In January, the number of notable insider purchases was somewhat muted. But with the turn of the calendar page, insider enthusiasm has returned. Warren Buffett continues to build a stake in a media stock, and initial and secondary offerings tempted insiders to make big buys last week. Let’s take a quick look at these transactions.

24/7 Wall St. Key Points:

-

Share buying by insiders has surged in February.

-

Warren Buffett continues to build a stake in a media stock, and initial and secondary offerings tempted other insiders.

-

Take this quiz to see if you’re on track to retire. (sponsored)

Is Insider Buying Important?

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

The earnings-reporting season is still underway, so many insiders are prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported in the past week, starting with the largest and most prominent.

Metsera

- Buyer(s): two directors

- Total shares: around 3.0 million

- Price per share: $18.00

- Total cost: over $54.2 million

This obesity-focused biopharmaceutical company just had an initial public offering, and these buyers helped themselves to some of those Metsera Inc. (NASDAQ: MTSR) shares. Last month, the company announced positive topline phase 2a clinical data for its ultra-long-acting GLP-1 receptor agonist, MET-097i. The company raised $275 million in its IPO, giving it a market value of about $1.85 billion. Since it went public, its shares have changed hands between $25.06 to $30.02 apiece, well above the IPO price.

Sirius XM

- Buyer(s): 10% owner Berkshire Hathaway

- Total shares: around 2.3 million

- Price per share: $22.24 to $24.23

- Total cost: nearly $54.0 million

Berkshire Hathaway acquired a notable number of Sirius XM Holdings Inc. (NASDAQ: SIRI) shares back in October and December, and it has returned to add more to its stake. That is up to almost 119.7 million shares, or over 35%. The company posted strong quarterly results last month, and last year it completed its spin-off from Liberty Media. Though the stock has gained about 14% since the beginning of the year, the share price is over 49% lower year over year. It was last seen near $26. The mean price target, though, is just $24.00, meaning analysts currently see no upside in the next 12 months. Their consensus recommendation is to hold shares.

89bio

- Buyer(s): 10% owner R.A. Capital Management

- Total shares: more than 5.7 million

- Price per share: $8.75

- Total cost: about $50.0 million

This transaction was part of a secondary offering of shares that raised approximately $288 million. San Francisco-based 89bio Inc. (NASDAQ: ETNB) is a clinical-stage biopharmaceutical company engaged in the development and commercialization of innovative therapies for the treatment of liver and cardio-metabolic diseases. Last year, it strengthened its executive leadership team and board of directors with seasoned industry veterans. Shares were last seen trading for more than $11 per share, after popping around 46% since the beginning of the year. The consensus price target is all the way up at $30.67, so analysts see plenty of room to run in the coming year. All but one of the nine analysts who cover the stock recommend buying shares.

TKO

- Buyer(s): 10% owner Silver Lake West HoldCo

- Total shares: about 251,500

- Price per share: $153.96 to $159.19

- Total cost: over $39.5 million

After scooping up $88 million worth of shares in the prior week, this buyer came back for more. TKO Group Holdings Inc. (NYSE: TKO) is the parent of Ultimate Fighting Championship and World Wrestling Entertainment. There has been speculation that UFC programming could end up on Netflix, and UFC recently named its official wireless provider in the United States. Since the third-quarter report, the stock is up almost 3% and trading near an all-time high above $161 per share. The $159.82 consensus price target suggests no upside in the next 12 months, yet all but three out of 18 analysts recommend buying shares, three of them with Strong Buy ratings. Goldman Sachs recently maintained its Buy rating. Note that the buyer’s stake is up to more than 1.8 million shares.

Custom Truck One Source

- Buyer(s): 10% PE One Source

- Total shares: more than 8.1 million

- Price per share: $4.00

- Total cost: less than $32.6 million

Custom Truck One Source Inc. (NYSE: CTOS) stock has outperformed the broader markets with a gain of more than 6% since the beginning of the year. The share price was last seen about 29% higher than the buyer’s purchase price. Analysts on average anticipate nearly 20% further upside in the next 52 weeks to their mean price target of $6.17. Their consensus recommendation is to buy shares of this Kansas City-based commercial truck and heavy equipment sales and services provider. The buyer’s stake is up to more than 156 million shares.

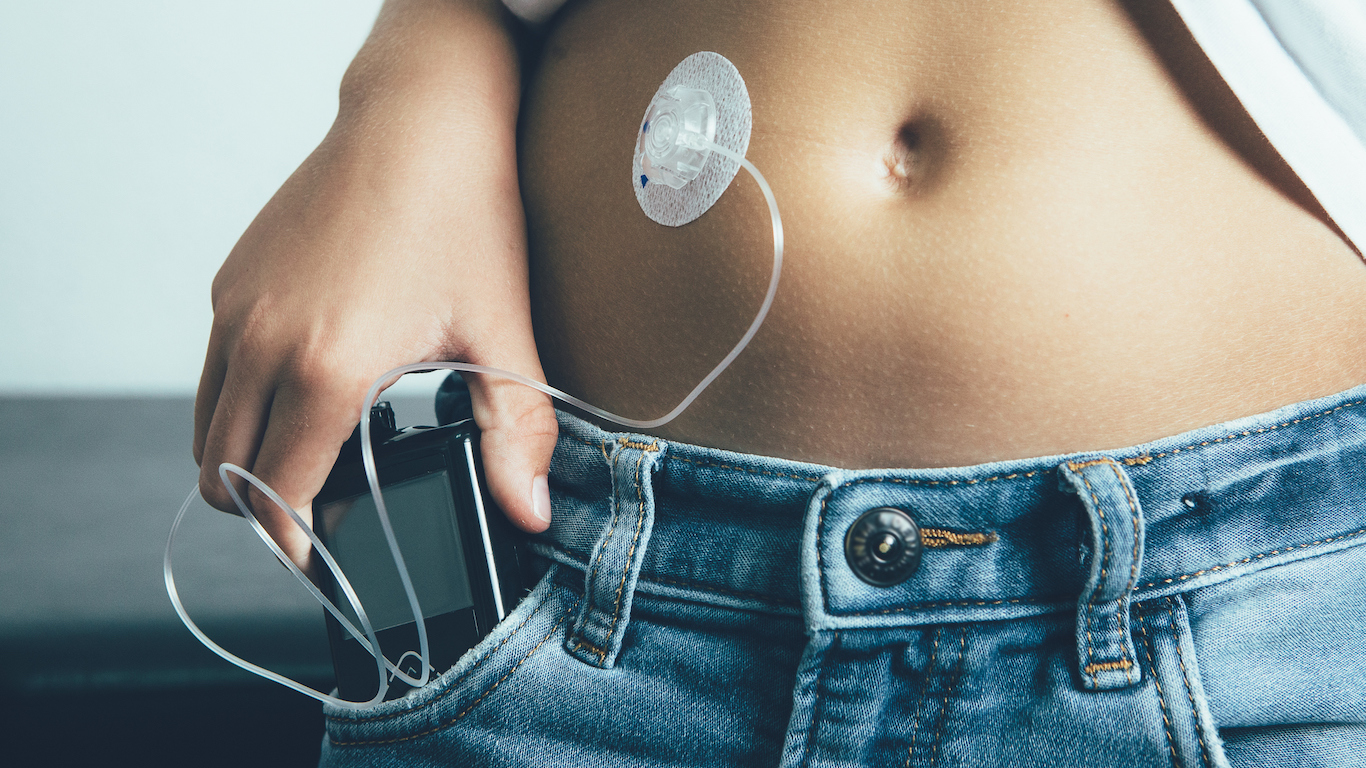

Beta Bionics

- Buyer(s): an officer and 10% owner Wellington Hadley Harbor Aggregator IV

- Total shares: over 1.0 million

- Price per share: $17.00

- Total cost: more than $17.6 million

This California-based maker of medical devices also just had an initial public offering, which raised more than $234 million. The beneficial owner above’s acquisition was a private placement at the IPO price. Beta Bionics Inc. (NASDAQ: BBNX) shares have traded for between $21.72 and $24.50 apiece so far. They were last seen changing hands for more than $23, but the stock has underperformed the Nasdaq since going public. Note that the officer above not only bought some shares but sold a few as well.

And Other Insider Buying

In the past week, some insider buying was reported at Ashland, Atlas Energy Solutions, Caterpillar, Dorchester Minerals, JetBlue, LendingClub, Murphy Oil, Norfolk Southern, Olin, 1-800-Flowers.Com, PBF Energy, and Texas Capital Bancshares as well.

Prediction: This Pharma Stock Will Be the Best Performer in 2025

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.