Personal Finance

Suze Orman says “no decision is bigger than deciding when to start receiving your Social Security” – 3 tips for making the right call

Published:

After years of hard work and paying taxes, you may feel empowered to collect your Social Security benefits as soon as possible.

You can begin earning Social Security benefits at age 62. But if you wait until your full retirement age or until age 70, you would earn a bigger payout.

“If you are in your late 50s and in good health, you should seriously consider the upside of delaying when you start, so you can earn a higher benefit,” says finance guru Suze Orman.

But before you decide when to begin collecting Social Security checks, keep these points in mind.

24/7 Wall St. Insights

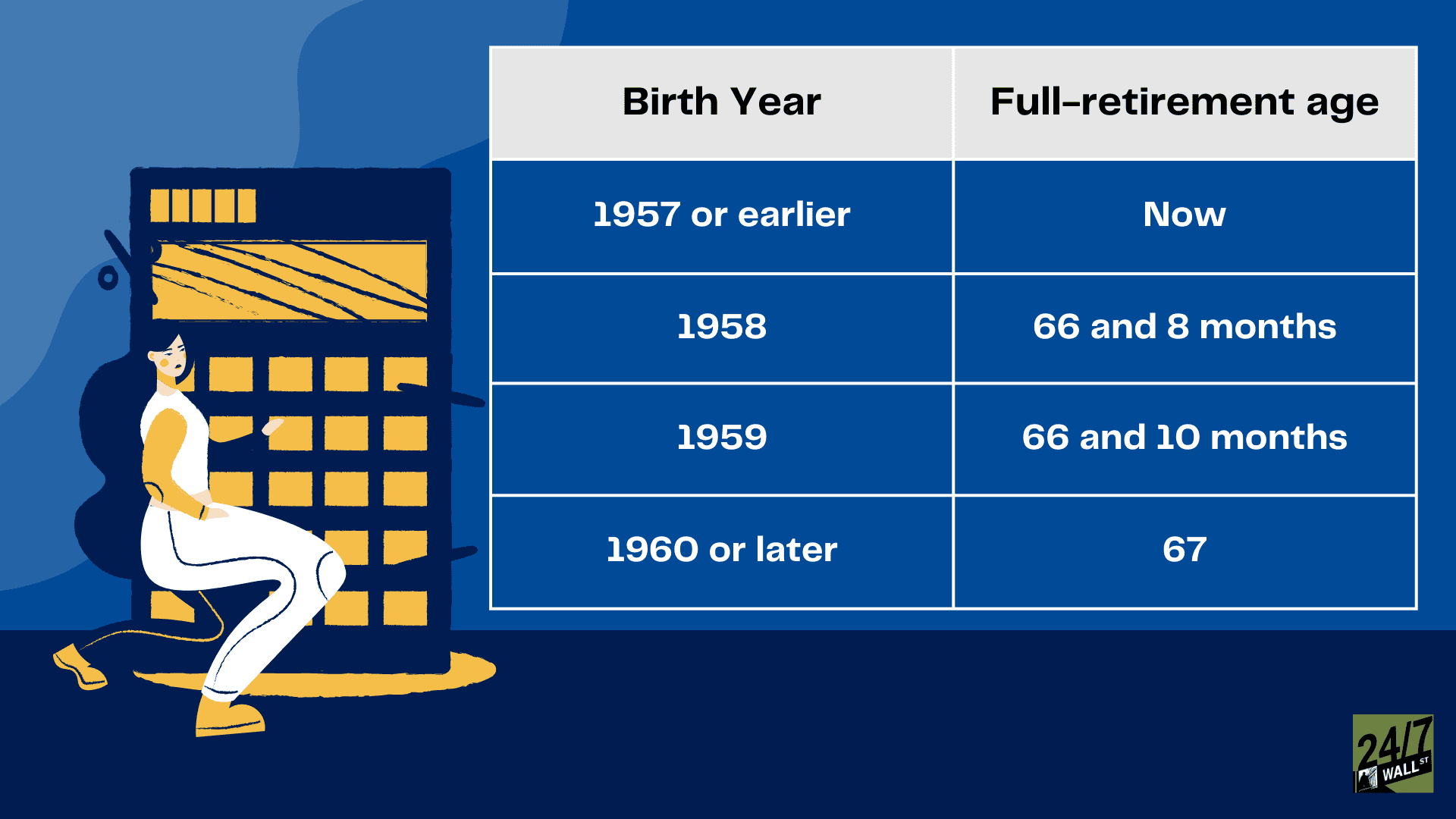

Your full-retirement age depends on your birthday. If you were born in 1957 or earlier, you’ve reached your full retirement age. If you were born in 1958 or later, your full-retirement age would vary.

If you’re healthy and have other reliable sources of income, you should consider delaying Social Security payments until you reach your full-retirement age.

That’s because if you start collecting Social Security before your full retirement age, your payments will be permanently reduced for each month before your full retirement age.

But waiting could pay off.

“At your full retirement age (age 67 for everyone born in 1960 or later), your benefit will be 30% larger than if you start at age 62,” Orman noted on her blog published in March.

There’s an upside to waiting a bit longer. For every year you delay collecting Social Security benefits after you reach your full-retirement age, your benefits increase by 8% up until you reach age 70. These bumps are known as delayed retirement credits (DRC).

So review your finances and see if you have enough readily available money to sustain you until you reach age 70. Here are some places to look in.

Make sure you know how much you can take from these sources and when you could do so without penalty. It’s also crucial to understand the tax implications of all these accounts.

Moreover, you may want to consider working part-time or pick up a side gig to cover you until your full-retirement age or until age 70 in order to maximize your Social Security benefits.

But there’s virtually no upside to delaying your Social Security payments past age 70.

If you absolutely need your Social Security benefits to make ends meet and have no other sources of income, then you may want to begin collecting early.

You should also consider this option if you’re in poor health and don’t expect to live to your full-retirement age or up to 70.

The average life expectancy for a 65-year-old male is around 84, according to the Social Security Administration (SSA). That stretches to 87 for females.

But there are other reasons why you may consider collecting Social Security benefits early. Here are some examples.

You can no longer work to make ends meet.

You don’t expect your spouse to live beyond average life expectancy.

You’re the lower-earning spouse, and your higher-earning partner can delay for higher payments.

Social Security benefits play a crucial role in the income for retirees across the country and will continue to do so. And after working your whole life paying into the system, you may want to take your cut as soon as you can. But if it’s feasible, delaying collecting Social Security benefits until your full-retirement age or until age 70 could mean larger payments to fund the retirement you deserve.

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.