Massachusetts-based drug developer Acrivon Therapeutics aims to raise $100M through its initial public offering in what is shaping up to be one of the largest biotech IPOs for the year.

The cancer biotech firm first filed with the U.S. Securities and Exchange Commission (SEC) in October but held back from revealing price details on the launch. Acrivon announced last Thursday that it would be offering 5.9 million shares at a range between $16.00 to $18.00. The IPO is due to price on Wednesday night, November 9, before floating on the Nasdaq under the ticker “ACRV” on Thursday, November 10.

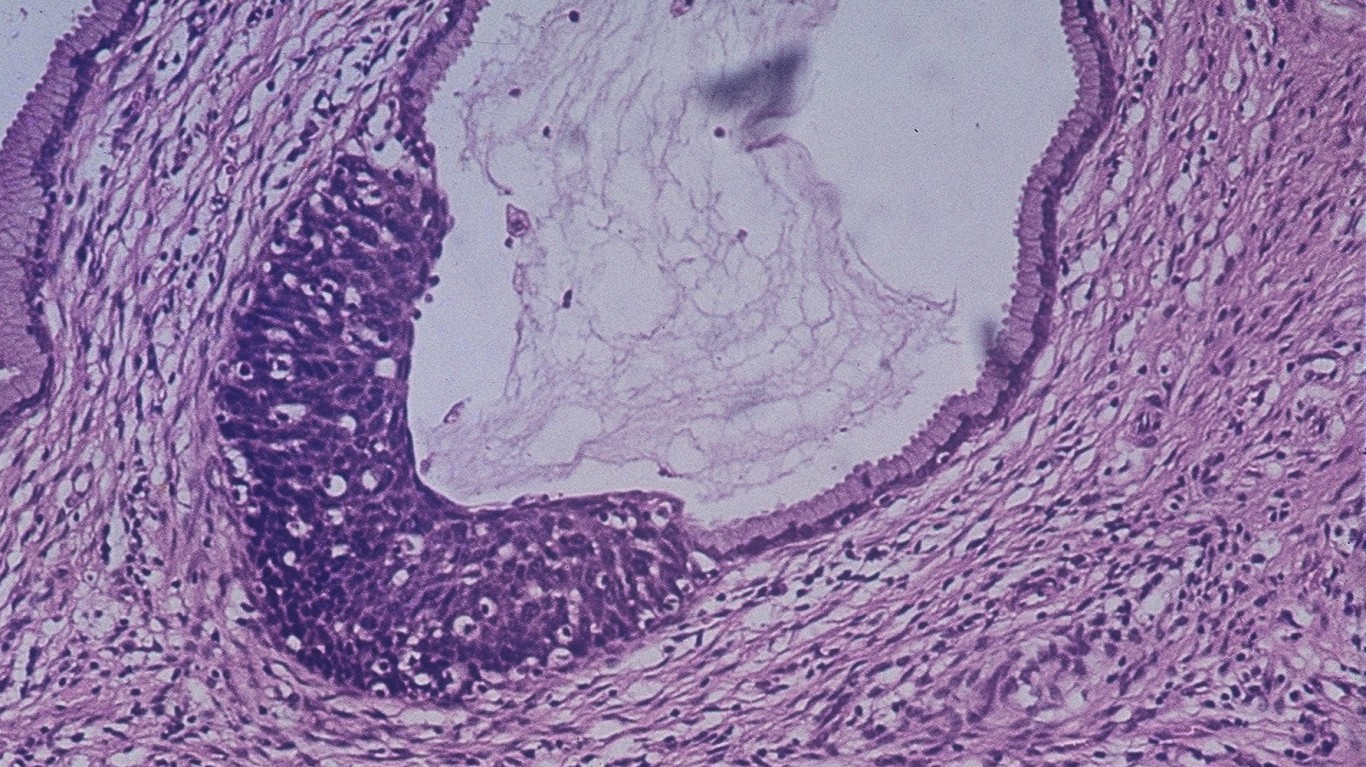

The firm specializes in developing precision oncology medicines. Its proprietary “Acrivon Predictive Precision Proteomics” (or AP3) platform leverages diagnostics to predict the likely response of a given tumor to a drug, enabling highly specific administration to patients.

In June, the firm’s leading drug candidate, the ACR-368, obtained clearance from the U.S. Food and Drug Administration (FDA) to progress with Phase 2 clinical trials. As a kinase inhibitor, the ACR-368 treats cancer by inhibiting specific enzymes that trigger a tumor’s growth.

The ACR-368 will be tested on multiple tumor types, including ovarian, endometrial, and bladder cancers.

By last year’s end, the firm had raised over $120 million in private markets. Its biggest backers include Chione Limited, RA Capital Management, Perceptive Life Sciences, Citadel, Wellington Biomedical, and Sands Capital Life Sciences.

Investors will note Acrivon is currently running at a loss. Last year the company ran through $16 million and generated no revenue.

Demand is increasing for the kind of drugs Acrivon develops. According to Straits Research, last year, the global Ovarian Cancer Market was worth US$1.54 billion but is expected to grow at an average compounding rate of 23.8% for the rest of the decade to reach around US$20 billion by 2030.

Some of the more established players in the space include Sierra Oncology, AstraZeneca, Janssen Pharmaceuticals, Johnson & Johnson, ImmunoGen, and Eli Lilly and Company, which partnered with Acrivon on ACR-368 trials. Investors will be sizing up how much of this growing market Acrivon may be able to seize upon once it goes public.

Yet Acrivon isn’t the only biotech company jumping into the markets this election week. Intensity Therapeutics (which also develops drugs for cancer), machine learning pharmaceutical research platform Bullfrog AI, and nuclear medicine firm ASP Isotopes, are all due to go public, albeit at much smaller caps.

Investors will be keeping an eye on politics this week as the nation heads to the ballot box for the midterm elections on Tuesday. Historically, mid-term elections have often triggered a shift to bullish sentiment in the markets.

One study from Morgan Stanley that collated data from 1930 to 2018 showed the Dow Jones Industrial Average (DJIA) typically slumps in the lead-up to mid-terms before making up for lost ground in the period afterwards. The DJIA underperformed by around 4% up to the mid-terms (from January through to October) but then outperformed historical averages by 6% in the following year (from October to October the following year), per the study.

Predicting the outcome of this week’s election is hard enough – how equities go is anyone’s guess at this stage. Yet, Acrivon and other newly-listed companies could benefit from a boost to their initial floating if markets follow that historical trend.

This post was produced and syndicated by Wealth of Geeks.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.