When Consumer Reports magazine tested its first Model S sedan from Tesla Inc. (NASDAQ: TSLA) in 2015, the car posted a score of 103 out of a possible 100. The magazine had to adjust its scoring system to bring the Model S score back to just perfect.

In 2018, the Tesla brand was dropped from the Consumer Reports reliability rankings, before the Model 3 made it back onto the list last year as the fifth most reliable luxury company, and the Model S was second of four ultra-luxury cars. Overall, the Tesla brand was the 23rd most reliable in 2019.

Things have gotten worse for the world’s most valuable car company. Of 26 brands in Consumer Reports’ latest reliability rankings, Tesla finishes an inglorious 25th, ahead of only the Lincoln brand from Ford Motor Co. (NYSE: F).

Tesla’s Model Y received a reliability rating of just 5 out of a possible 100. That was still more than double the miserable 2 rating for Lincoln’s Aviator, or the score of 1 for Ford’s Explorer SUV.

The highest scoring Tesla was the Model 3 with a score of 53, more than 10 points below the lowest score for any Mazda, the top-ranked brand for reliability with a score of 83. The lowest scoring Mazda was the Mazda3 with a score of 64.

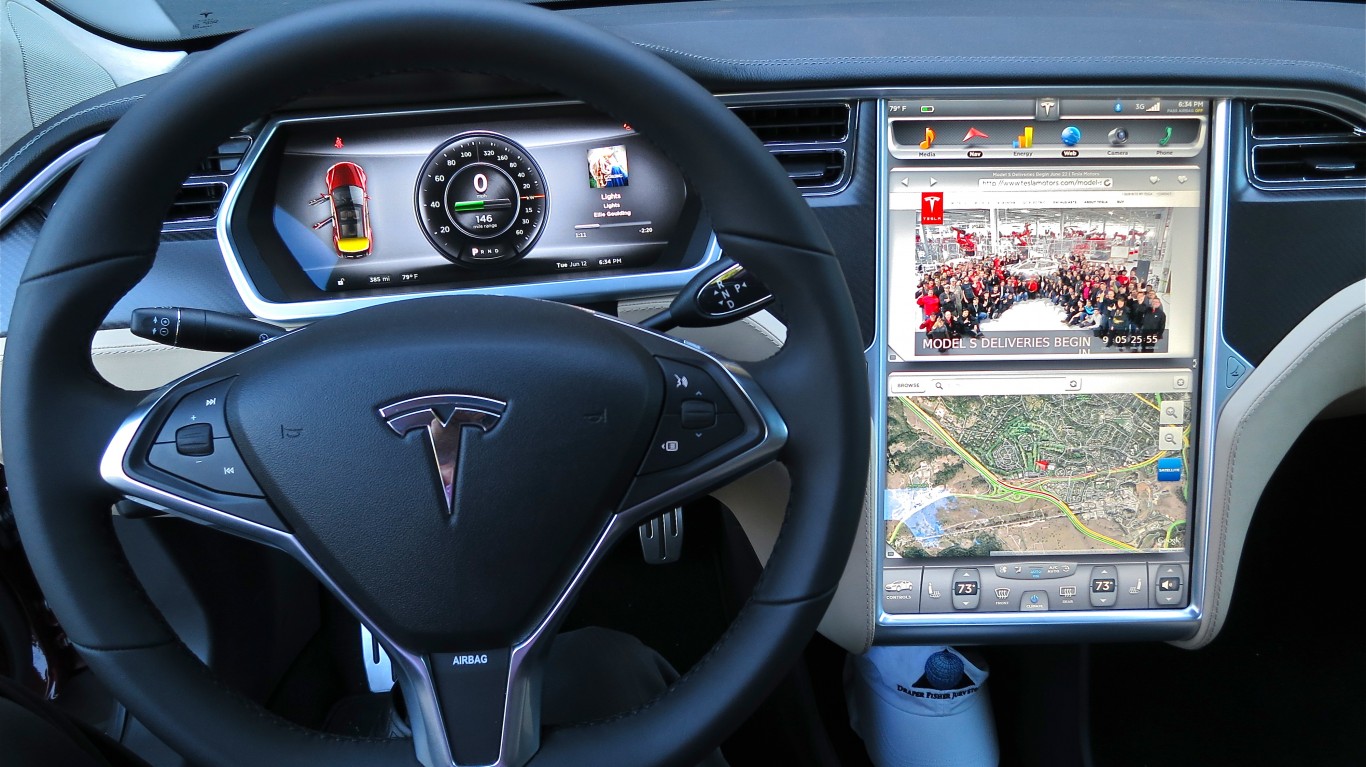

Anita Lam, the magazine’s associate director of automotive data integration, noted that it is not the electric drive train that leads to low rankings for Tesla and other EV makers: “It’s all the other new technology that could show up on any car—new infotainment systems, more sophisticated power equipment and gadgets—that often gets put on new EVs to feed a perception that they’re supposed to be luxurious and high-tech.”

That’s why feature-packed models like Tesla’s Model S and Model X experience more ongoing reliability problems than, say, a Ford Edge with a brand-high reliability score of 69. The Edge comes with many fewer whiz-bang features than the Tesla EVs.

Still, there’s no stopping Tesla’s stock price. Shares posted a new 52-week high of $508.61 Thursday morning and traded at around $506.00, up 4%, at last look. Its 52-week low is $65.42, and the consensus price target is just $354.28. The stock is still riding the wave created by its coming inclusion in the S&P 500 index.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.