Investing

Looking for $1500 in Safe Passive Income Each Year? Invest This Much in Pfizer.

Published:

24/7 Wall St. Insights

Passive income is a financial strategy known for generating revenue without the need for the earner’s continuous active effort. This makes it an attractive option for those looking to diversify their income streams or achieve financial independence.

According to the Internal Revenue Service (IRS), passive income generally includes earnings from rental activity or any trade or business in which the individual does not materially participate. It can also include income from limited partnerships and other similar enterprises where the individual is not actively involved.

Those looking to buy solid, safe dividend stocks may consider pharmaceutical giant Pfizer. The stock looks like a great idea now as a solid passive income-generating machine. The shares have traded sideways for almost a year and look ready to break out and try to move toward 52-week highs. Dividend investors can also take advantage of this free report.

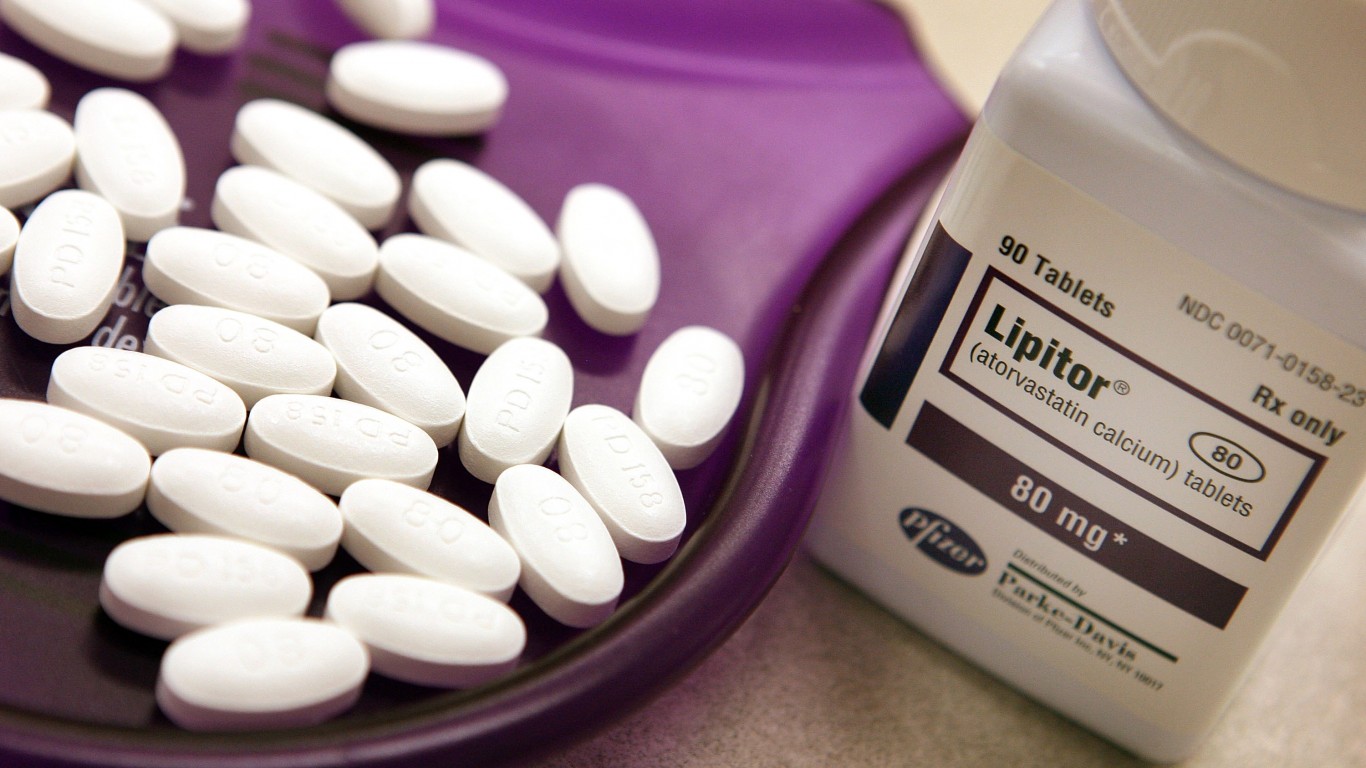

This top pharmaceutical stock was a massive winner in the COVID-19 vaccine sweepstakes but has struggled over the past year as many are not getting boosters. Pfizer Inc. (NYSE: PFE) discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It also pays a hefty 5.88% dividend, which has risen yearly for the past 14 years.

The company offers medicines and vaccines in various therapeutic areas, including:

Pfizer also provides medicines and vaccines in various therapeutic areas, such as:

Trading not far from its lowest split-adjusted level in thirteen years, the stock is an incredible bargain at current levels and pays a massive dividend. Pfizer reported revenues of $13.3 billion in the second quarter, representing 3% year-over-year operational growth, despite an expected decline in COVID revenues and a 14% year-over-year operational increase in revenues from the company’s non-COVID product portfolio.

The pharmaceutical giant raised full-year 2024 revenue guidance to $59.5 billion to $62.5 billion and lifted adjusted diluted EPS guidance to $2.45 to $2.65. Patient investors will receive one of the highest blue-chip dividends, and shares trade at a reasonable 9.88 times estimated 2025 earnings.

Investors looking to generate $1,500 per year in passive income by owning Pfizer shares, which pay $1.68 per share each year, would have to buy 895 shares of the stock at current trading prices. That would be approximately a $22,837 purchase, and as mentioned, with the stock looking to break out toward a 52-week high, there could be some excellent upside potential.

Want $1,500 in Safe and Dependable Passive Income? Invest This Much in AT&T.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.