Among the most notable insider purchases of the past week or so is an almost $20 million buy in an American semiconductor concern. It was just one of several notable transactions by beneficial owners recently.

24/7 Wall St. Key Points:

-

Some of the most notable purchases in the past week or so were made by return buyers.

-

A firm associated with Mexican billionaire Carlos Slim was among them.

-

Take this quiz to see if you’re on track to retire. (sponsored)

Some of the most notable purchases were made by return buyers, including a firm associated with Mexican billionaire Carlos Slim. A medical products maker and a biotech also saw notable purchases as well. Let’s take a quick look at these transactions.

Is Insider Buying Important?

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

The earnings-reporting season is still underway, so many insiders are prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported in the past week, starting with the largest and most prominent.

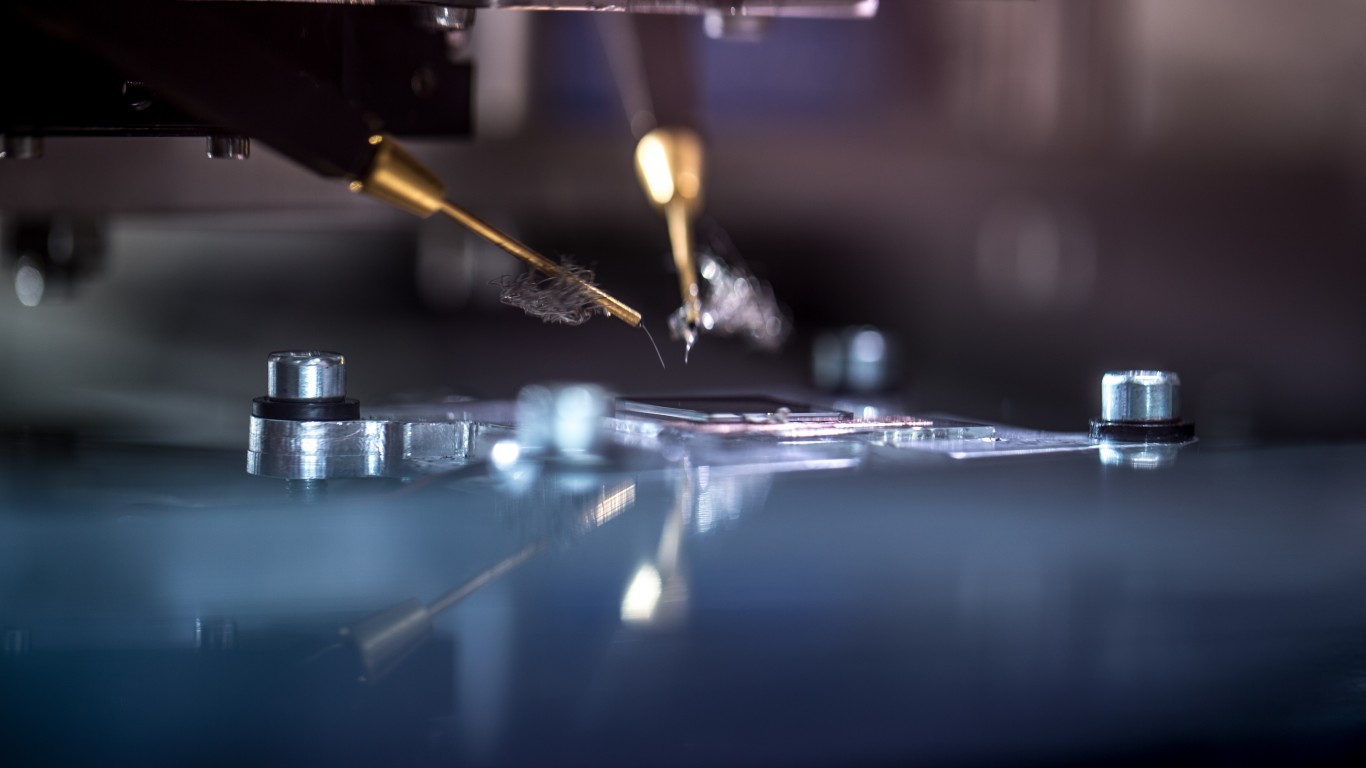

Amkor Technology

- Buyer(s): 10% owner Sujoda Investments

- Total shares: almost 869,600

- Price per share: $21.85

- Total cost: nearly $19.0 million

Founder and former CEO James Kim distributed these Amkor Technology Inc. (NASDAQ: AMKR) shares for the benefit of the Kim family.

This Arizona-based semiconductor packaging and test services provider posted mixed quarterly results last month. The share price has retreated more than 16% since then and is down over 20% since the beginning of the year to less than the buyer’s purchase price. Analysts have a consensus price target of $29.94, which is well below the 52-week high of $44.86.

Of nine analysts who cover the stock, six of them recommend buying shares, three of them with Strong Buy ratings. At least four of them reiterated their ratings after the earnings report.

Staar Surgical

- Buyer(s): 10% owner Broadwood Partners

- Total shares: over 663,700

- Price per share: $16.00 to $18.20

- Total cost: almost $11.3 million

This buyer has been buying shares since December and returned to the buy window and boosted the stake in Staar Surgical Co. (NASDAQ: STAA) to almost 12 million shares.

This maker of implantable lenses for the eye recently announced some layoffs and named a new chief executive. The stock has tumbled about 30% since the beginning of the year, but shares were last seen still within the buyer’s purchase price range. Analysts anticipate more than 15% upside in the next 12 months to their $18.67 consensus price target. Yet, only three of 13 analysts who cover the stock recommend buying shares.

Septerna

- Buyer(s): the CEO, CFO, and a beneficial owner

- Total shares: almost 1.1 million

- Price per share: $5.55 to $6.00

- Total cost: more than $6.4 million

Clinical-stage biotechnology company Septerna Inc. (NASDAQ: SEPN) had its initial public offering last fall. So far, shares have traded in a range of $4.17 to $28.99, and they were last seen changing hands a little above the purchase price range above.

The current consensus price target is $25.67, which represents around a 333% gain in the next 52 weeks. Analysts on average have recommended buying shares since the beginning of the year.

Note that the beneficial owner, Third Rock Ventures VI, boosted its stake to more than 4.2 million shares. CEO Jeff Finer now has a stake of about 771,900 shares.

PBF Energy

- Buyer(s): 10% owner Control Empresarial de Capitales

- Total shares: 389,000

- Price per share: $20.85 to $23.77

- Total cost: more than $8.5 million

This investment firm controlled by billionaire Carlos Slim has been scooping up shares of PBF Energy Inc. (NYSE: PBF) since last June. Now its stake is up to around 30 million shares.

The New Jersey-based refiner recently posted its third consecutive quarterly net loss due to falling margins. The stock has retreated about 30% since the report, and in fact has trended downward for almost a year. Shares were last seen trading for less than the buyer’s latest purchase price range. Analysts have a mean price target of $26.31, which represents almost 35% upside potential in the coming. Yet, none of the 15 analysts who follow the stock recommends acquiring shares.

Profrac

- Buyer(s): Executive Chair Matt Wilks and 10% owner Farris Welks

- Total shares: more than 627,500

- Price per share: $6.93

- Total cost: over $4.3 million

Texas-based hydraulic fracturing services company ProFrac Holding Corp. (NASDAQ: ACDC) named a new chief financial officer last spring. Third-quarter results lagged Wall Street expectations, but the next earnings report is due soon. Some see the stock as well-positioned for a breakout.

The share price is more than 19% lower than it was at the beginning of the year, as well as below the buyer’s purchase price. The consensus price target of $7.40 is less than the 52-week high of $9.75, but it represents more than 23% upside for the shares in the next 12 months. Yet, none of the six analysts who cover the stock recommend buying shares.

1-800-Flowers.com

- Buyer(s): 10% owner Fund 1 Investments

- Total shares: about 558,000

- Price per share: $6.62 to $7.58

- Total cost: almost $4.0 million

1-800-Flowers.com Inc. (NASDAQ: FLWS) posted disappointing quarter results at the end of January and the stock retreated more than 15% afterward. It is now down almost 29% since the beginning of the year, far more than the S&P 500. On last look, shares were trading below the purchase price range above.

The $9.88 mean price target indicates Wall Street sees around 61% upside in the coming year. The consensus recommendation remains to buy shares. Note that this buyer has been scooping up shares since the beginning of the year. The stake is up to more than 7.6 million shares. Plus, the buyer has also been picking up Tile Shop Holdings Inc. (NASDAQ: TTSH) shares.

And Other Insider Buying

In the past week, some insider buying was reported at Akamai Technologies, Amkor, Apple Hospitality REIT, Cleveland-Cliffs, Coeur Mining, CRISPR Therapeutics, Denny’s, Dentsply Sirona, Freshpet, Grocery Outlet, HF Sinclair, Huntington Ingalls Industries, IBM, Kratos Defense, Matador Resources, Peabody Energy, PG&E, Regions Financial, Roblox, Roku, Salesforce, Skyworks Solutions, and Wolverine World Wide as well.

Amazon Stock Price Prediction: Where Will It Be in 1 Year

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.