Health and Healthcare

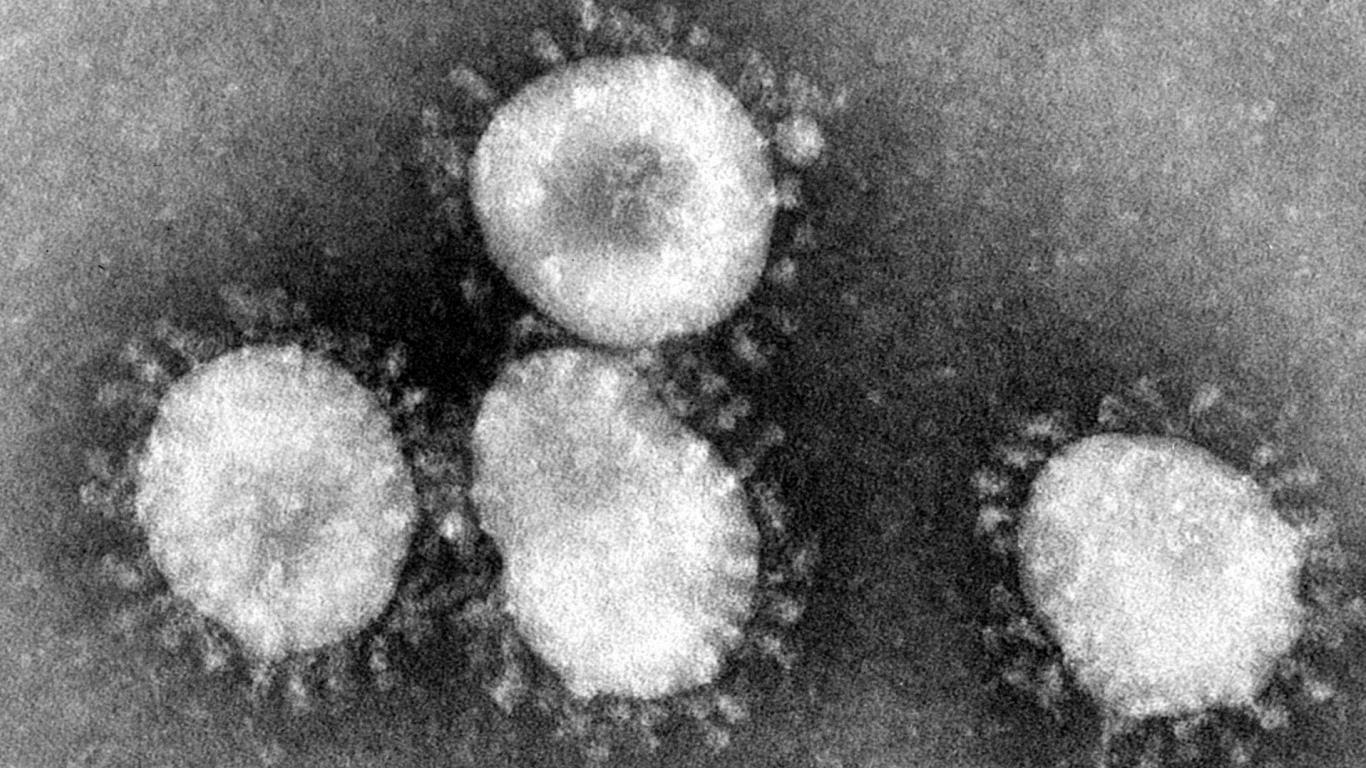

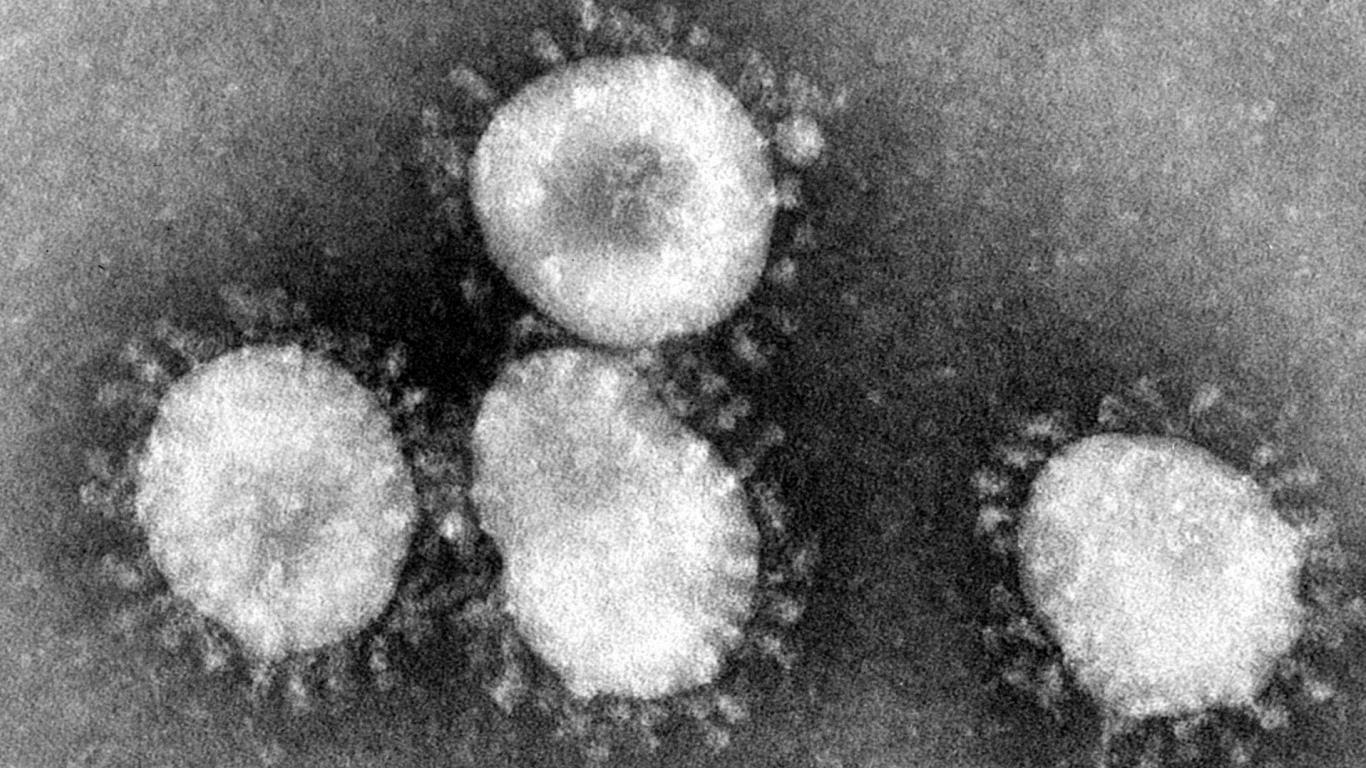

As WHO Declares COVID-19 a Pandemic, What Really Changes?

Published:

It appears that there is a surprise when an international watchdog escalates an emergency status. The World Health Organization now has upgraded the COVID-19 outbreak to pandemic status, as the cases outside of China have risen exponentially in the past two weeks. The WHO website does not have an update on the matter, but major media sites have announced the upgrade, calling COVID-19 a pandemic. The Dow Jones industrials were down over 1,200 points and under 23,800, and the S&P 500 was last seen down almost 134 points at 2,748.29.

With the number of cases rising globally, the United States has joined in with the rising cases in Italy, Iran, South Korea, Japan and others.

As the markets are updating price changes rapidly, this is a developing story, and we are awaiting news from the WHO as to whether this will trigger more formal responses.

As for what this means for the broader financial markets, Goldman Sachs’ Peter Oppenheimer issued a report inside the Goldman Sachs Insights this week. On the severity and duration of a bear market, that report included:

It’s difficult to say with any certainty, given how much is still unknown about the spread of the virus and the lack of historical precedent. We’ve never before entered a bear market because of a viral outbreak. But if you believe we haven’t hit the trough and we are in fact headed for bear territory, it’s useful to look to the history of bear markets to get a sense of their duration and intensity. There are three different types, each with different triggers and characteristics: structural bear markets, cyclical bear markets and event-driven bear markets. At this stage, we think the balance is still in favor of this being an event-driven bear market, suggesting that the rebound in equity markets will be swift. On average, these kinds of bear markets triggered by exogenous shocks have seen declines of 29% and lasted nine months, with markets regaining their previous levels within 15 months.

Perhaps the biggest question is this: Why did it take so long for the WHO to make its declaration when it was already more than obvious.

This is still one of those situations in which things will get worse before they get better. As of this morning, a tool on MarketWatch that tracks the coronavirus cases showed that there were 121,061 cases and 4,368 deaths tied to COVID-19.

In other news, Bernie Sanders has said that he plans to stay in the presidential race despite his recent primary losses over the past eight days.

The Average American Is Losing Momentum On Their Savings Every Day (Sponsor)

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4%1 today. Checking accounts are even worse.

But there is good news. To win qualified customers, some accounts are paying more than 7x the national average. That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn a $200 bonus and up to 7X the national average with qualifying deposits. Terms apply. Member, FDIC.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.