24/7 Wall St. Insights

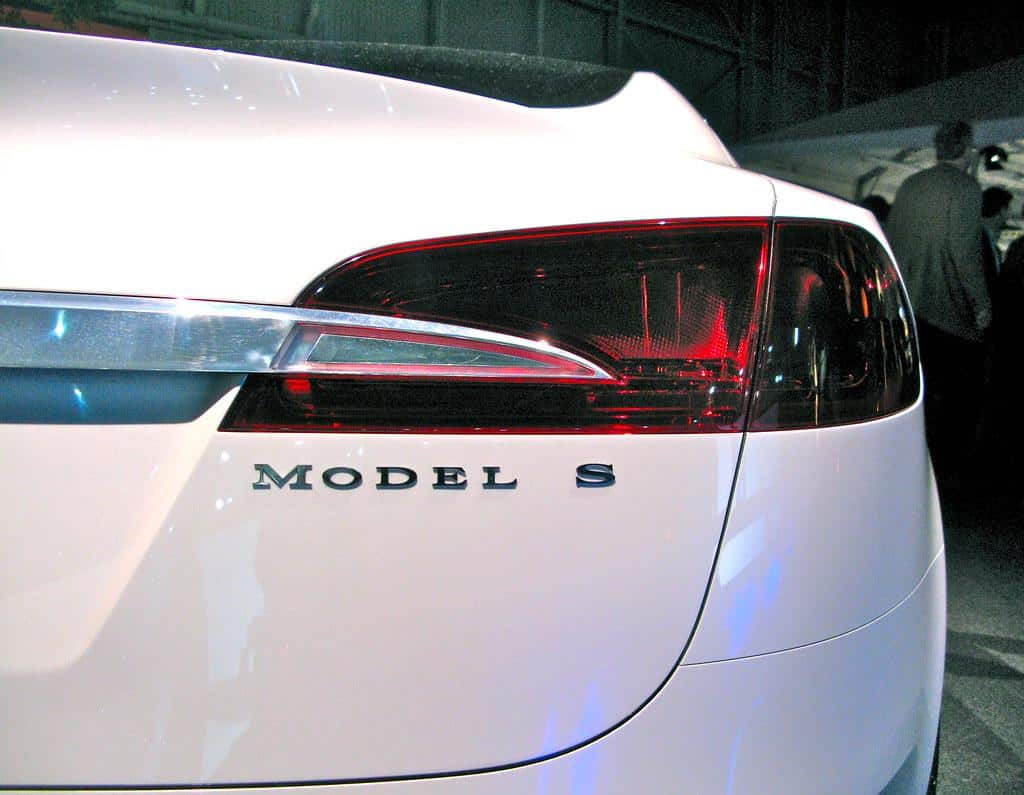

- Tesla Inc. (NASDAQ: TSLA) faces fierce competition for market share in China.

- Will its powerful brand be enough to sustain it there?

- Also: Dividend legends to hold forever.

China electric vehicle (EV) companies have started to release their September EV sales figures. Some are extremely impressive. Li Auto Inc. (NASDAQ: LI), one of the largest China-based companies, had deliveries of 53,709, which was a record. Some of its cars have small gasoline engines to extend range. Zeekr, which only makes fully electric cars, had monthly record deliveries of 21,333.

Several of the other China EV companies, including the giant BYD, have not announced September deliveries yet. Tesla Inc. (NASDAQ: TSLA) has also not released its figures.

The released figures clearly show that China’s local car companies have largely continued to have significant success. Tesla needs to grow sales faster than its rivals to hold approximately 10% of China’s EV market.

Tesla faces two challenges in China, the world’s leading EV market. First, some Chinese EVs have price points of $15,000, while Tesla’s prices are not nearly as low.

The other challenge is the proliferation and, in some cases, the success of local manufacturers. The number of them alone continues to fragment the market, making it more difficult for Tesla to hold its place in the delivery rankings.

Tesla may claw back market share. It has a powerful brand. However, it needs to bring down its retail prices. There are too many lower-priced alternatives.

Another EV Industry Domino Falls Over

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.