Personal Finance

I'm a conservative investor with $1.2 million in retirement accounts — did I ruin my chances for early retirement?

Published:

Many believe that becoming a millionaire means we’ll be able to retire early to a life of carefree luxury. Unfortunately, $1 million isn’t quite what it used to be. But depending upon when we want to quit the rat race and that we still have many years of living ahead of us, we’re going to need a lot more saved than just a million dollars.

However, it’s hard when we’re very risk-averse. Although it’s true that the greater the risk, the bigger the reward, the reward is by no means guaranteed. Overcoming the fear of taking risks is often the hardest part of achieving our goals.

This was brought to mind by a Redditor on the r/fatFIRE subreddit who, although he’s done quite well for himself in a relatively short amount of time, is a long way from his target because he is too conservative when investing. Due to his fear of losing it all, he foresees himself having to work well into his 60s.

They say the first step in overcoming a problem is recognizing you have one. He is at least making progress in one area.

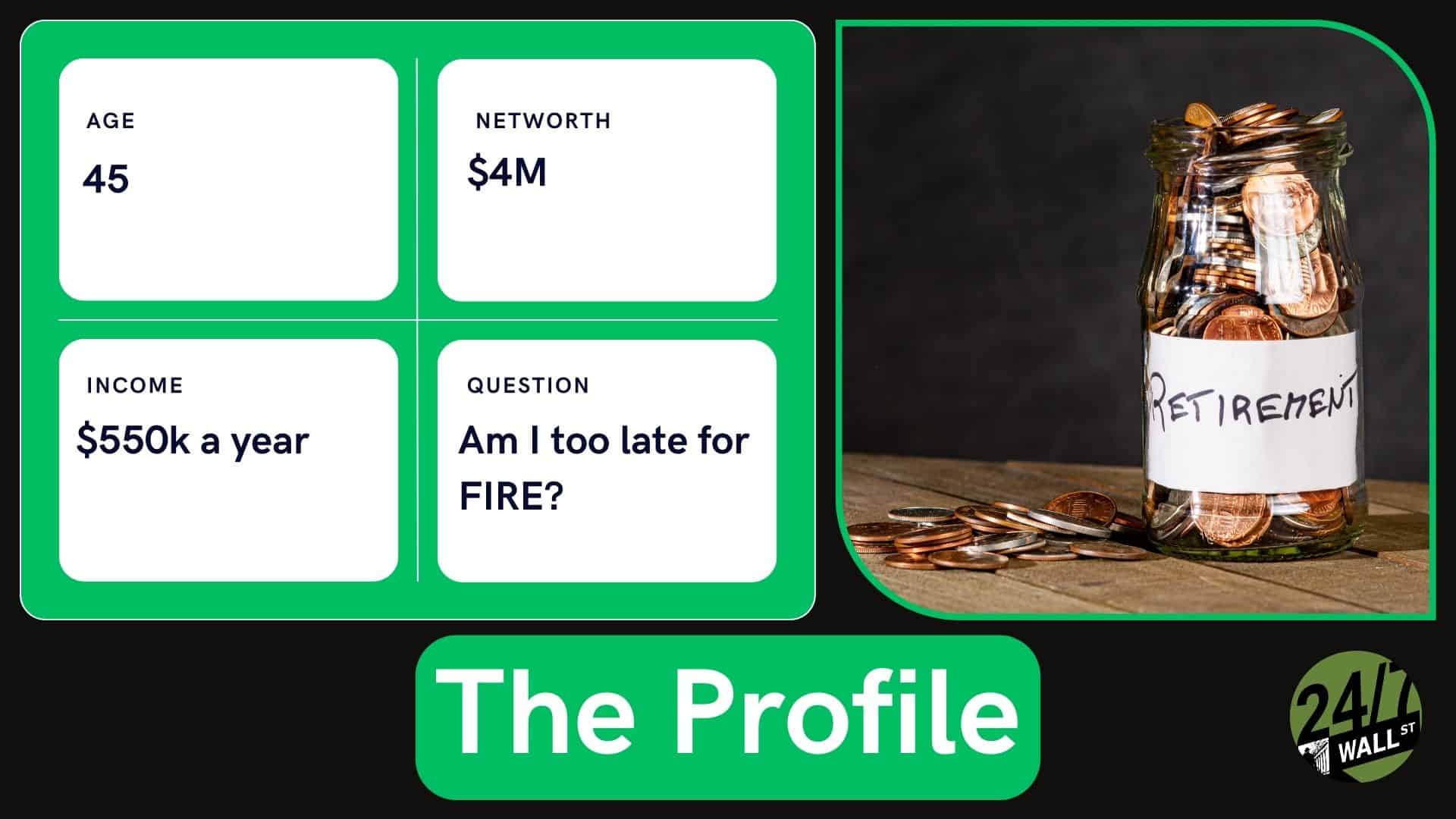

The Redditor and his wife are 45 years old with household income of $500,000 a year. His net worth is about $4 million spread over retirement accounts worth $1.2 million, liquid assets of $1.6 million, and home equity of $1.5 million from a primary residence and five rental properties.

Considering he started investing and thinking about his future later in life, the Redditor has come a long way in a short amount of time.

Now I’m not a financial planner, so these are only my opinions, but I believe that while the Redditor could retire early, he is probably right a regular retirement schedule is in the cards because of his fear of losing capital.

It is important to understand losing capital is a serious issue, particularly as you get closer to retirement. While the Redditor could have been more aggressive when he was younger, now as he approaches retirement, being conservative is probably an advantage.

Despite the Redditor being a high wage earner, he’s also a big spender with annual expenses around $250,000 a year. For his salary and net worth, that’s a lot, and he is staggering under a debt load of around $2.7 million related to his rental properties. No wonder he is gun shy about risk!

When it comes to investing, he is so fearful that if a stock goes up just 3% or 4% he immediately sells to lock in the profit. In doing so, he misses out on potential long-term gains. He then keeps most of his money in cash waiting for a correction that never comes.

Because of his fears, one of the most important things the Redditor can do to improve his circumstances is speak with a financial advisor. An engaged professional can ensure he stays on track and not react to every bad news cycle a company encounters. One can also help him craft a roadmap unique to his situation and stick to it.

If you want to retire early and live comfortably, it is going to entail taking risks. Being skittish about investing means you probably shouldn’t be investing, at least not in individual stocks. Rather, buy an index fund like the Vanguard S&P 500 Trust (NYSEARCA:VOO) or Vanguard Total Stock Market ETF (NYSEARCA:VTI). It’s a set-and-forget strategy that helps you earn the market’s long-term average over time.

More essential, though, is getting financial professionals on your team. They can create a plan of attack for reaching your goals and keep you on course while preventing you from giving into your fears.

You also need to give yourself some grace. The Redditor has actually achieved a lot despite his shortcomings, and while he still has much work to do, he should still pat himself on the back for bringing himself and his family this far along the journey.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.