion, driven by the impact of the COVID-19 pandemic and the associated deferral of medical procedures to the Surgery, Orthopaedics, and Vision businesses. However, compared to the second quarter, there is a turnaround in the business.

Looking ahead to the 2020 full year, Johnson & Johnson expects to see EPS in the range of $7.95 to $8.05 and adjusted operational sales between $82.0 billion and $82.8 billion. Consensus estimates are calling for $7.89 in EPS and $80.75 billion in revenue for the year.

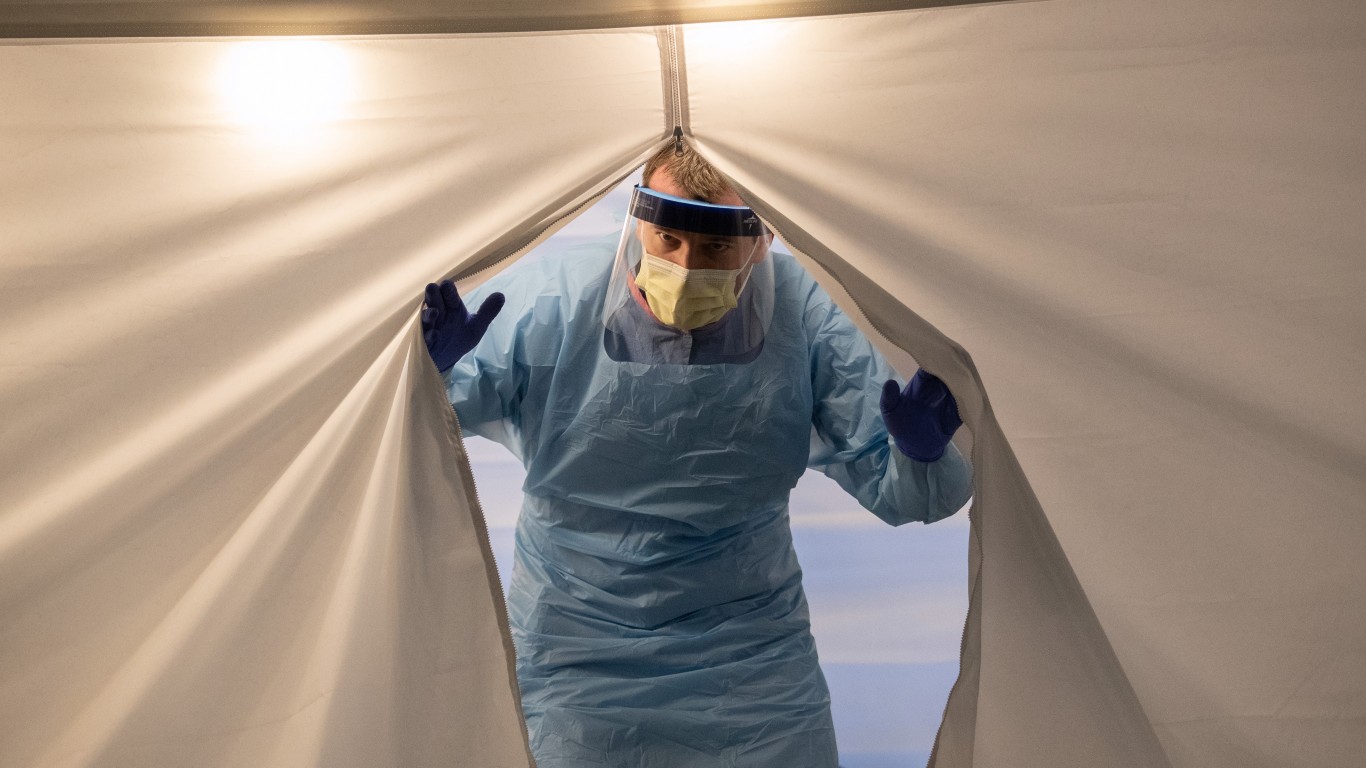

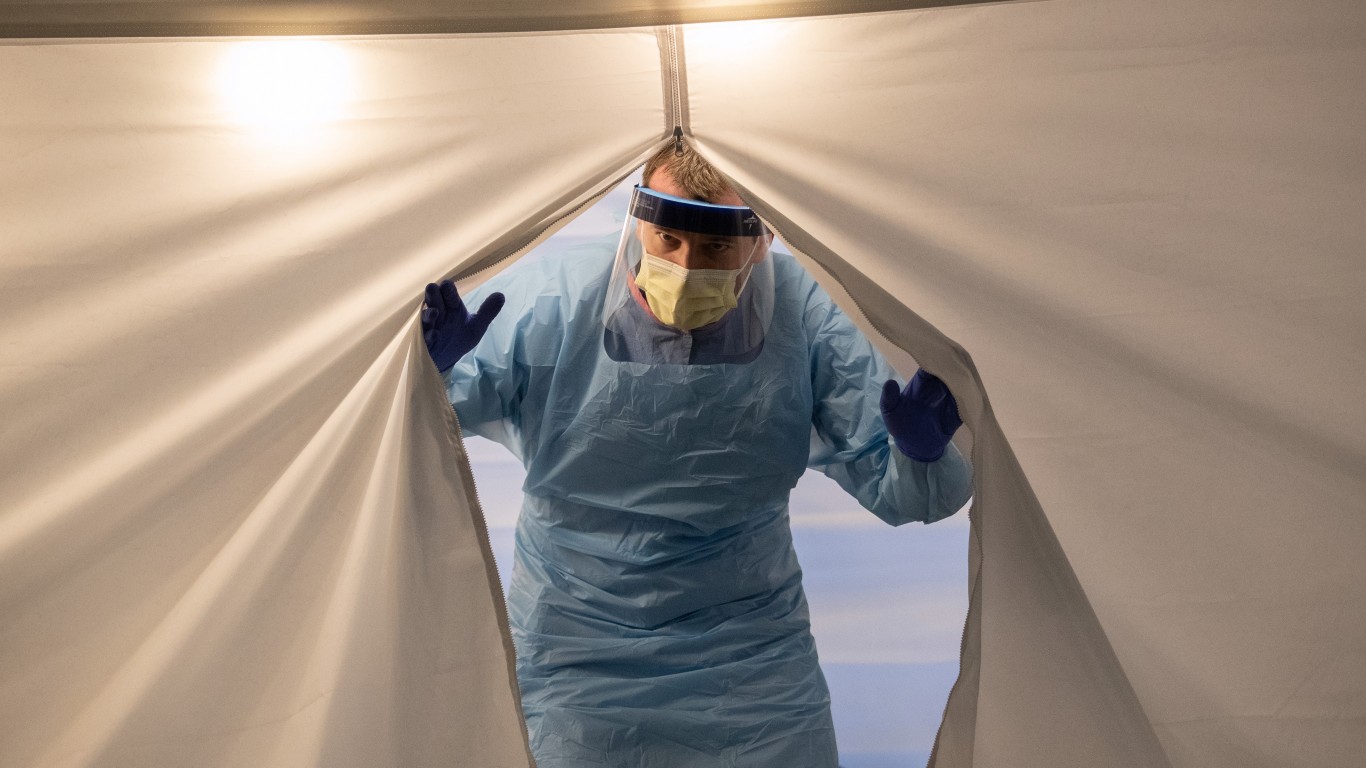

Separately, the company announced that it would be pausing its late-stage coronavirus vaccine trial. The pause is the result of an adverse effect with a single patient. AstraZeneca had invoked a similar protocol in its late-stage trial. In the meantime, Johnson & Johnson will be reviewing data involved with the adverse event, and management believes that it will get back on track soon.

Management noted that its world-class R&D team is working to advance the Phase 3 trials of its COVID-19 vaccine and to uphold the highest standards of transparency, safety and efficacy, while other dedicated teams provide ongoing support to hospitals and patients as they return to sites of care.

Johnson & Johnson stock traded down about 2% on Tuesday, at $148.68 in a 52-week range of $109.16 to $157.00. The consensus price target is $164.59.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.