Investing

The 6 Most Shorted Nasdaq Stocks: Why Short Sellers Like AMD, BlackBerry

Published:

Last Updated:

As the markets tanked at the beginning of 2016, what were the short sellers up to? Well, among the most heavily shorted stocks traded on the Nasdaq, the movement was mostly positive though mostly mild. Of the top six, only AMD and BlackBerry saw significant rises between the December 31 and January 15 settlement dates, of more than 11% and nearly 10%, respectively. Intel bucked the trend, though.

Note that the four most shorted Nasdaq stocks all had more than 120,000 shares short by the end of the period.

After retreating more than 2% in the previous period, the short interest in Frontier Communications Corp. (NASDAQ: FTR) resumed its rise, adding more than 4% to come in at nearly 173.86 million shares by mid-month. That was 15.0% of the telecom’s float. The days to cover slipped to less than 11 as the average daily volume increased. Shares ended the short interest period down almost 9%, just a little lower than the Nasdaq in that time. Frontier announced a board shake-up during that time. The share price now is down more than 4% year to date. The stock closed most recently at $4.45, within a 52-week trading range of $3.81 to $8.46.

The more than 145.49 million Sirius XM Holdings Inc. (NASDAQ: SIRI) shares short in the middle of January was more than 1% lower than on the previous settlement date. That was 7.1% of the company’s float. The past year’s peak short interest of more than 160 million was back in August. At the current average daily volume, it would take more than four days to cover all short positions. Sirius said it added more subscribers in 2015 than it had forecast. The share price ended the two-week period about 10% lower and has declined more since. The stock ended Wednesday at $3.63 a share, in a 52-week range of $3.31 to $4.20.

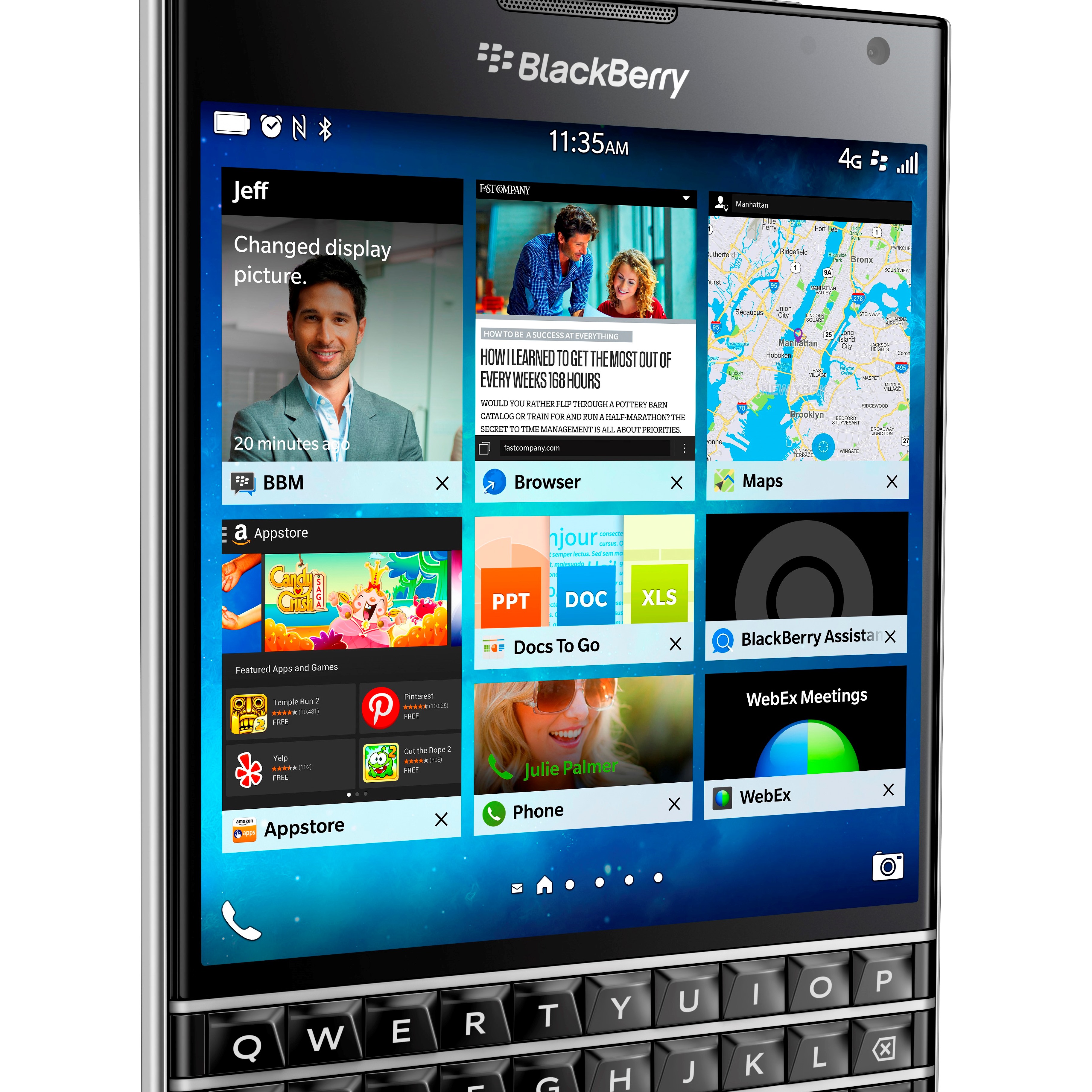

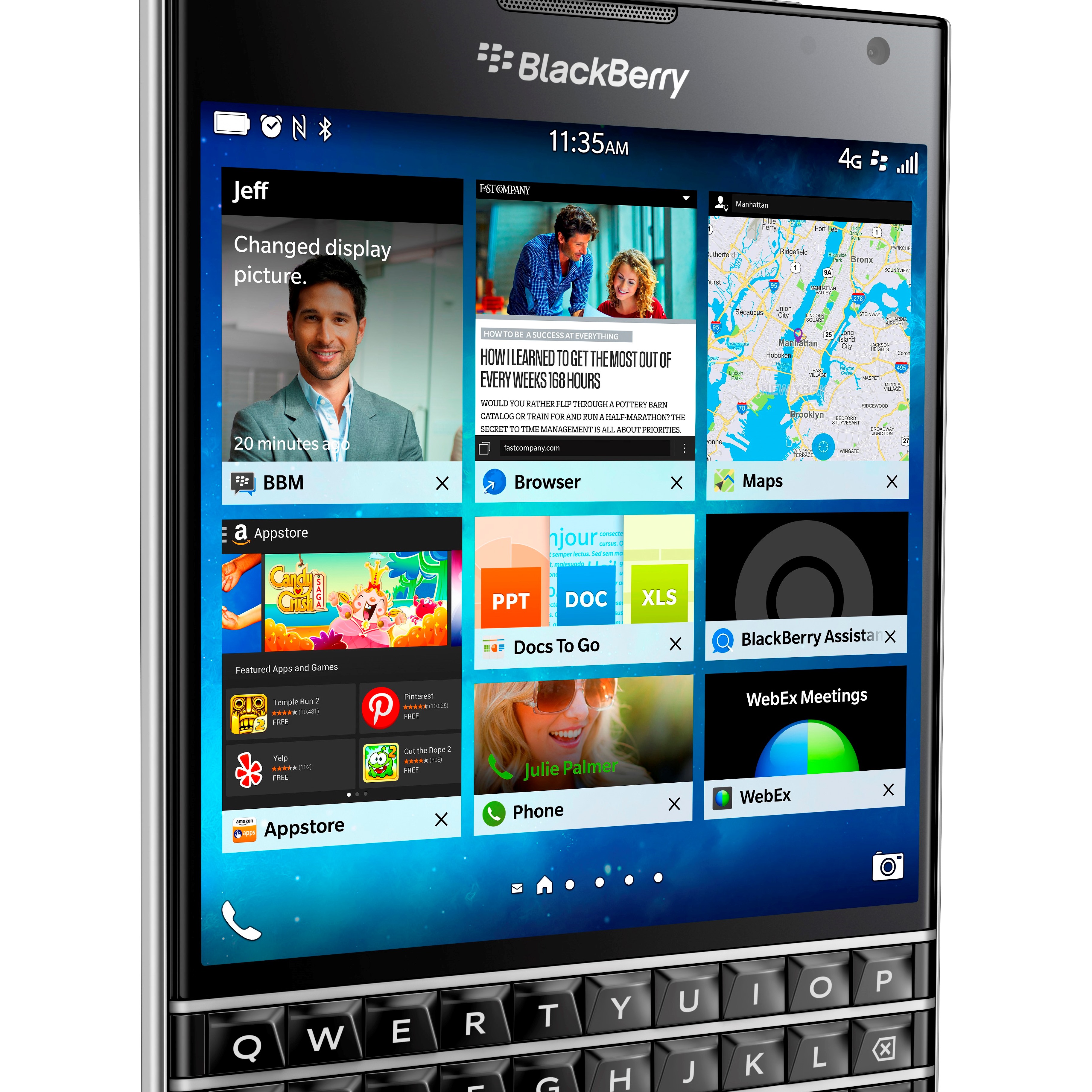

BlackBerry Ltd. (NASDAQ: BBRY) short interest had lingered at less than 80 million since last September, but the latest reading landed at around 82.79 million, after increasing more than 9% in the first weeks of January. That was 15.8% of the company’s total float, and it would take about seven days to cover all short positions, up just a little from in the previous period. BlackBerry recently said it would focus on Android phones in 2016, and short sellers watched the stock pull back more than 24% during the two weeks. Shares closed Wednesday at $6.88, down almost 26% since the beginning of the year, and in a 52-week trading range of $5.96 to $11.45.

More than 76.93 million Intel Corp. (NASDAQ: INTC) shares were sold short as of the most recent settlement date. That was more than 6% lower than at the start of the period, it totaled 1.6% of the company’s float and it was the lowest level of short interest in at least a year. It would take a little more than two days to cover all short positions. Intel posted better-than-expected earnings during the period, but shares still ended the two weeks about 12% lower. They closed at $29.81 on Wednesday, down more than 13% year to date. The stock has changed hands between $24.87 and $35.59 per share in the past year.

Rounding out the top 10 were Groupon Inc. (NASDAQ: GRPN), Apple Inc. (NASDAQ: AAPL), Yahoo! Inc. (NASDAQ: YHOO) and Micron Technology Inc. (NASDAQ: MU). The mover here was Yahoo, with a 15% jump in short interest to lift it into the top 10. The number of Apple shares short declined marginally, the only retreat among these four.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.