24/7 Wall St. Insights

- Nvidia Corp. (NASDAQ: NVDA) relies on major customer Meta Platforms Inc. (NASDAQ: META) for much of its revenue.

- Developments between them this year bode well for both companies and their stocks.

- But is Wall Street on board?

- Also: 2 Dividend Legends to Hold Forever.

After tremendous growth since the beginning of 2023, Nvidia Corp. (NASDAQ: NVDA) stock’s momentum stalled this summer, with its market capitalization swinging above and below $3 trillion. The artificial intelligence (AI) darling will need to resume that moment if it wishes to be the first publicly traded U.S. company to reach a value of $5 trillion, as some have predicted it will. To do that, it will need to lean on its biggest customers.

Bloomberg estimates that Nvidia receives 40% of its revenue from the mega-cap tech companies, particularly those that are Magnificent 7 members along with Nvidia. As much as 13% of that revenue comes from Meta Platforms Inc. (NASDAQ: META) in particular.

Meta and Nvidia

Meta CEO Mark Zuckerberg said earlier this year that Meta would be spending “billions of dollars” on AI chips from Nvidia because AI would be its biggest investment focus in 2024. In April, Meta raised its capital expenditure plans to between $35 billion to $40 billion on AI research, data centers, and other infrastructure costs. That was up from a previous forecast of $30 billion to $37 billion.

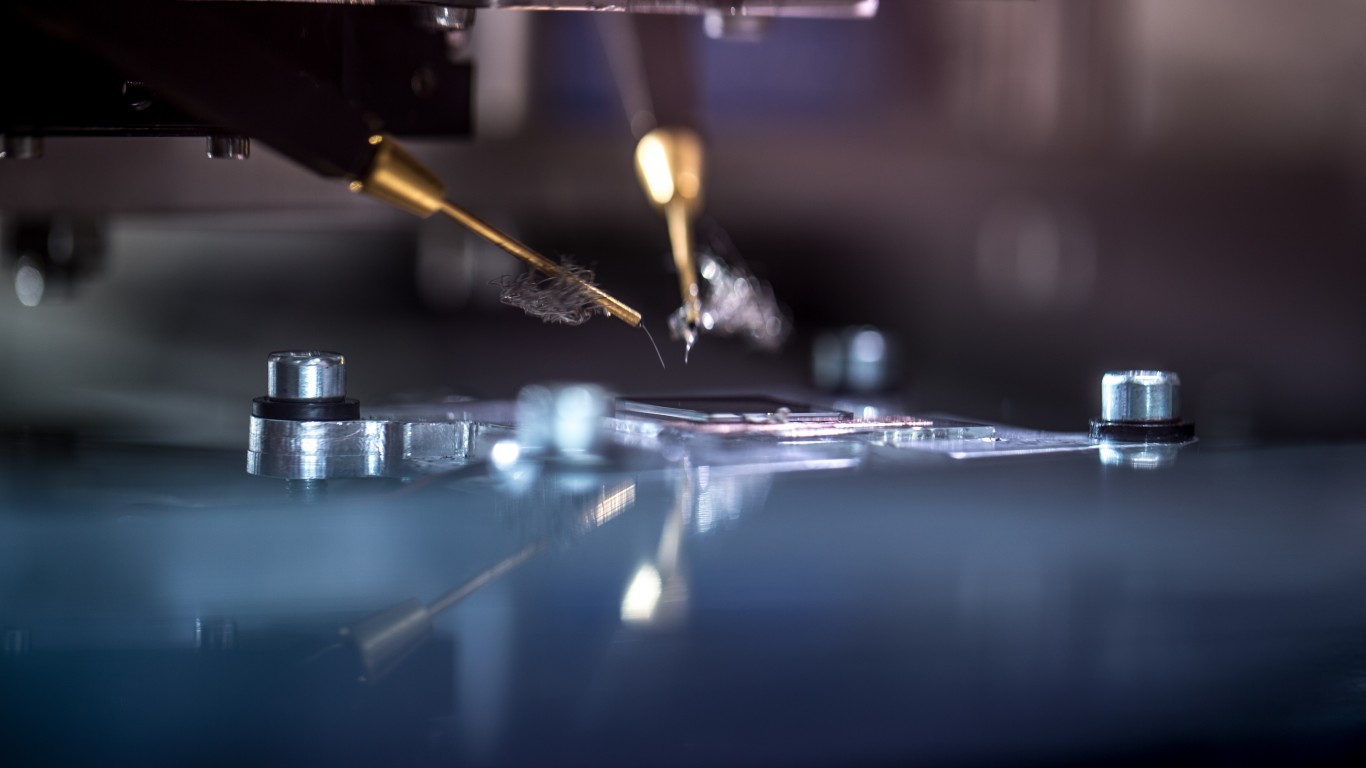

As of July, Meta was speculated to have 600,000 Nvidia graphics processor units (GPUs) installed across its servers in data centers. As AI products grow more complex, the amount of time it takes to train them rises exponentially. So too the demand for computing power to speed up the process increases.

Zuckerberg and Nvidia CEO Jensen Huang traded praise for each other when they appeared together at a Q&A session at a graphics conference in August. And Meta said recently that its infrastructure expenses would rise again in 2025 as it purchased even more data center components. This all bodes well for both companies and for their stocks. Let’s take a look at what Wall Street expects.

Meta Stock

Meta’s share price is about 340% higher than it was two years ago, when the AI tidal wave began. The stock has also outperformed the Nasdaq year to date, with a gain near 66% in that time. Keeping up the momentum would put in on a path to a $2,570 share price and a $6.6 trillion market cap in two years.

However, the consensus price target is only marginally higher than the current share price, meaning analysts see little upside at this time. Yet, the high price target is $811, which would be gain of nearly 39% in the next 12 months. Despite the analysts’ caution in terms of upside potential, 56 out of 64 recommend buying shares, 20 of them with Strong Buy Ratings.

Nvidia Stock

In the past two years, the share price has added about 1,100%. The Nasdaq has seen a gain of less than 78% in that time. Since the beginning of this year, the stock is nearly 173% higher, almost all of that gain before June. If the momentum resumes, it could be on a path to a $1,470 share price and an almost inconceivable market cap in two years.

Wall Street currently does not see that happening. The analysts have a consensus price target of $148.23. That represents about 11% upside potential in the next 12 months. And it would give us a $165 share price two years from now. Of 38 analysts who cover Nvidia stock, 21 of them have Buy or better ratings. Note though that analyst sentiment has softened in the past couple of months.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.