The national average cost of renting an apartment rose to $1,465 a month over the first six months of 2019, a jump of 2.6% ($37) since January and up more than 6% since June of 2017. Between May and June, rents increased by 0.8%, the largest monthly increase since May of last year.

The good news for Americans seeking a new rental home is that price hikes in the second half of a year are generally much lower ($8 in 2018 and $4 in 2017).

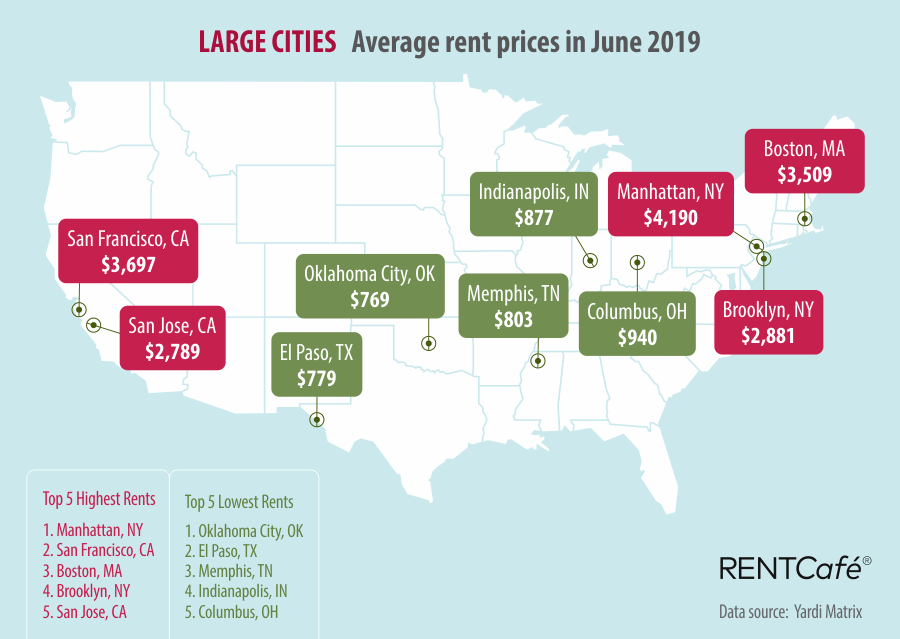

The data was reported Monday by RENTCafé based on data collected by Yardi Matrix. The numbers include rental price data for commercial properties of at least 50 rental housing units regardless of apartment size. The most expensive city in the country for renters is, unsurprisingly, New York, where Manhattanites pay an average of $4,190 a month. The least expensive city in the country is Wichita, Kansas, where the average rent is $656 a month.

Among the nation’s largest cities, San Francisco and Boston trailed only Manhattan, while the large city with the lowest average rent is Oklahoma City ($769). Close behind Boston are Brooklyn and Queens, New York City boroughs ranking fourth and sixth most expensive at $2,893 and $2,598, respectively. Queens may be on its way to becoming the new Brooklyn, as rents in Manhattan and Brooklyn rose by about 0.7% each in the first half of the year. Rent in Queens rose by 3.42%, the largest increase of any city in the top 20 in any size category.

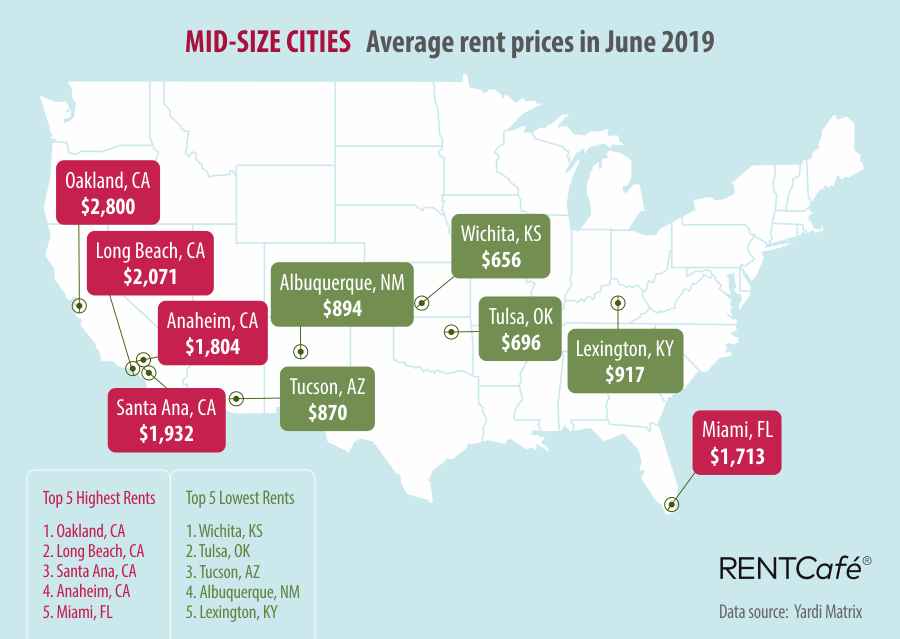

Oakland, California, just across the bay from San Francisco, is the midsize city with the most expensive average rent ($2,800 a month), more than four times the rent in Wichita.

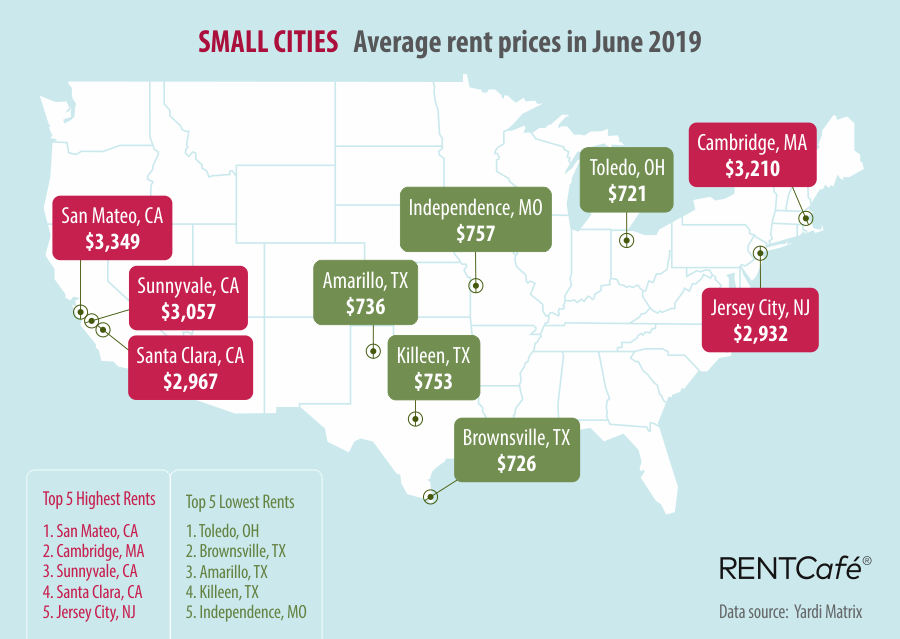

The San Francisco effect also affects the rent in San Mateo, the most expensive of the small cities ($3,349), while Toledo, Ohio, is the small city with the lowest average rent ($721).

According to RENTCafé, the most common search term for renters is “rentals near me” with two-bedroom apartments getting 44% of the searches. One-bedroom apartments nabbed about 28% of searches, 3-bedroom units had nearly 17% of searches and studio apartments received about 12% of the searches.

A recent report by the Joint Center for Housing Studies at Harvard University noted that the share of renter households declined by 1% between 2016 and 2018 to 35.6% of all U.S. households. High-income renters (incomes of at least $75,000) now comprise more than 25% of all renter households, up from 19% in 2008. More than half of all renter households make less than $45,000 annually with a median of $40,530.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.