Special Report

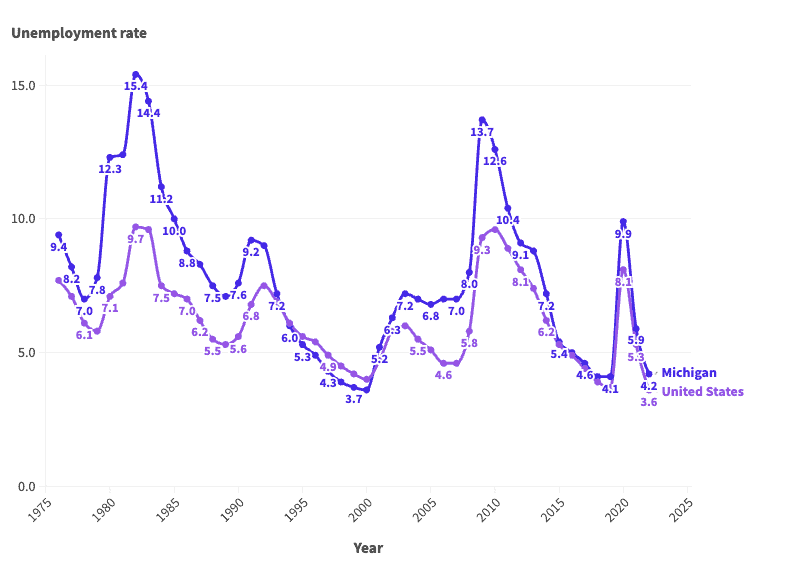

For Almost 50 Years Michigan's Unemployment Rate Has Been Worse Than the US Average

Published:

In an era of economic uncertainty, the U.S. job market remains resilient. After falling to 3.7% in November 2023, the national unemployment rate has been below 4% for 22 consecutive months, the longest streak in over 50 years.

Of course, if history is any guide, much of the economy is subject to boom and bust cycles — and the job market is no exception. Since the mid-1970s, the average annual unemployment rate in the U.S. has fluctuated between 3.6% and nearly 10%, according to the Bureau of Labor Statistics.

These same cyclical patterns are also evident in Michigan, where the job market is supported largely by the manufacturing and retail trade industries. The annual unemployment rate in the state was 4.2% in 2022, only slightly higher than the state’s lowest recorded annual jobless rate of 3.6%. However, conditions for job seekers have not always been so favorable.

According to historical BLS data going back to 1976, the annual jobless rate has been as high as 15.4% in Michigan. More than once, unemployment in the state has either matched or come close to that peak.

This is how Michigan’s job market has changed in each of the last 47 years.

| Year | Michigan unemployment rate | U.S. unemployment rate | Unemployed population in Michigan |

|---|---|---|---|

| 1976 | 9.4 | 7.7 | 375,056 |

| 1977 | 8.2 | 7.1 | 337,939 |

| 1978 | 7.0 | 6.1 | 296,859 |

| 1979 | 7.8 | 5.8 | 339,231 |

| 1980 | 12.3 | 7.1 | 531,279 |

| 1981 | 12.4 | 7.6 | 532,261 |

| 1982 | 15.4 | 9.7 | 662,859 |

| 1983 | 14.4 | 9.6 | 617,154 |

| 1984 | 11.2 | 7.5 | 484,805 |

| 1985 | 10.0 | 7.2 | 436,559 |

| 1986 | 8.8 | 7.0 | 391,816 |

| 1987 | 8.3 | 6.2 | 377,221 |

| 1988 | 7.5 | 5.5 | 344,509 |

| 1989 | 7.1 | 5.3 | 330,618 |

| 1990 | 7.6 | 5.6 | 353,539 |

| 1991 | 9.2 | 6.8 | 426,685 |

| 1992 | 9.0 | 7.5 | 424,245 |

| 1993 | 7.2 | 6.9 | 347,057 |

| 1994 | 6.0 | 6.1 | 292,697 |

| 1995 | 5.3 | 5.6 | 257,276 |

| 1996 | 4.9 | 5.4 | 239,907 |

| 1997 | 4.3 | 4.9 | 212,570 |

| 1998 | 3.9 | 4.5 | 199,520 |

| 1999 | 3.7 | 4.2 | 191,761 |

| 2000 | 3.6 | 4.0 | 187,817 |

| 2001 | 5.2 | 4.7 | 266,726 |

| 2002 | 6.3 | 5.8 | 311,436 |

| 2003 | 7.2 | 6.0 | 357,218 |

| 2004 | 7.0 | 5.5 | 352,186 |

| 2005 | 6.8 | 5.1 | 343,901 |

| 2006 | 7.0 | 4.6 | 355,349 |

| 2007 | 7.0 | 4.6 | 354,668 |

| 2008 | 8.0 | 5.8 | 402,532 |

| 2009 | 13.7 | 9.3 | 638,574 |

| 2010 | 12.6 | 9.6 | 580,853 |

| 2011 | 10.4 | 8.9 | 467,194 |

| 2012 | 9.1 | 8.1 | 423,499 |

| 2013 | 8.8 | 7.4 | 413,509 |

| 2014 | 7.2 | 6.2 | 343,703 |

| 2015 | 5.4 | 5.3 | 258,391 |

| 2016 | 5.0 | 4.9 | 241,690 |

| 2017 | 4.6 | 4.4 | 225,394 |

| 2018 | 4.1 | 3.9 | 205,713 |

| 2019 | 4.1 | 3.7 | 202,560 |

| 2020 | 9.9 | 8.1 | 483,886 |

| 2021 | 5.9 | 5.3 | 277,993 |

| 2022 | 4.2 | 3.6 | 203,427 |

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.