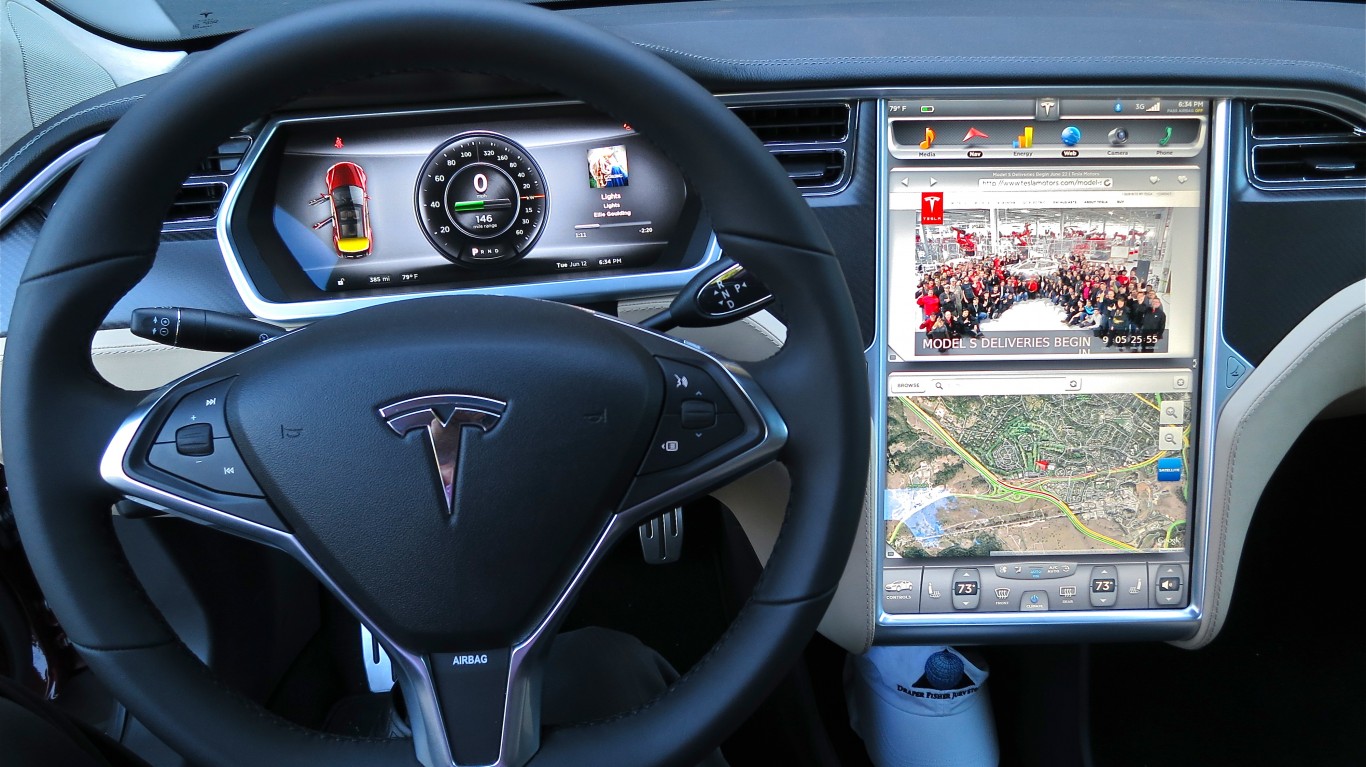

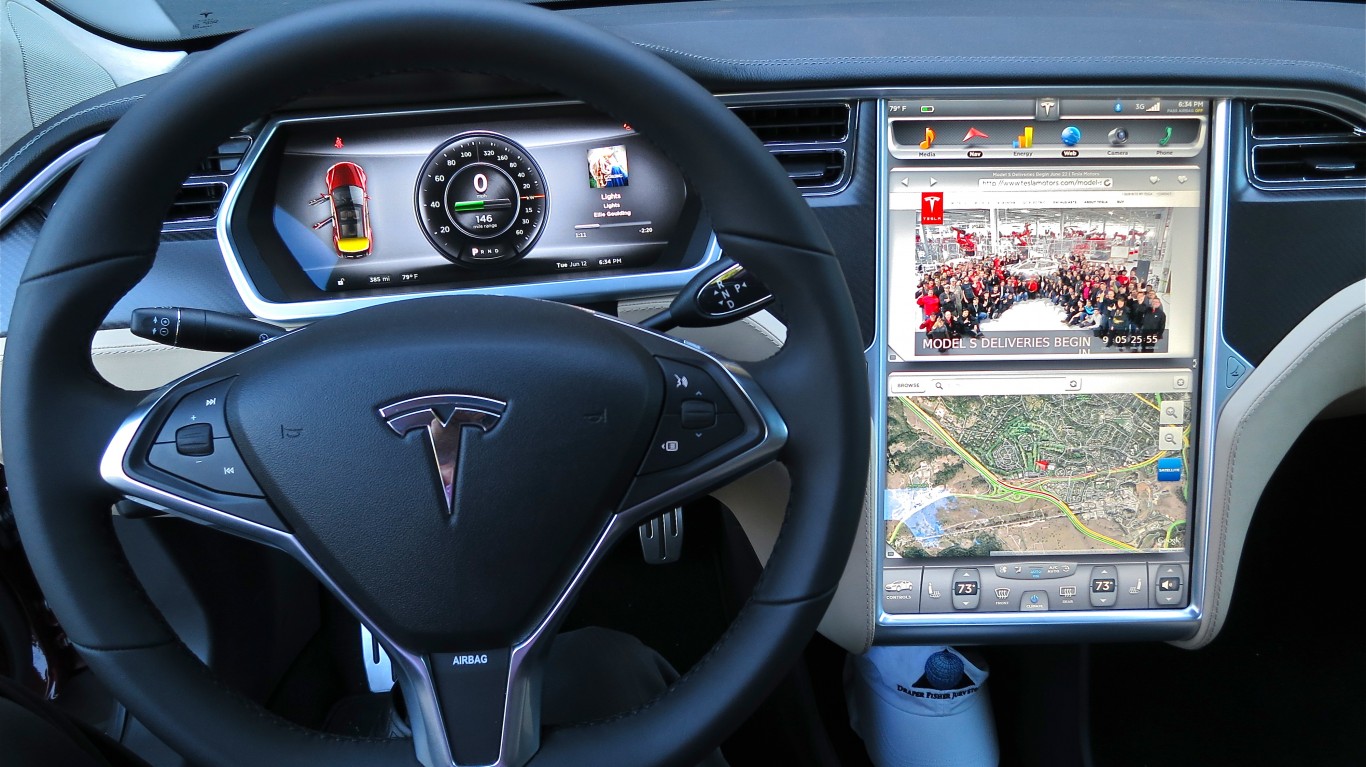

Cars and Drivers

If This EV Sales Forecast Is Right, Tesla Is Underpriced

Published:

In a good year, over 70 million cars are sold worldwide. Until recently, the great majority of those were powered by gasoline or diesel. That has changed some. Electric vehicle (EV) sales probably number between 1 million and 2 million a year. The investment gamble on EV companies is that while total car sales stay flat, EV sales will rise at the rate of double digits, perhaps for decades. Tesla Inc. (NYSE: TSLA) certainly will be the main beneficiary of that trend, at least short term.

At its current run rate, Tesla will sell 500,000 cars this year. The pandemic-driven recession has cut its growth sharply from the previous three years. Tesla has more than hinted at a recovery.

MarketWatch recently reported, “Global electric-vehicle sales will grow 50% or more next year, while sales of internal combustion engine vehicles are expected to grow 2% to 5%. That’s the view of analysts at Morgan Stanley, who in a note to clients on Friday also predicted that global EV penetration would top 4%, rising to 31% by 2030.”

That means electric car sales could reach 20 million by the end of the decade. Tesla would not need an extraordinary market share to sell 10 times the annual volume it does today. The question for Tesla investors is whether 5 million unit sales a year supports its current market cap, which is close to $600 billion. Based on its skyrocketed share price and the number of short-sellers who have been ruined by negative bets, the answer yes.

Of course, the forecast for EV sales through 2030 could leave out a period of growth that may occur in the years just after. National governments increasingly will require many of the cars sold in the countries to be EVs, if only to reduce carbon footprints and support multinational agreements like the Paris Agreement. Political considerations may push EV sales as much as consumer demand. As an example, the United Kingdom may ban all fossil fuel car sales after 2030.

As investors scratch for reasons to push Tesla’s shares higher, the new research gives them another one.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.