With the looming threat of global climate change, there has been a strong push for alternatives to internal combustion engine (ICE) vehicles. Electric vehicles (EVs) are one of the potential solutions to this technological problem. After some initial glitches and missteps, Tesla (NASDAQ: TSLA) showed that there could be a market for EVs. Upon Tesla’s promising start, other vehicle manufacturers rushed to get their own electric vehicles to market. Audi, a subsidiary of Volkswagen, manufactures a line of EVs that have had trouble finding market share. Audi had two of the 15 worst-selling EVs in 2023. Listed below, in no particular order, are six obstacles to Audi’s EV success. (Also see the 13 Biggest Electric Vehicle Business Failures in American History).

1. Lower Range Than Comparable EVs

The range of a vehicle on a single charge is an essential issue for EV owners. Charging opportunities can be unpredictable (see the section on infrastructure below), and consumers want to drive a reasonable distance before needing another charge. In 2023, Consumer Reports evaluated 22 EVs to see whether the range on one charge matched the EPA estimates. Audi’s 2002 Q4 50 e-tron Premium Plus performed below the EPA’s estimates and was the fourth worst vehicle on the list. This puts Audi at a disadvantage compared to other EV companies.

2. High Consumer Prices Relative to Other Models

While Audi offers a limited single-charge range to its buyers, prices are still at a premium, even though Audi has a reputation as a more affordable luxury car company. The entry-level Audi EV, the 2024 Audi Q4 e-tron, costs $49,800 for the base trim package, which is about $1,000 higher than the average base price for the top ten selling EVs. Of course, Audi’s top-end EVs are near the top of the market in terms of price, with its priciest model, the e-tron GT, having a base price of $105,400. By comparison, Audi’s entry-level ICE model, the A3, has an MSRP of $35,800.

3. Software Problems

The first automobiles were operated entirely with mechanical and manual controls. As the industry developed, manufacturers discovered that automating many controls led to a safer, more efficient, and more enjoyable driving experience. With the development of computing systems, computers were added to the control process. With the development of EVs, computers play a pivotal role in controlling the vehicle and the user experience. Control software is paramount when choosing an EV, and Audi has been having software issues. Consumers have complained of crashing MMI (Multi Media Interface) systems and malfunctions of its Pre Sense crash avoidance systems. Due to these issues, Audi has delayed the production of some of their most promising models.

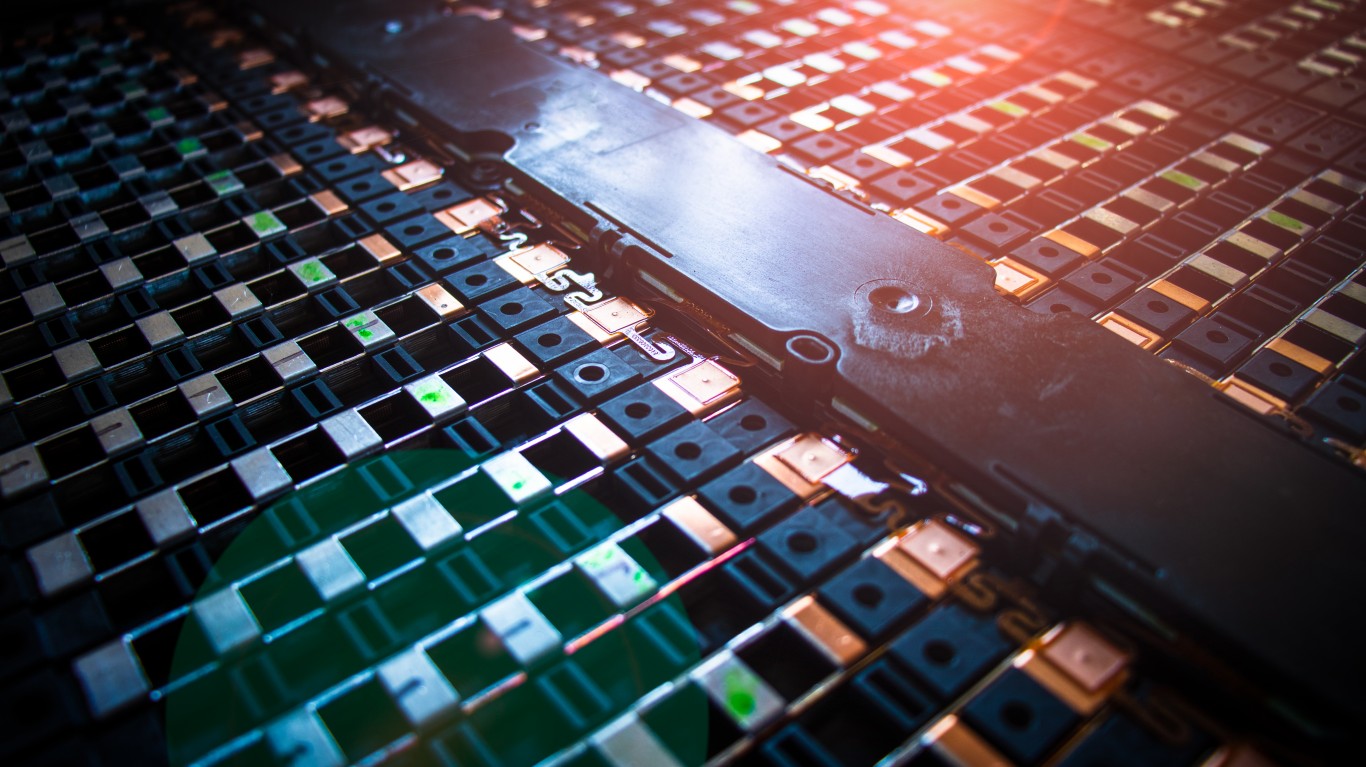

4. High Costs of Batteries and Materials

Some issues regarding cost and availability are common to all EVs. One significant issue concerns the availability of materials, especially battery availability. Problems with the supply chains for battery materials such as lithium, cobalt, and nickel have occurred. Not only were there supply chain issues, but there were also shortages of these elements as the market for batteries is rapidly expanding. In this area, lessening EV demand may help create a battery surplus, so this may be changing already.

5. Patchy Infrastructure

Another common issue with EVs is the lack of a fully developed charging infrastructure. Fueling stations are everywhere with ICE vehicles, and the infrastructure for gasoline-powered engines has developed for over 100 years. Charging stations for EVs are expensive and sometimes challenging to find space for. Additionally, EVs do not yet have standardized charging ports, though they are moving that way. Just because a driver sees a charging station does not mean it will be compatible with their vehicle. Charging times also differ among charging stations. The new fast-charging equipment is not as widespread as previous iterations, and this can result in long delays as drivers wait for their vehicles to charge.

6. Weak Demand

Apart from issues common to Audi, material cost and infrastructure issues have prompted customers to pull back on EV demand. Many believe that this transitional time calls for a return to an emphasis on hybrids, which can bridge the gap until some of the kinks are worked out of the infrastructure. Of course, this does impact Audi’s plans for the EV market, whether it is their fault or not. When all these issues are added together, they suggest a growing problem for Audi’s plans for their EV line.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.