Here are two numbers that tell an interesting story:

- As a group, gas-electric hybrid vehicles had a 3% share of the U.S. market in the first quarter. That’s down from 3.3% last year.

- Sales at Fiat Chrysler’s (OTC: FIATY) all-SUV Jeep brand are up 49% so far this year.

Of course, as with any two cherry-picked numbers, there’s more to the story than what they tell. But the basic story in those two numbers is true: SUV sales in the U.S. (and elsewhere) are soaring, while hybrid sales have fallen from their peak.

What’s going on? Are hybrids past their peak?

IHS Automotive analyst Tom Libby recently crunched the numbers on the U.S. market for hybrids. He points out that there are more hybrid models on the U.S. market than ever — 47 by his count — but as a group, their share of the overall market has declined since last year.

ALSO READ: The Most Reliable Hybrid Electric Cars

As Libby notes, the conventional wisdom in the auto business is that total sales go up when a new model joins a market segment. But even though the total number of hybrid models on the market is at an all-time high, hybrids’share of the U.S. market is down.

Meanwhile, SUV sales are booming. Does that mean that consumers aren’t worried about gas prices anymore?

Not necessarily. For starters, these aren’t 2003’s SUVs.

SUV sales are booming, but these are different SUVs

The great SUV boom that we saw a decade ago was centered on heavy truck-based SUVs. Those vehicles, often equipped with thirsty V8 engines, got poor fuel economy — but gas was cheap and credit was easy, so buyers gobbled them up.

Those vehicles still exist, but sales are way down. For the most part, today’s SUVs are different. They’re “crossovers,” based on unibody platforms designed for cars, rather than heavy body-on-frame platforms designed for pickups. They’re lighter, and feature far more fuel-efficient drivetrains. (They’re also more pleasant to drive.)

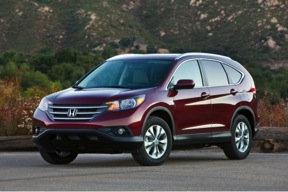

Compact crossover SUVs like Jeep’s freshly-overhauled Compass and Honda’s (NYSE: HMC) popular CR-V feature four-cylinder engines that can get close to 30 miles per gallon on the highway.

Honda’s CR-V gets an EPA-rated 31 miles per gallon on the highway, much better than the thirsty old SUVs that were popular a decade ago. Source: Honda

That’s not far from what you’d get in a modern sedan — but the SUV comes with more room, and its upright position and all-wheel-drive inspires more confidence in snow or other harsh conditions.

They’re also easier to get into and out of than a relatively low-slung sedan, a real consideration for aging Baby Boomers who might be dealing with chronic hip or back troubles.

Consumers still value fuel efficiency

None of this means that the move to more fuel-efficient vehicles has stalled. Hybrid sales have tended to jump in the wake of gas-price spikes, but gas prices have been relatively steady for a while now. It’s no surprise that consumers would seek more practical or affordable alternatives, especially when there are plenty of choices that are still pretty fuel efficient.

Sales of the Lincoln MKZ Hybrid have more than doubled this year. Source: Ford Motor Company.

And while hybrids as a market segment may represent a smaller piece of the automotive pie than they did not long ago, sales are still substantial — and some automakers are seeing solid gains. Sales of Toyota’s (NYSE: TM) market-leading Prius are down almost 11% through May, but Ford’s (NYSE: F) total hybrid sales are up over 21% in the same period.

Don’t feel too bad for Toyota, though: Its SUV sales are up 16.6%.

OPEC is absolutely terrified of this game-changer

Imagine a company that rents a very specific and valuable piece of machinery for $41,000 per hour (That’s almost as much as the average American makes in a year!). And Warren Buffett is so confident in this company’s can’t-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report reveals the company we’re calling OPEC’s worst nightmare. Just click HERE to uncover the name of this industry-leading stock… and join Buffett in his quest for a veritable landslide of profits!

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.