Special Report

How Washington's Job Market Compared to the US Over the Last 47 Years

Published:

In an era of economic uncertainty, the U.S. job market remains resilient. After falling to 3.7% in November 2023, the national unemployment rate has been below 4% for 22 consecutive months, the longest streak in over 50 years.

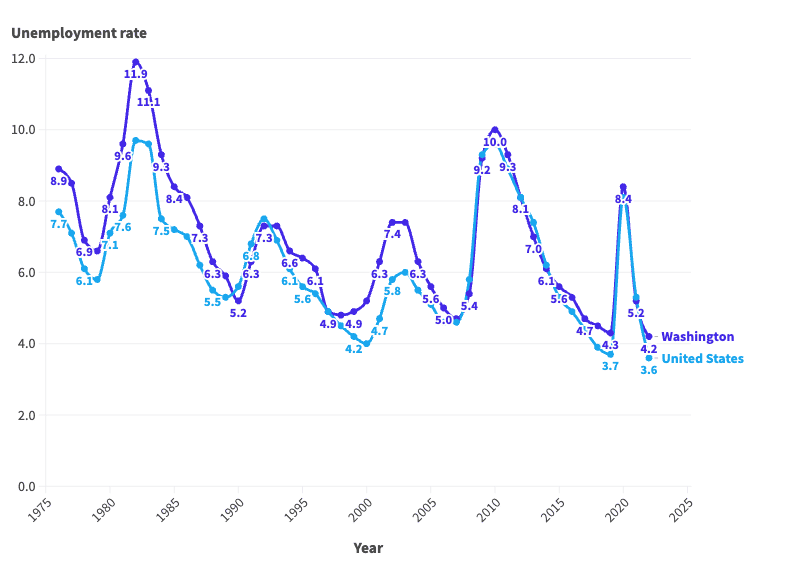

Of course, if history is any guide, much of the economy is subject to boom and bust cycles — and the job market is no exception. Since the mid-1970s, the average annual unemployment rate in the U.S. has fluctuated between 3.6% and nearly 10%, according to the Bureau of Labor Statistics.

These same cyclical patterns are also evident in Washington, where the job market is supported largely by the professional and scientific and retail trade industries. The annual unemployment rate in the state was 4.2% in 2022, a multi-decade low. However, conditions for job seekers have not always been so favorable.

According to historical BLS data going back to 1976, the annual jobless rate has been as high as 11.9% in Washington. More than once, unemployment in the state has either matched or come close to that peak.

This is how Washington’s job market has changed in each of the last 47 years.

| Year | Washington unemployment rate | U.S. unemployment rate | Unemployed population in Washington |

|---|---|---|---|

| 1976 | 8.9 | 7.7 | 142,037 |

| 1977 | 8.5 | 7.1 | 142,710 |

| 1978 | 6.9 | 6.1 | 123,698 |

| 1979 | 6.6 | 5.8 | 130,381 |

| 1980 | 8.1 | 7.1 | 156,112 |

| 1981 | 9.6 | 7.6 | 187,403 |

| 1982 | 11.9 | 9.7 | 235,851 |

| 1983 | 11.1 | 9.6 | 228,865 |

| 1984 | 9.3 | 7.5 | 193,051 |

| 1985 | 8.4 | 7.2 | 173,797 |

| 1986 | 8.1 | 7.0 | 176,980 |

| 1987 | 7.3 | 6.2 | 164,862 |

| 1988 | 6.3 | 5.5 | 146,110 |

| 1989 | 5.9 | 5.3 | 145,129 |

| 1990 | 5.2 | 5.6 | 129,580 |

| 1991 | 6.3 | 6.8 | 156,004 |

| 1992 | 7.3 | 7.5 | 190,334 |

| 1993 | 7.3 | 6.9 | 196,376 |

| 1994 | 6.6 | 6.1 | 172,578 |

| 1995 | 6.4 | 5.6 | 174,883 |

| 1996 | 6.1 | 5.4 | 171,201 |

| 1997 | 4.9 | 4.9 | 145,985 |

| 1998 | 4.8 | 4.5 | 146,536 |

| 1999 | 4.9 | 4.2 | 147,241 |

| 2000 | 5.2 | 4.0 | 157,856 |

| 2001 | 6.3 | 4.7 | 185,301 |

| 2002 | 7.4 | 5.8 | 219,675 |

| 2003 | 7.4 | 6.0 | 226,245 |

| 2004 | 6.3 | 5.5 | 201,073 |

| 2005 | 5.6 | 5.1 | 182,714 |

| 2006 | 5.0 | 4.6 | 165,704 |

| 2007 | 4.7 | 4.6 | 156,610 |

| 2008 | 5.4 | 5.8 | 182,379 |

| 2009 | 9.2 | 9.3 | 286,984 |

| 2010 | 10.0 | 9.6 | 316,342 |

| 2011 | 9.3 | 8.9 | 293,412 |

| 2012 | 8.1 | 8.1 | 265,444 |

| 2013 | 7.0 | 7.4 | 229,825 |

| 2014 | 6.1 | 6.2 | 207,249 |

| 2015 | 5.6 | 5.3 | 193,577 |

| 2016 | 5.3 | 4.9 | 189,031 |

| 2017 | 4.7 | 4.4 | 172,929 |

| 2018 | 4.5 | 3.9 | 168,546 |

| 2019 | 4.3 | 3.7 | 166,916 |

| 2020 | 8.4 | 8.1 | 332,714 |

| 2021 | 5.2 | 5.3 | 203,002 |

| 2022 | 4.2 | 3.6 | 168,024 |

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.