Personal Finance

I'm 48 with a $4.5 million net worth and am ready to retire soon - but I'm struggling with departing my meaningful job

Published:

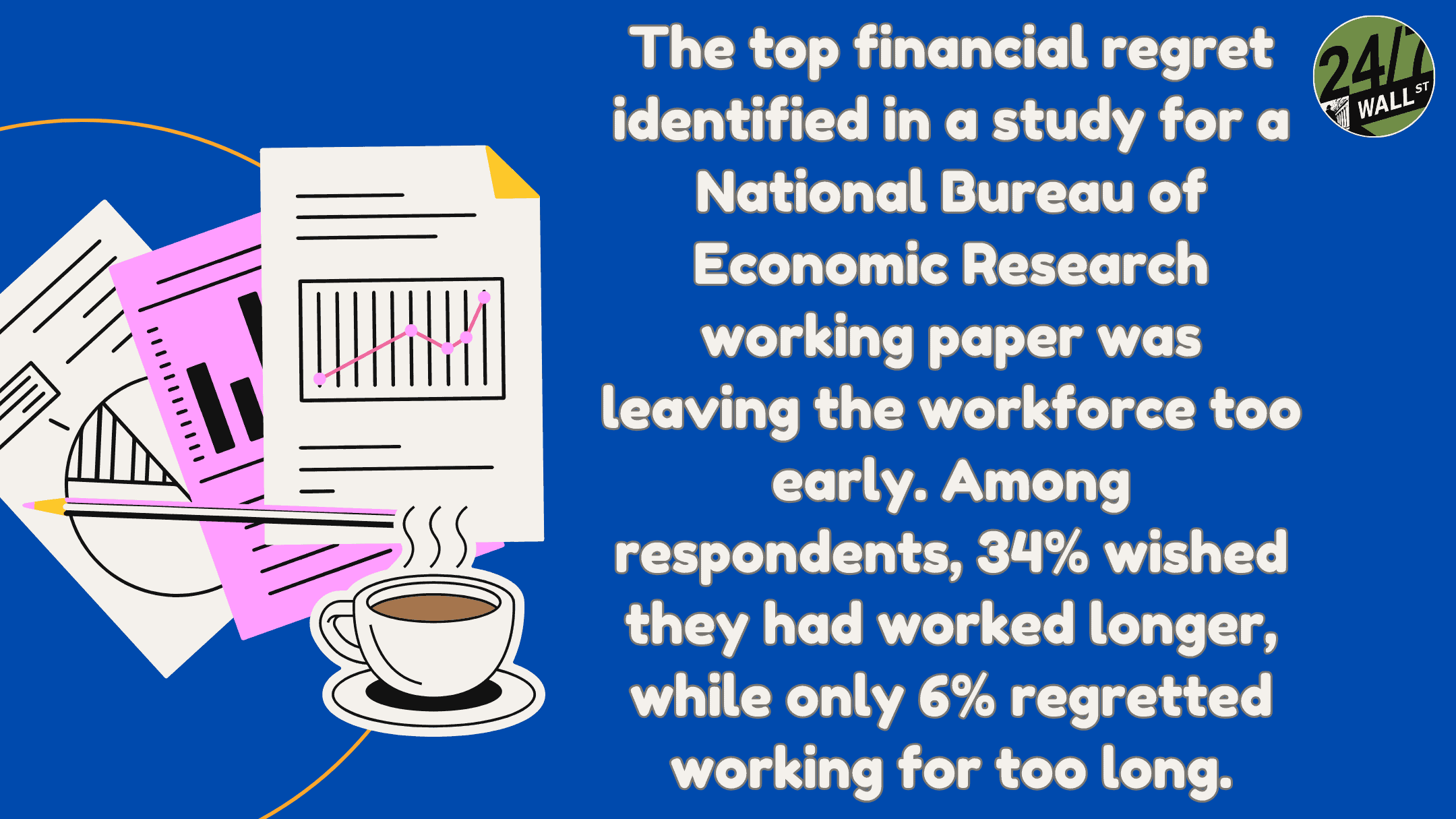

One of the hardest parts of retiring isn’t actually saving for retirement – it’s actually retiring. Many people get a lot of their meaning from their career, and when it’s time to leave it, they suddenly realize that they don’t want to.

For instance, I came across a similar situation in a recent Reddit post. This Redditor, a 48-year-old woman with a significant net worth, pension plans, and financial independence, was having a hard time quitting her job.

(I’ve covered early retirement before. Check out my article on early retirement strategies for more information.)

Despite her and her husband’s plan to retire early and enjoy life, she’s struggling with walking way from a career she’s built over decades. However, she finds her career intoxicating and enjoys it very much.

Here’s my advice to those in a similar position. Remember, this isn’t financial advice, just my opinion:

Working becomes a huge part of anyone’s identity. However, it’s important to look at your priorities as a whole and consider what you want your life to look like. It’s easy to just keep doing the same thing, but that’s often not what we need to be most fulfilled.

In this particular instance, I recommend considering the unique experiences the Redditor may want to prioritize outside of work. It may make sense to go on a sabbatical and travel for money just to see what it would be like.

Don’t plan on just staying home all day. Identify what you like to do outside of work, whether it’s travel, hobbies, or volunteer work. These passions will likely end up taking up much of your time in retirement, so it helps to identify them before you retire.

There are lots of ways to make a difference outside of work, too. Volunteer work or even part-time consulting goals can provide flexibility and meaning.

The Redditor mentioned a vague “one more challenge” goal she keeps setting for herself. I recommend giving yourself a concrete timeline for transition instead. Planning to retire “some day” will lead to you never retiring at all. It’s best to have a fixed date as soon as possible.

Everything is an opportunity cost. If you decide to continue working, you’re losing something. For instance, a high-stress job can prolong your health. Remember that financial independence allows you to make health, relationships, and new adventures.

That said, it’s up to you to take advantage of that.

A sabbatical gives you the chance to test a life of ease before committing to full retirement. If you’re questioning whether or not you want to retire, taking a sabbatical is a great option. It’s hard to do anything if you’ve never done it before. A sabbatical takes some of the unknown away!

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: are you ahead, or behind on your retirement goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With SmartAsset’s free tool, you can connect with vetted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.