According to a ranking of eight U.S. air carriers, the best airline for overall performance is Delta Air Lines Co. (NYSE: DAL) and the worst is United Continental Holdings Inc. (NYSE: UAL). The ranking was prepared by airfarewatchdog.com and is based on May 2014 data reported to the U.S. Department of Transportation in four basic service areas: canceled flights; on-time arrivals, mishandled bags, and denied boardings. The website also includes the ACSI customer satisfaction rating to complete the ranking.

Delta leaped from sixth place in 2013 to first place in 2014 based on having the fewest canceled flights, the second-best on-time records, and the highest ACSI score among the country’s remaining legacy carriers — Delta, United Continental, and American Airlines Group Inc. (NASDAQ: AAL).

Virgin America, the soon-to-come-public airline controlled by Richard Branson, finished second again in 2014 and had the best score in the mishandled bag category.

Alaska Air Group Inc. (NYSE: ALK) ranked third, posting the second-best score for fewest cancelled flights and the top score for on-time arrivals.

Ranked fourth is JetBlue Airways Corp. (NASDAQ: JBLU) which ranked best in the number of denied boardings (just 3.58 per million passengers compared with second-place Virgin America’s 17.13 and 8th place United’s 245.61). JetBlue was also top-rated for customer satisfaction in the ACSI survey.

Privately-held Frontier Airlines finished fifth in the airfarewatchdog.com ranking. Republic Airways Holdings Inc. (NASDAQ: RJET) completed the sale of the airlines to private equity firm Indigo Partners in December 2013. Indigo plans to re-make Frontier into what the firm’s managing partner called “an ultra-low-cost carrier.” Indigo had been a major investor in another ultra-low-cost airlines, Spirit Airlines Inc. (NASDAQ: SAVE) until selling its stake in July of 2013.

Southwest Airlines Co. (NYSE: LUV) finished sixth, with the worst on-time arrival score and the worst mishandled bag score. Southwest scored second in the ACSI survey primarily on the basis of its low fares, indicating that U.S. passengers will forgive a lot of sins if the price is low enough.

Seventh overall was American which scored next to last in the ACSI ranking and could do no better than fourth in any individual category ranking. The airlines did not rank at the bottom of any category.

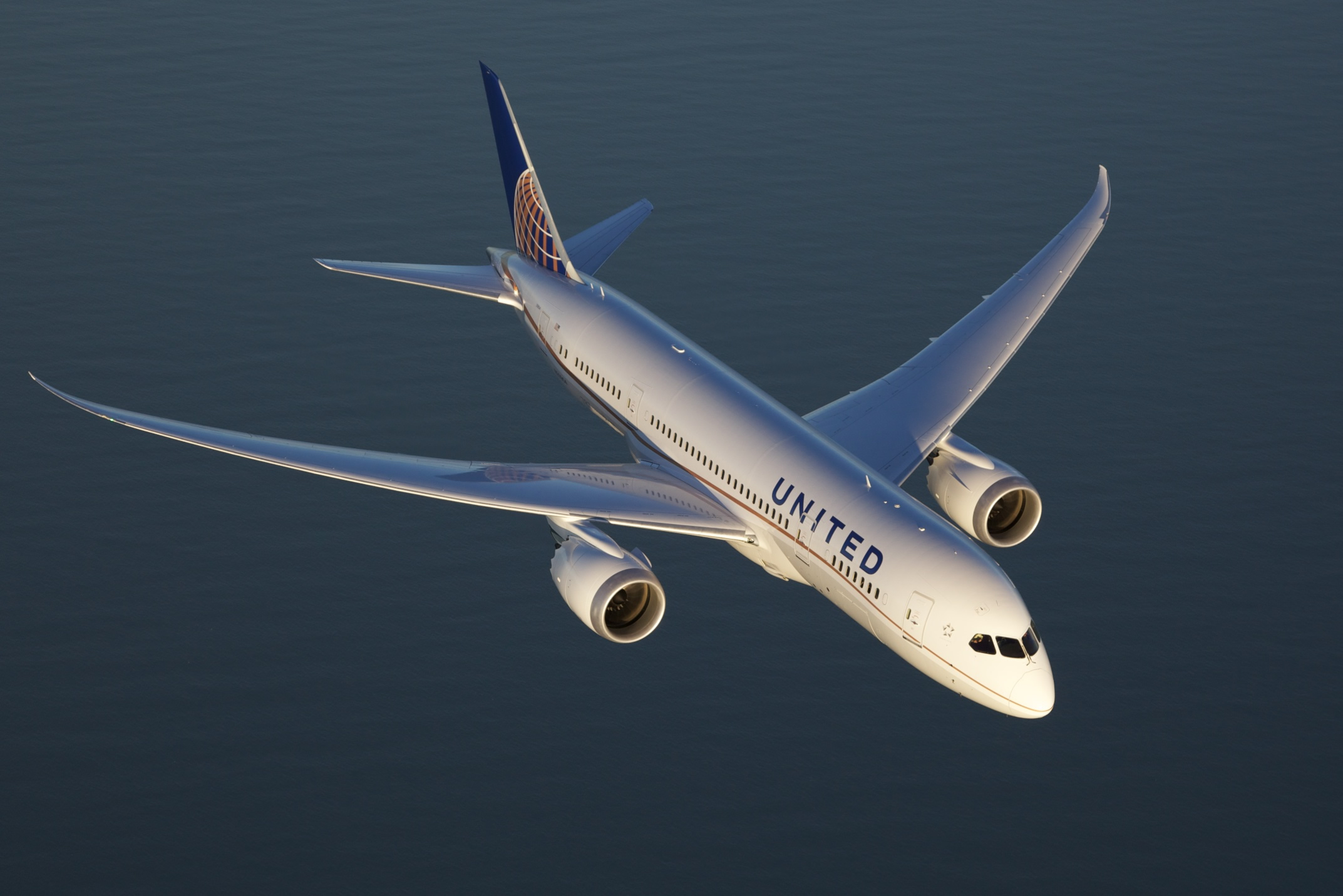

The overall worst airlines is United, which had the lowest ASCI score and the highest number of denied boardings. Much of the low customer satisfaction score is due to the still-to-be-fully-completed merger between United and Continental airlines. Airline mergers take years to sort out and this one is no different.

Since the merger between American and U.S. Airways was completed in December, airline stocks have lifted off. United is up nearly 15%, and it’s the worst performer. The best is Southwest, up nearly 53% followed by American which is up 51%. The other legacy carrier, Delta, is up more than 25%.

ALSO READ: Richard Branson Strikes Again: Virgin America Files for IPO

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.