24/7 Insights

- New EU tariffs on Chinese electric vehicles will benefit Tesla Inc. (NASDAQ: TSLA).

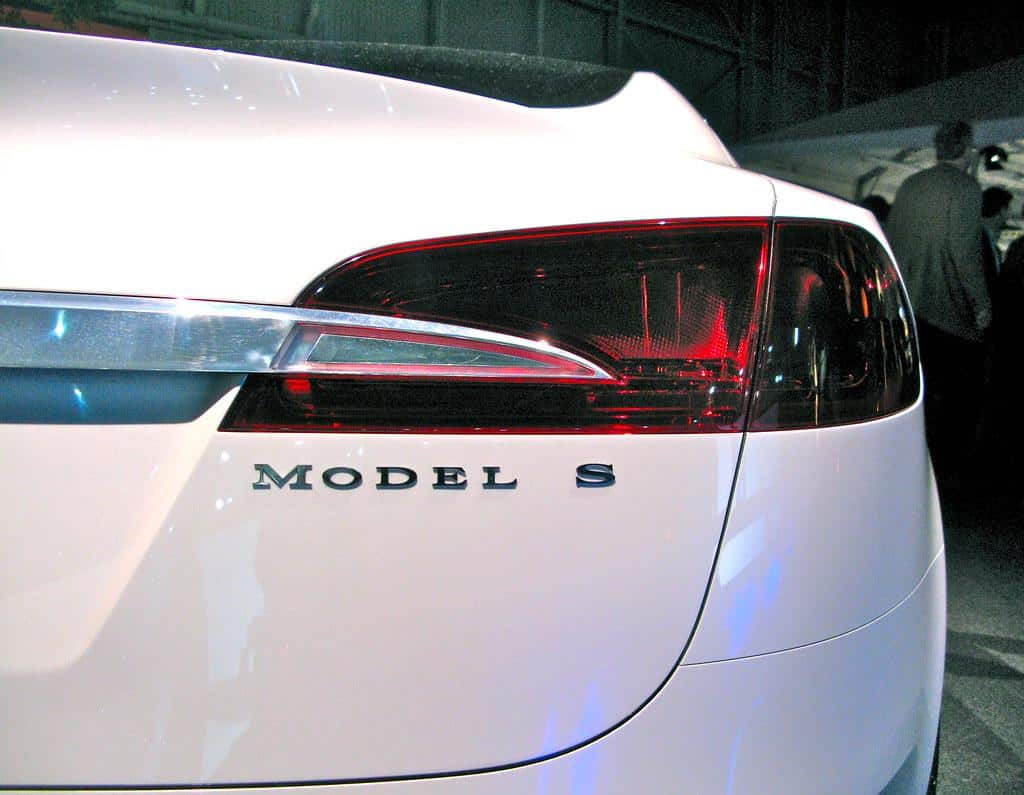

Despite the objections of large nations like Germany, the European Union put major tariffs on Chinese electric vehicles (EVs), according to the Financial Times. It helps local manufacturers like Fiat dodge competition from cheap Chinese cars. But it also helps Tesla Inc. (NASDAQ: TSLA). Europe is among its major markets. Investors have worried that China’s inexpensive but impressive EVs would knock down Tesla’s sales and market share worldwide. For now, not in Europe.

The tariffs can be as high as 25%. As the Financial Times pointed out, the tariffs also generate revenue. “Brussels is pushing ahead with Chinese electric vehicle tariffs that are set to bring in more than €2bn a year,” the paper reported.

The EU used the same reasoning as the U.S. government did when it put tariffs as high as 100% on Chinese cars. The Chinese government underwrites the costs of EV manufacturers, which means private car makers operate at a disadvantage. Whether or not that is entirely true, it keeps out competition.

What happens next? Many analysts believe that Chinese cars will be affordable even with the 25% tariffs because they already carry low prices. Local companies may be shielded, but only to a limited extent, unless they can drop EV product prices.

The other effect of the tariffs is that China may well retaliate. That means it will put tariffs on some cars built by EU-based manufacturers, making it more difficult for those manufacturers to sell their cars into the world’s largest auto market.

Tesla already sells hundreds of thousands of its cars in China each year, and it has its factory there. That means China treats it as a local company, and EU tariffs will not apply.

Europe just gave Tesla a break.

Here Is How Much Money Tesla Makes Every Minute

∴

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.