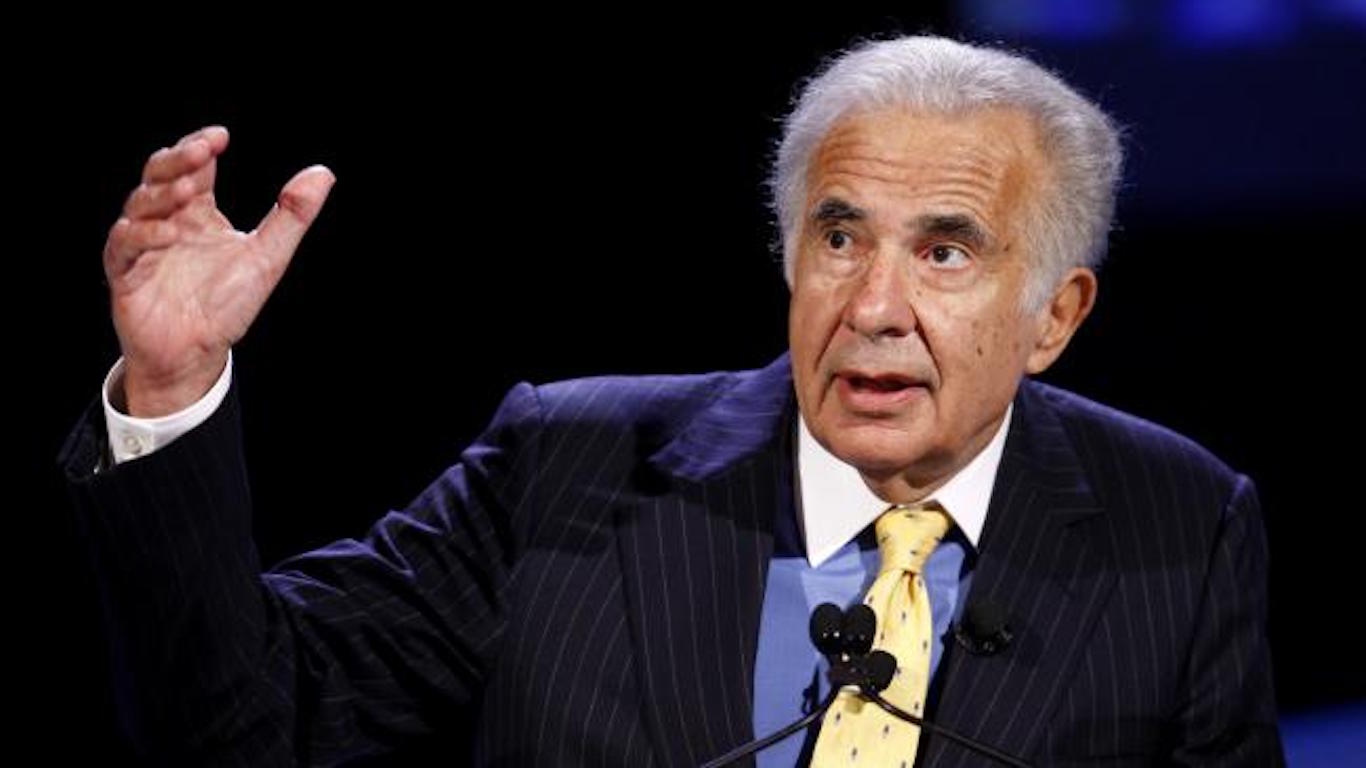

No matter whether Dell was trying to take itself private, as was the case five years ago, or return to being publicly traded, as is the case today, one thing hasn’t changed: Carl Icahn is not happy with the proposal.

In July, Dell, which is currently privately held by founder Michael Dell and private equity firm Silver Lake Partners, announced a plan to bring the computer hardware maker back to the public market in a reverse merger with a tracking stock Dell set up to track its $60 billion investment in VMware Inc. (NYSE: VMW). The tracking stock trades on the New York Stock Exchange as Dell Technologies Inc. (NYSE: DVMT).

On Monday, activist investor Icahn, who acknowledged ownership of 8.3% of DVMT stock, said he would launch a proxy fight encouraging shareholders to vote against the proposed merger.

Five years ago, in Round 1 when Michael Dell and Silver Lake were looking to take Dell private, Icahn filed suit to halt the merger, calling the planned go-private deal an “insult to shareholders.” The Dell-Silver Lake offer of $24.75 billion for the company, in Icahn’s opinion, undervalued the company. Icahn threw in the towel.

So Round 2 of this battle of the heavyweights now focuses on a plan to offer Michael Dell’s computer company once again on the public market. Michael Dell and Silver Lake say they will pay existing DVMT shareholders $21.75 billion for their roughly 15% economic interest in the tracking stock.

According to Icahn, DVMT shares trade at around $92 a share but are worth about $144 a share “on a pure mathematical basis.” Icahn says his calculations indicate that Dell-Silver Lake is offering a payment of around $94 a share. VMware shares closed at $144.04 on Monday.

Because Dell has been buying up the tracking stock at a discount to the price of VMware stock, Icahn argues that Michael Dell and Silver Lake will pocket most of an $11 billion windfall that should be shared with DVMT shareholders.

Icahn also accuses Dell-Silver Lake of threatening to force DVMT shareholders to convert their shares into Class C common shares of Dell stock unless the DVMT shareholders approve the reverse merger. Calling the forced conversion a “cram down,” Icahn says the threat is an “empty one” if DVMT shareholders stick together.

Icahn has some help this time around. Paul Singer’s Elliott Management and hedge fund P. Schoenfeld Asset Management also oppose the Dell-Silver Lake offer for DVMT shares.

Michael Dell has called this his final offer to DVMT shareholders, the same thing he said that caused Icahn to launch his lawsuit five years ago. Dell won that round.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.