Ford Motor Company

NYSE: F

$11.18

Closing Price on November 22, 2024

F Articles

Toyota is no longer the most valuable car company as measured by market capitalization. That honor now belongs to Tesla, even though Tesla sells a fraction of the vehicles Toyota does each year.

Published:

Ford stock has lagged the market but could get a lift as workers return to factories and buyers return to showrooms.

Published:

The pandemic has caused supply and demand problems for Ford and damaged consumer confidence.

Published:

Ford will likely have the summertime blues when it comes to reaching its sales goals. How bad those blues will be depends on the pandemic, unemployment numbers, and consumer sentiment.

Published:

May U.S. car sales are expected to be down sharply from a year ago. That shows the long road to a comeback for America's large carmakers.

Published:

It may seem improbable that a huge discount warehouse company can help a car company that is desperate to find buyers. Yet, Costco is doing just that.

Published:

Car sales in Europe imploded in April, hurting the ambitions of two of America's largest car companies.

Published:

Even as Ford plants reopen the coronavirus has cut demand and rattled the supply chain, as well as shareholders.

Published:

Uber has run out of ways to attract riders while the spread of COVID-19 requires safety rules and social distancing. Revenue has collapsed.

Published:

This Detroit automaker needs to get back on track, and the only way they can do that is by restarting production in a safe but effective way before it falls to penny stock status.

Published:

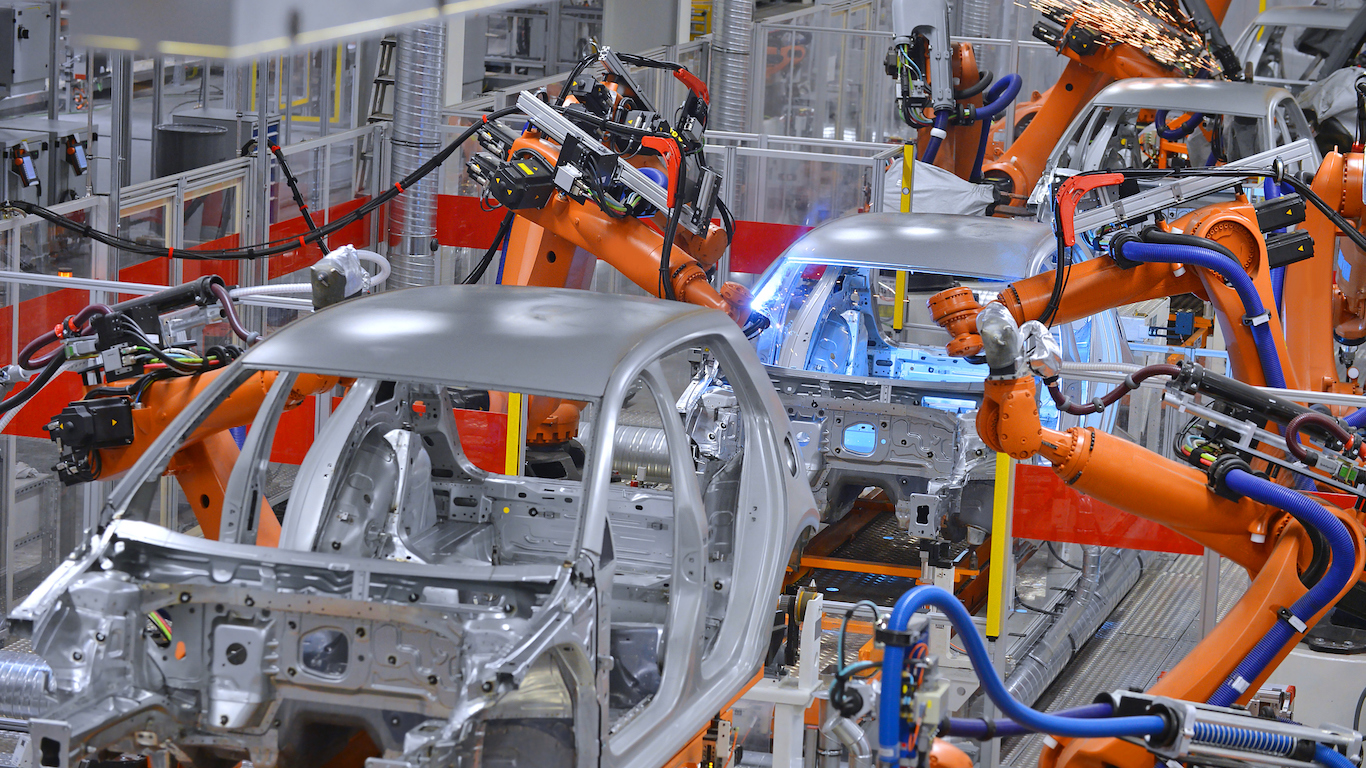

Ford has reopened plants in China and Europe and plans to follow in North American on May 18. The move towards electrics remains a big push for the company, even for its best-selling vehicle, the...

Published:

Last Updated:

Ford intends to restart the assembly lines at its North American factories on May 18. The plants have been closed since March 19 because of the coronavirus pandemic.

Published:

The average age of a car on the road in America is over 11 years. This poses a nearly impossible dilemma for manufacturers as they try to get sales back to former levels.

Published:

Ford's balance sheet troubles and junk-rated debt make a recovery difficult. The company has to get back on its feet quickly.

Published:

While Ford stock is at the back of the pack in terms of its performance, the outlook provided with recent earnings doesn’t paint an encouraging picture going forward, for neither the stock nor the...

Published: