Energy

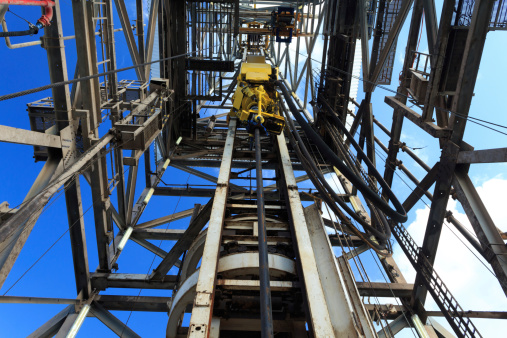

Low Crude Oil Prices Leave Thousands of US Wells Uncompleted

Published:

Last Updated:

In February EOG Resources Inc. (NYSE: EOG) said it would delay a significant number of well completions and plans to close out 2015 with 285 uncompleted wells, up from 200 at the end of 2014. Continental Resources Inc. (NYSE: CLR), Apache Corp. (NYSE: APA) and Anadarko Petroleum Corp. (NYSE: APC) have also said that they plan to delay well completions until crude oil prices pick up again.

Well-drilling costs include the actual drilling of the hole to the well’s total depth, evaluation of the well’s potential and the casing and cementing of the borehole. Completion services include adding all the equipment that will be used to extract the oil from the well.

In a conventional oil well, the cost of drilling the hole accounts for nearly all the well costs. In an unconventional well that requires fracking to get the oil flowing, completion costs can account for as much as two-thirds of the cost of the well. And total well costs often run more than $6 million for a well in the Bakken and Eagle Ford shale plays. If there are 1,400 wells awaiting completion in the Eagle Ford, a savings of $4 million per well conserves $5.6 billion in cash. Even in the oil business, that is real money.

Holding off on well completions has several advantages. First is the obvious one of not adding to the glut of production at prices below $50 a barrel. Second is the conservation of cash, which the price of oil is not producing in sufficient quantity. Third, if a producer wants to complete a new well to replace one that has reached the end of its useful life, the company is currently in a strong bargaining position with the services outfits that do the completion work. Finally, when prices do rise the uncompleted wells can be completed quickly and get the cash register ringing again.

Combined with falling rig counts and the slowdown in new drilling, the decisions by the larger players to postpone completions do lead to the conclusion that production will slow down later this year and crude oil prices are likely to begin rising again. But given how quickly the shale producers can respond to price movements, the price increases may not be all that big or all that long-lived.

ALSO READ: U.S. Has 690 Million Barrels in Petroleum Reserve

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.