Personal Finance

2 out of 3 financially secure retirees have at least $250,000 saved - are you on track to achieve that?

Published:

Last Updated:

According to a recent Federal Reserve survey, the majority of Americans require over half a million dollars in savings to achieve financial security in retirement. The survey also showed that a significant number of retirees need at least a million dollars to feel comfortable.

This emphasizes the significance of psychological security in retirement, indicating that a higher savings goal is essential for a mentally satisfying retirement.

Of course, more than a million dollars would help many retirees feel even more secure.

Also: Take this quiz to see if you’re on track to retire (Sponsored)

Retirement in America is exceptionally complicated. While many retirees report a high degree of financial well-being, this reality is far from uniform.

The Federal Reserve’s Survey of Household Economics and Decision Making (SHED) revealed a significant gap between what people have saved and what they need to feel financially secure in retirement. Financial security isn’t just about the number you have in the bank. To a large extent, it’s how you feel about the money in the bank.

Do you feel like you have enough? Or have you missed your goals?

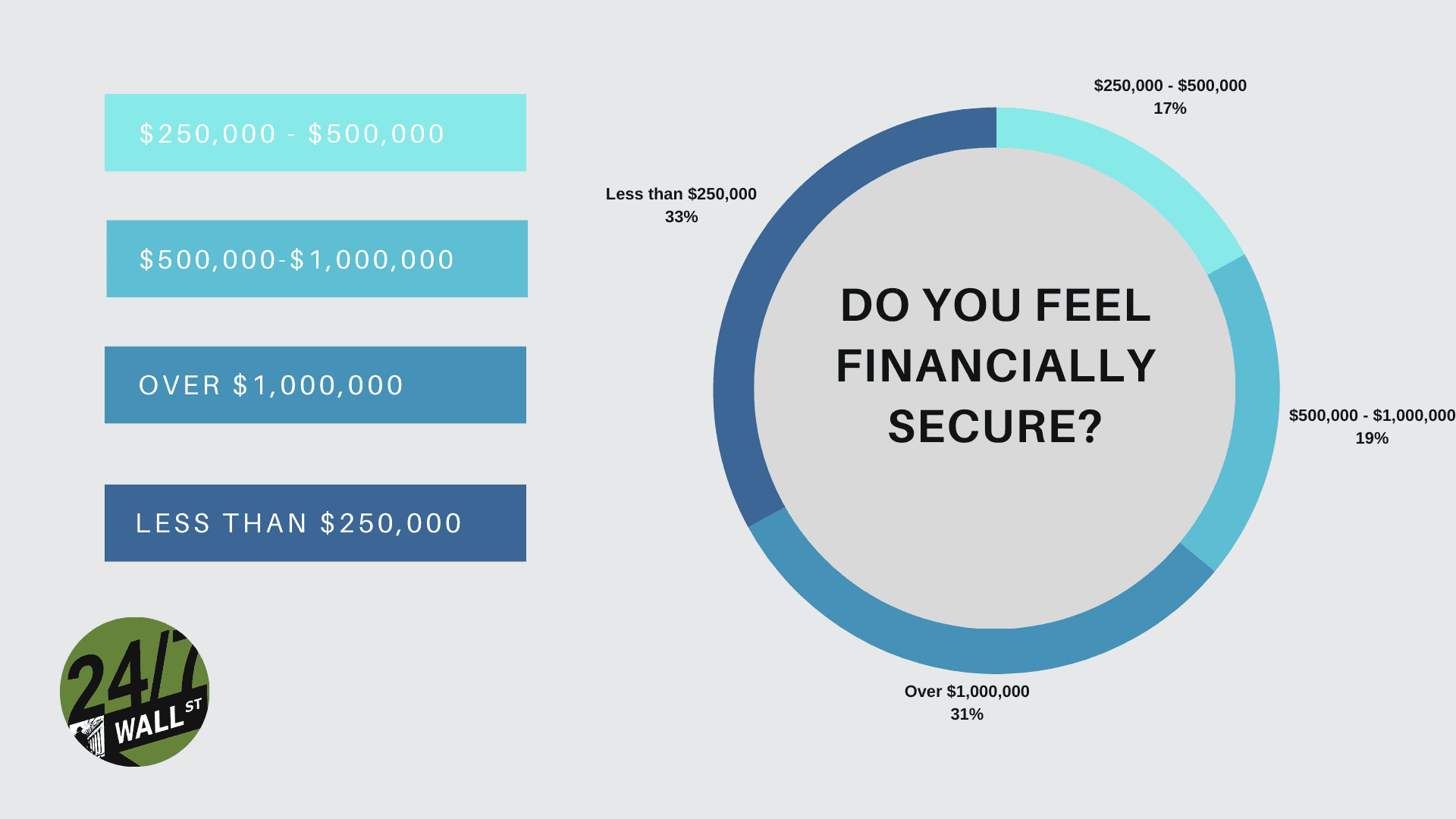

The survey found that 31% of financially secure retirees had more than a million dollars saved. This was followed by 19% with $500,000 to $1 million and 17% with $250,000 to $500,000. Notably, these figures suggest that roughly two-thirds of financially secure retirees had at least a quarter-million dollars saved.

Of course, feelings aren’t necessarily reality. Just because someone feels they’re financially secure doesn’t mean they’re necessarily ready to weather incoming storms. Let’s break down those numbers a bit more:

With savings between $250,000 and $500,000, 17% of respondents fall into a somewhat precarious position. While this amount might seem substantial, it may not be sufficient to maintain a comfortable lifestyle throughout retirement, particularly considering factors like inflation and unexpected expenses.

That said, the cost of living isn’t the same everywhere. Depending on where the retiree lives, it may be completely possible to only have $250,000 saved. Plus, these retirees likely have other sources to include, like a pension. In this case, they wouldn’t need as much savings to feel financially secure.

Generally, experts recommend saving at least $500,000 for retirement, but as the survey proves, this isn’t 100% accurate. This group only makes up 19% of those who feel financially secure for retirement. Many people save less and feel financially secure, but many people also need quite a bit more to feel ready for retirement.

The number you need in your bank account depends on where you live and your plans for retirement. If you want to travel the world, $500,000 probably won’t be enough!

With over a million dollars saved for retirement, 31% of respondents reported that they felt relatively financially secure. This level of savings is often enough to provide a significant cushion against unexpected expenses and allow for a more comfortable retirement lifestyle.

However, $1,000,000 may not be enough for everyone, as you might guess. If you want a very luxurious lifestyle or live in a high-cost-of-living area, you probably want even more saved.

Inflation and rising living costs can seriously erode the purchasing power of retirement savings over time. This means that the amount of money you need today probably won’t be the same amount you need decades from now.

Instead, you’ll likely need quite a bit more per month, though no one can accurately predict inflation. We don’t know exactly how much more you’ll need, but it may end up being a significant amount.

We’ll dive into how much you’ll need to save for different monthly income levels in these next few sections. However, before we do, it’s important to keep in mind that these calculations make some assumptions that aren’t necessarily true. We also can’t figure out what inflation will be decades ahead of time, so that remains a huge unknown.

Here is a quick list of things to keep in mind when looking at these calculations:

Assuming a retirement of 20 years and an annual return of 7%, to cover estimated annual expenses of $36,000, you would need to save approximately $550,000. This assumes you don’t have any pensions or other sources of income, which would lower this further.

Assuming a 20-year retirement with an annual 7% return, you would need to save about $950,000 to cover around $60,000 annual expenses. Again, this is for a single person and assumes that you don’t have other significant sources of income.

Using the same metrics as before, you’d need $1.9 million saved at least. This is far above average.

Financial planning involves a lot of numbers, but there is a serious psychological factor, too. Retirement is a serious life transition that leaves a lot of people reeling, even when they’ve been looking forward to it for years. Not feeling ready for retirement can make the transition even harder.

Financial insecurity can be a serious burden in retirement if you aren’t careful. In fact, over 80% of older Americans are unable to sustain a financial shock if they need long-term care services or another long-term financial hardship. Simply put, that means that many older Americans are one crisis away from finding themselves in poverty.

Even if you don’t find yourself in one of these situations, the constant worry of one occurring can lead to stress and anxiety at a time of your life that’s supposed to be the most relaxing.

On the other hand, financial stability provides you with the freedom to enjoy your retirement. With enough of a nest egg, you can focus on personal enjoyment – not stress about your finances.

Yes, money is about numbers. But how you feel about your financial situation is often just as important.

Getting started on your retirement savings early is highly recommended.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.