Special Report

How Arizona's Job Market Has Fared Since Trump Was Elected

Published:

Last Updated:

In an era of economic uncertainty, the U.S. job market remains resilient. After falling to 3.7% in November 2023, the national unemployment rate has been below 4% for 22 consecutive months, the longest streak in over 50 years.

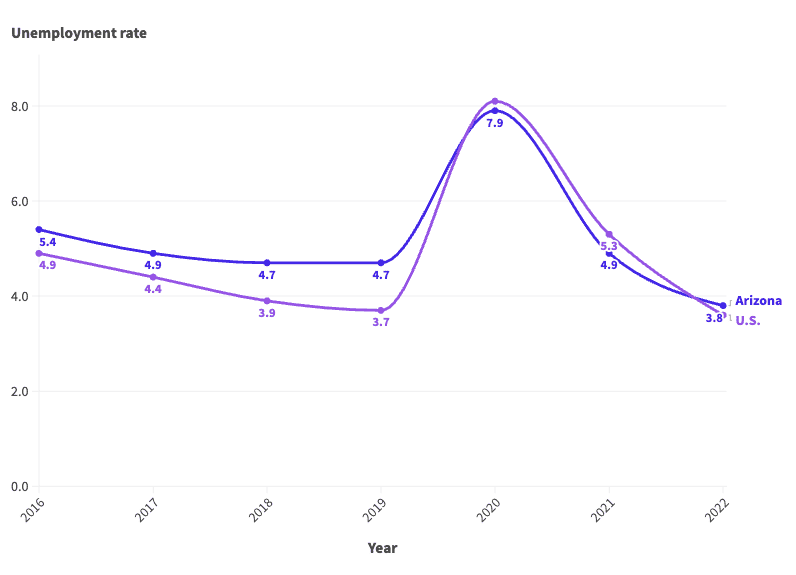

Of course, if history is any guide, much of the economy is subject to boom and bust cycles — and the job market is no exception. In the last seven years — a period that spanned three presidential administrations and included a global pandemic — the average annual unemployment rate in the U.S. has fluctuated between 3.6% and 8.1%, according to the Bureau of Labor Statistics.

These same cyclical patterns are also evident in Arizona, where the job market is supported largely by the professional and scientific and retail trade industries. The annual unemployment rate in the state was 3.8% in 2022, a multi-decade low. However, conditions for job seekers have not always been so favorable.

According to BLS data going back to 2016, the year Donald Trump was elected president, the annual jobless rate has been as high as 7.9% in Arizona.

This is how Arizona’s job market has changed since 2016.

| Year | Arizona unemployment rate (%) | U.S. unemployment rate (%) | Unemployed population in Arizona |

|---|---|---|---|

| 2016 | 5.4 | 4.9 | 177,617 |

| 2017 | 4.9 | 4.4 | 160,411 |

| 2018 | 4.7 | 3.9 | 159,708 |

| 2019 | 4.7 | 3.7 | 165,058 |

| 2020 | 7.9 | 8.1 | 271,187 |

| 2021 | 4.9 | 5.3 | 178,381 |

| 2022 | 3.8 | 3.6 | 138,128 |

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.