Rackspace Hosting Inc. (NYSE: RAX) is scheduled to release its first-quarter financial results after the markets close on Monday. The consensus estimates call for $0.22 in earnings per share (EPS) on $518.95 million in revenue. In the same period of last year, the company posted EPS of $0.20 and revenue of $480.20 million.

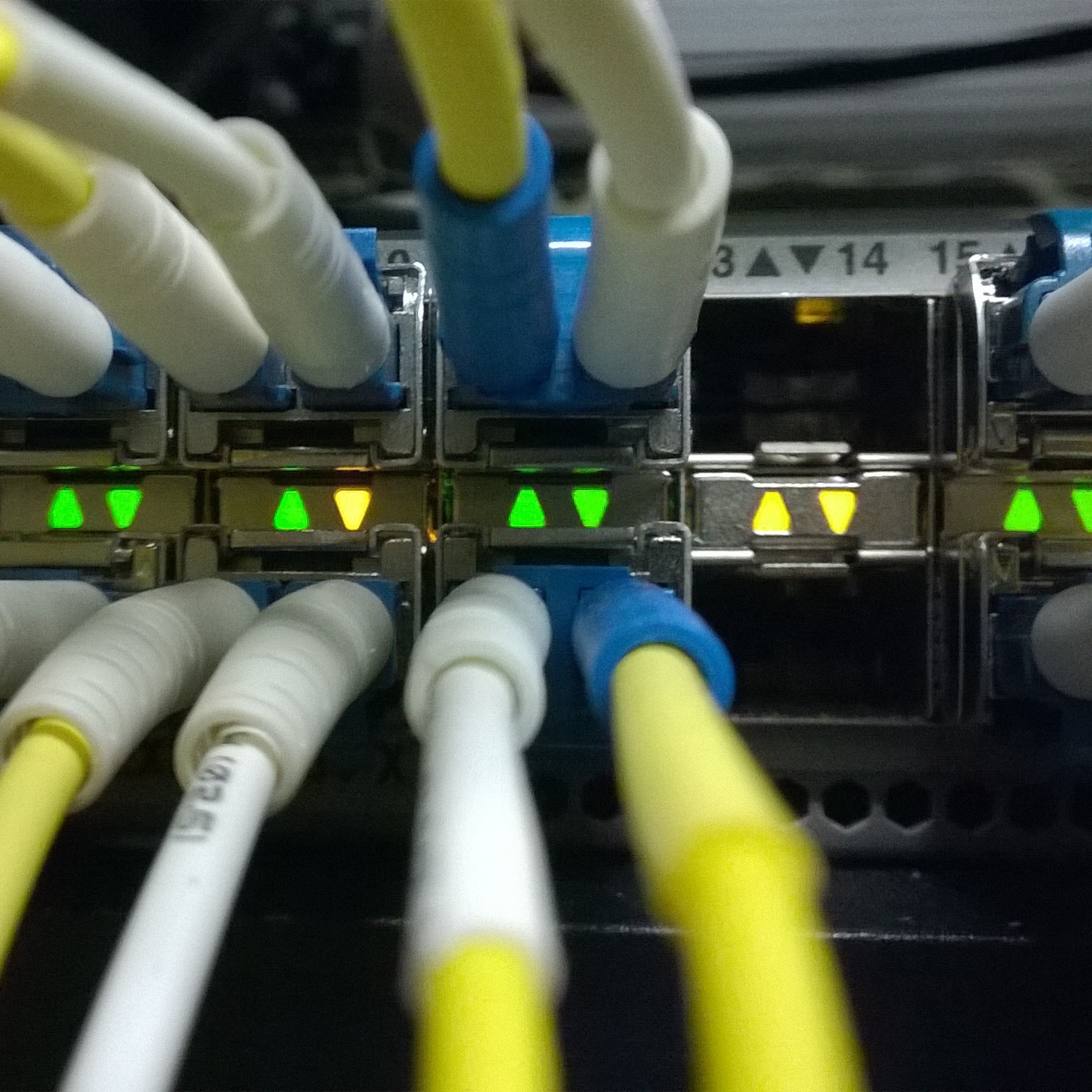

This company is the self-described number one managed cloud company, which helps businesses tap the power of cloud computing without the challenge and expense of managing complex IT infrastructure and application platforms on their own. Rackspace engineers deliver specialized expertise, on top of leading technologies developed by AWS, Microsoft, OpenStack, VMware and others, through a results-obsessed service known as Fanatical Support.

The company has more than 300,000 customers worldwide, including two-thirds of the Fortune 100. Rackspace was named a leader in the 2015 Gartner Magic Quadrant for Cloud-Enabled Managed Hosting. The company also recently granted 37 new nonexecutive officer employees restricted stocks shares as an employment inducement.

A few analysts weighed in on Rackspace prior to the earnings report:

- Wells Fargo reiterated an Outperform rating.

- Merrill Lynch reiterated a Buy rating.

- FBN Securities has a Sector Perform rating and a $21 price target.

- JPMorgan has a Neutral rating and a $22 price target.

So far in 2016, Rackspace has underperformed the broad markets, with the stock down 12%. Over the past 52 weeks, the stock is down nearly 60%.

Shares of Rackspace were trading at $22.34 on Monday, with a consensus analyst price target of $26.71 and a 52-week trading range of $15.05 to $54.07.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.