Cars and Drivers

If You Invested $1,000 In Tesla 10 Years Ago, You Might Not Be as Rich as You Think

Published:

Tesla (Nasdaq: TSLA) is one of the most iconic stocks of the 21st century. Not only did the company bring electric vehicles to the mass market in the United States and many other nations, but it also became the largest car company in the world.

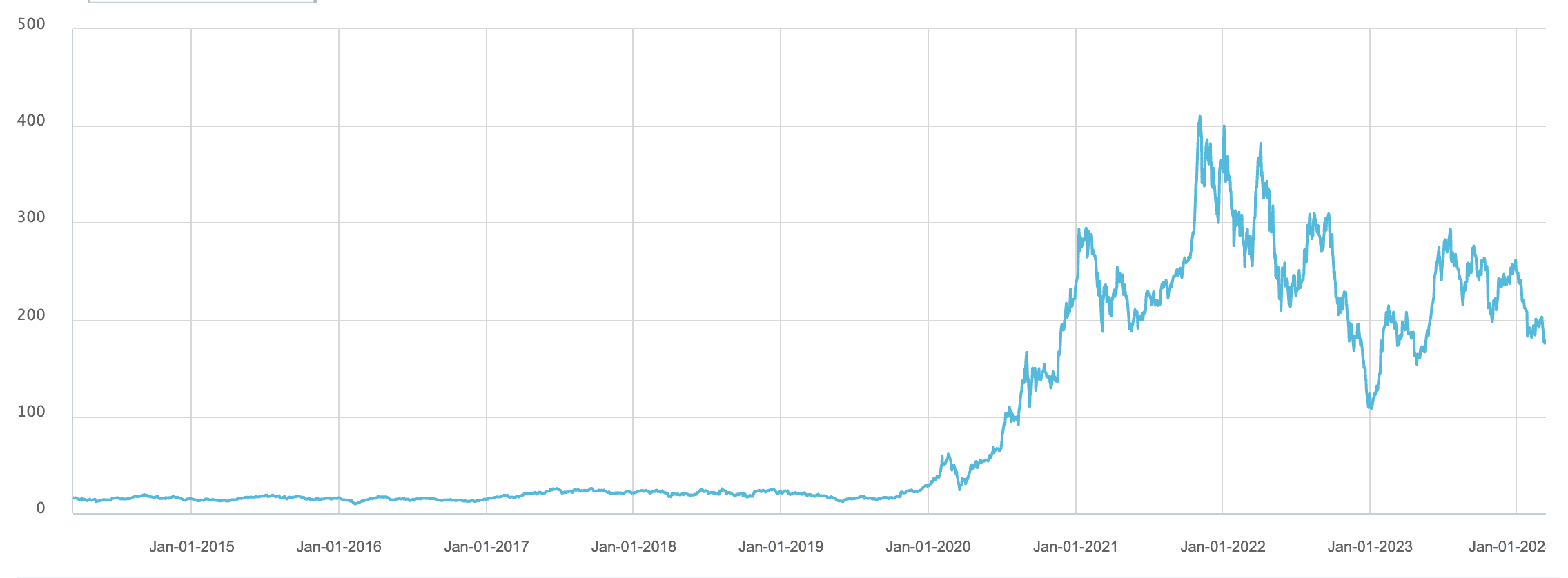

Needless to say, Tesla’s stock has enriched long-term investors. Yet, how much you’ve made from Tesla is highly dependent on whether you purchased the stock before two major runs in its share price. Let’s look back at how much Tesla has made investors over the last 10 years and beyond.

$1,000 invested in Tesla 10 years ago would be worth $11,421 today. To be clear, that’s an absolutely exceptional return. $1,000 put into an S&P 500 index fund 10 years ago would be worth $2,739 today.

Yet, there are a couple important notes about Tesla’s performance over this time.

As I noted in the headline, while Tesla’s performance over the past decade has been outstanding, it might surprise you that $1,000 “only” turned into $11,421. That’s because Tesla is known for being a “million-maker” stock. One that when purchased early has built vast fortunes. Let’s take the timeframe back to see what a longer-term purchase of Tesla has produced.

$1,000 invested in Tesla 14 years ago (at its IPO) is now worth $111,618. Now, we’re talking about some seriously mind-bending returns!

Put another way, $10,000 invested in the stock at its IPO would be worth over a million.

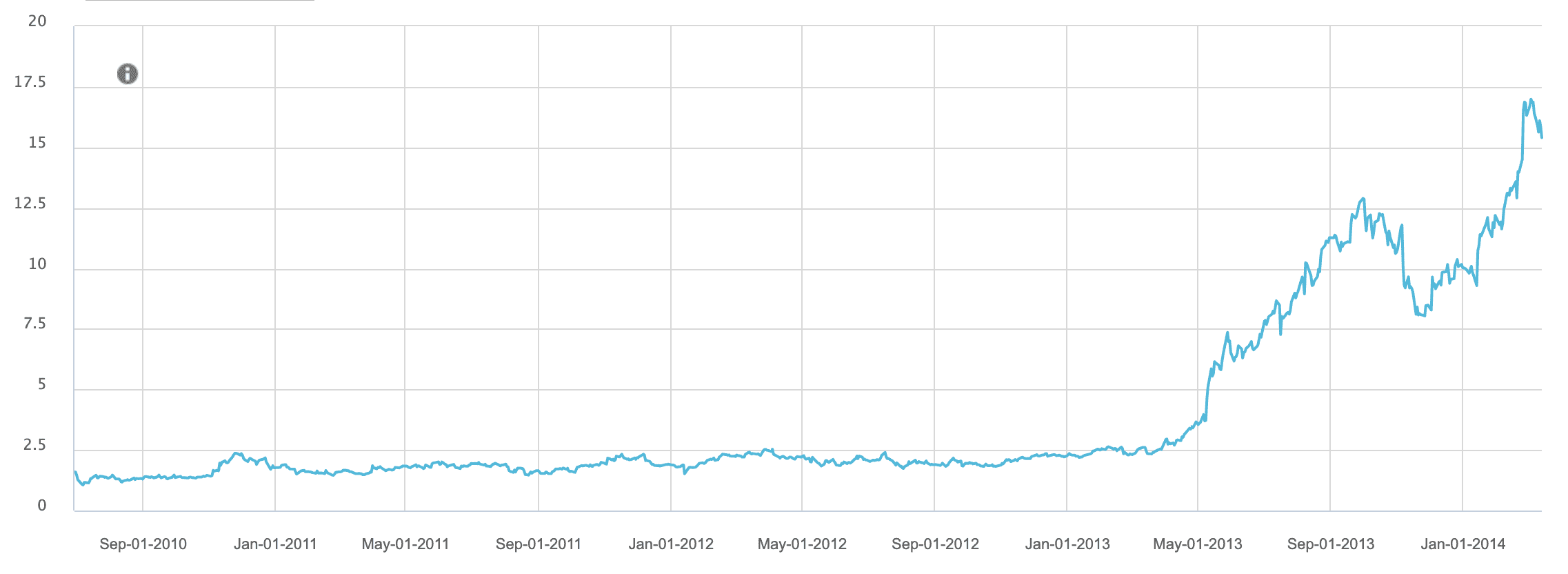

However, you didn’t need to buy Tesla exactly at its IPO to see incredible gains from its shares. Once again, we see a massive rally in a short period of time when most wealth was built in this early phase of Tesla’s existence.

From late 2010 (just months after Tesla’s IPO), the stock was flat until 2013. Then it began a rally that would see its shares grow 8-fold in little more than a year.

Of course, if you overlay Tesla’s two big periods of wealth growth with product launches, you’ll find that their gains coincided with a couple of major events.

In 2013 the Model S broke out as a hit car and gains in late 2019 into 2021 align with the Model 3 reaching scale and the initial success of the Model Y after it.

Looking into the future, could Tesla be poised for another third major accumulation of wealth? There are certainly some categories that could excite. Enthusiasm over self-driving and a major release that’s a massive step change in capabilities could drive shares higher again. Then there are product possibilities like the success of a $25,000 sedan as well.

Still, it’s a great lesson for investors to look at Tesla’s stock chart and realize that for vast periods of its history, Tesla’s stock simply plodded along. Investors who sold too quickly in these periods aren’t nearly as rich as you’d think most probably lost money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.